3 Ways to Know You Can Retire Right Now From Federal Service

The big question everyone asks: when is the right time to retire? Can I retire already? How would your life change if you knew the answer?

If you can answer yes to three critical questions, then you might have everything in place for you to retire right now, without having to wait longer or until your portfolio reaches a certain number. Let’s get into what these questions are.

Question One

The first question to which you must be able to answer “yes” is: do I have enough to retire? This might seem like an obvious question, but how can you really know?

We’ve worked with people with millions in their portfolio who put their financial independence in jeopardy by mismanaging their plan. There are many ways this can happen, to include overpaying taxes, not having the right distribution strategy in retirement, being incorrectly invested, failing to address the myriad risks present in retirement, and others. Retirement plans rarely fail overnight, and deviations often go unnoticed.

Maybe you know that you’ve done a good job saving but you’re just not sure how to turn your wealth into a lifetime of financial independence. That’s okay! In fact, it’s normal to feel this way. What will make you successful throughout retirement is different than what’s led you to success until now.

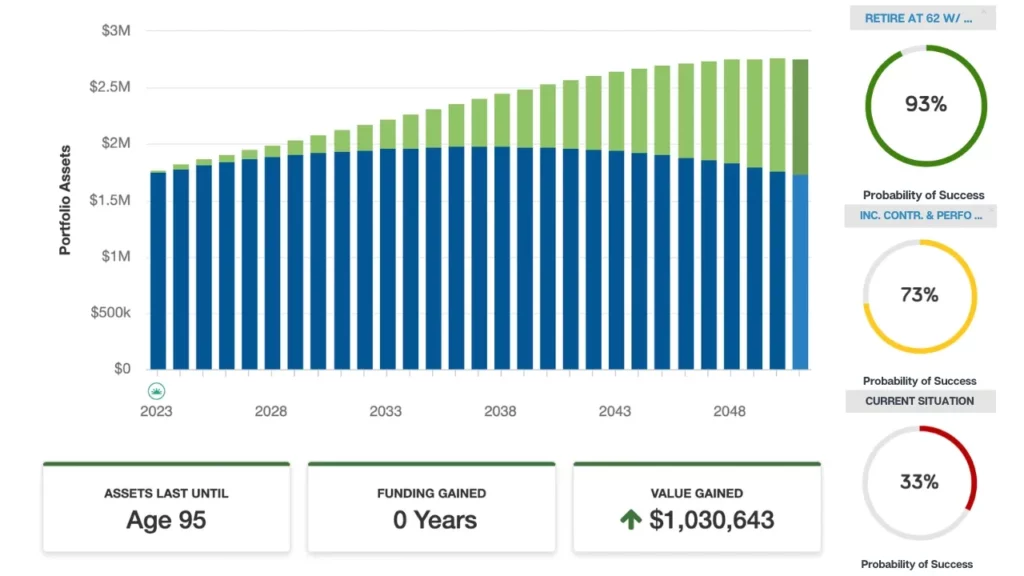

So how can you answer this question? There’s a way to get to a place where you can confidently say “yes, we do have enough to retire”, and it starts with creating your retirement plan that focuses on a few parts specifically designed to help you stay retired. Below is an example of what this can look like.

The first part is your income plan. How do you take money out in the most efficient way? From which accounts or investments should you make withdrawals and under which circumstances? Social Security and the FERS annuity (pension) are a big part of your income as a federal retiree, but your retirement accounts have to do the heavy lifting to support your lifestyle. Even if your lifestyle allows you to live more frugally, remember that health and long-term care are a major part of a retirement plan that require a lot of capital.

The second part is your investment plan. When you enter retirement, your portfolio’s job changes. While working, you’re supporting your portfolio by saving as much as possible and investing as aggressively as you can tolerate.

But when you’re retired, the roles reverse, and now your portfolio begins to support you. You’ll recognize that your investment strategy needs to look different now as you begin to use your money. Your income plan will help determine this.

The third part is your tax plan. Remember that every financial decision you make—from investment choices or how you generate your income—all of them come with an impact on your taxes. In retirement, it’s the first time in your life where you get to have significant control over your taxes, and there is incredible value to be had by those who plan appropriately.

When you have these parts of your retirement plan set up for each of the different 3-4 phases of your retirement, you begin to see how the grand plan comes together, and we’ve found that families can confidently move toward answering yes to this first question.

Question Two

The second question to which you must be able to answer “yes” is: do I know how I want to spend my time? Many federal employees think that retirement planning requires only getting the financial components together, and that couldn’t be further from the truth.

The reality is that successful retirements have a combination of both art and science:

Don’t get me wrong; the science part of your plan is incredibly important. But all of that has to meet in the middle with what’s really important to you.

Because otherwise, if it’s just about the maximum amount of money, here’s your plan: invest 100% in stocks, take Social Security at age 70, and work until the day you pass.

We can joke and have a laugh about this, but sometimes this is precisely what holds people back from getting into the retirement mindset. Retirement planning is where life planning and financial planning meet together.

Retirement is not all rainbows and sunshine like commercials on TV make it seem. It will certainly have its moments, but you need to find a sense of purpose in retirement as you do with your career.

We work with highly successful families who feel the need to be contributing to something, even in retirement. This often comes in the form of volunteering, sitting on boards, deepening personal and family relationships, etc.

The point is, they’ve carefully planned how they’ll spend their time, and we’ve worked together to make sure that their finances support their decisions for the rest of their lives.

The closer you are to being ready for retirement, the clearer this is going to become to you. We’ve found that when families go through the process to be able to answer yes to question one, they begin to transition more easily into answering yes to question two, too.

Question Three

The third question to which you must be able to answer “yes” is: am I ready for some adjustments? People are usually taken back by this.

One thing that most retirees never think about is how their schedules are going to change. In retirement, every day is Saturday, and while at first this sounds amazing, I can promise you that this is going to throw you off after a while.

If you’re married, have you thought about what it will be like having both your schedules be similar? If both you and your spouse are retired, are you spending all day together every day?

For better or for worse, but not for lunch, right? I jest, but it’s a serious question.

You’ve had a lifetime to grow accustomed to one way of life, and while a permanent vacation sounds great, eventually this is a part of life that could seem disenchanting as well.

As mentioned earlier, we find that it can be a good thing to have a sense of purpose or to be working towards something in retirement. The alternative can sometimes be a sort of cabin fever.

Retirement can be the best part of your life. They call them the golden years for a reason, but this only happens with diligent planning and intentional design.

Money has never bought happiness, but it sure buys comfort. It’s an important conduit from which we can support the lives we want to live, but it’s not everything in life.

If you find out that you could retire immediately, consider how that might change your life. If you’re curious, then we encourage you to start doing the planning, because it’s not just your money, it’s your future.