Should I Pay off My Home and Have No Mortgage?

I get this question a lot. There are many pundits who say that paying off the mortgage has to be your top priority, and that going into retirement with a mortgage is a bad financial decision.

This is something a lot of families worry about, and recently I received the question:

“Thiago, I’m concerned that our mortgage payments are going to affect our retirement lifestyle. We want to be able to spend more in early retirement on things like travel and helping fund our grandkids’ college funds, but we’re worried that we might be stretching our money too thin if we also have a mortgage payment… It makes us feel like we need to push off our goals and work longer to be able to support our family and our goals. Is it really true that a mortgage is a retirement killer?”

There are many different things that can cause a retirement plan to fail, and debt can certainly be one of them. But as with most things in financially planning, the answer is going to depend on different factors.

For some of our clients, paying off their mortgage gave them better financial flexibility in retirement. But we also have clients for whom paying off their mortgage meant not being able to do everything they wanted in retirement.

To help create context, I’m going to review a real financial plan example that shows keeping versus paying off a mortgage so you can see the long-term impact and how it might affect someone’s goals.

Let me start by saying that our approach to retirement planning is research-based. We want to make sure we’re not being influenced by any blanket common advice. As with most things in retirement planning, what’s good for one family may not be good for another.

Benefits of Paying Off Your Mortgage

Why pay off a mortgage in the first place? The obvious benefit is that it reduces expenses in retirement. The idea is that when retiring your salary is going away and only a portion of it is replaced by your FERS pension.

Some may be old enough for claiming Social Security, but most people wait until full retirement age which is typically several years after many federal employees retire. But there are some important considerations that are left out if we just stop there.

First, not all your monthly mortgage payment is your loan. Your monthly mortgage payment is made up of four parts: principal, interest, taxes, and insurance (“PITI”). For most people, taxes and insurance can be as much as a third of their total payment.

Also, if you have HOA fees, this too may be on top of your mortgage payment. Some have local city or municipality fees as well. Paying off a mortgage means the principal and interest are gone, but taxes, insurance, and other fees remain.

But is this reduction helpful in the long run? Does reducing expenses by paying off a mortgage truly mean that you have greater financial safety?

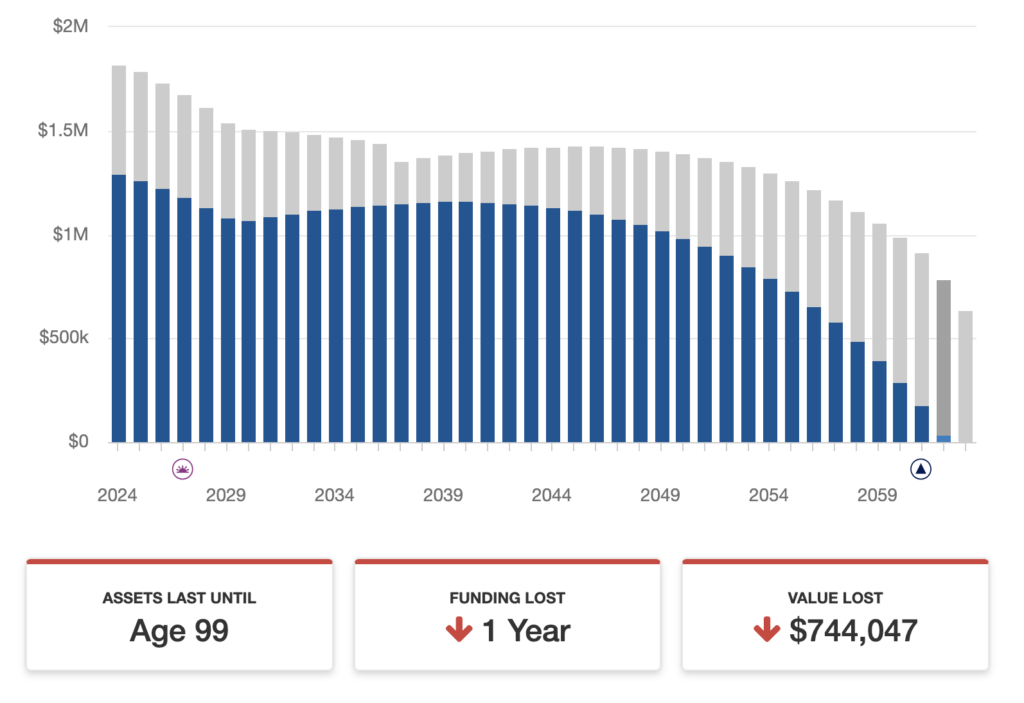

In our example, we have a married couple with a net worth (“NW”) of about $2.5M including their home, and in liquid assets they have about $1.8M between their TSP, brokerage, 401ks, etc. Their monthly mortgage payment is just under $3K/mo, and their all-in expenses is about $10K/mo, which is in line with most families here in the DC area.

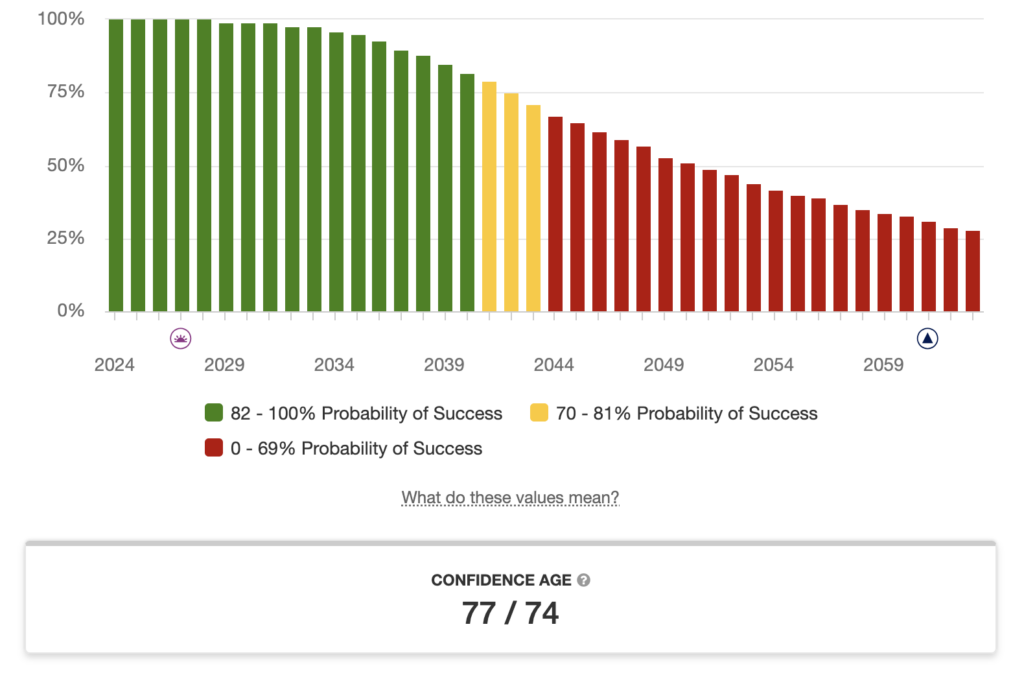

And by doing a lump sum payoff of their mortgage earlier in life, they’re projected to have lost almost ¾ of a million dollars over the course of their retirements. That’s money that they may need in late life for long term care, or assets that they could pass on to their heirs once they’re gone.

I’d have some serious concerns about this family paying off their mortgage early. The large amount of capital required to be used—plus the taxes—is too significant and negatively impacts the longevity of their plan. Using it for a mortgage payoff could mean that they won’t have enough money left over to support the rest of their lives.

The importance of assessing the long-term trajectory of your retirement plan can’t be overstated. Variables like expenses, financial decisions, market volatility, healthcare challenges, and more, should be addressed and adjusted for carefully.

Considerations Beyond Financial

There’s another important component to consider. So far, we’ve discussed only the financial consideration of this decision.

What if having this mortgage in retirement mentally blocks them from enjoying retirement? What if it makes them feel guilty spending more on things that excite them in fear of having this liability to their name?

Fearing spending too much in retirement is a real fear that many people have when they retire. We find that the closer people get to retirement, the higher their stress around it becomes, and sometimes they’re more stressed in retirement than they were when they were working.

There are two sides to retirement planning. The first side is what’s best for you financially. The other side is what makes you happy in retirement. The reality is that retirement planning lives somewhere in the middle—the intersecting point of a Venn diagram.

Successful retirees recognize that the reason their retirement is so fulfilling is because they blended smart financial planning with what makes them happy. I encourage you to seek the same, after all it’s not just your money, it’s your future.