4 Retirement Expenses You May Not Be Prepared For

People often spend a lot of time on their retirement plans. They think through what expenses they’re going to have, how to invest to meet their income needs, how much they need each year and throughout retirement, and many other elements.

But one area many retirement plans fail to address properly is in the category of expenses. Figuring out your retirement costs sounds easy, but over the years we’ve noticed four major expenses in retirement that most plans overlook.

In this column, we’ll discuss these four areas so that you can be aware of them and incorporate them into your retirement plan to help make sure you stay retired.

“One-Time” Expenses

We’ve been helping feds with their retirements for a long time, and I’m amazed at how many one-time expenses there are in retirement.

Maybe our friends tell us that they want to do an excursion in Italy or Iceland and want us to go with them. It sounds amazing and you want to go, but did you build in the extra cushion for this large one-time expense? Surely this one time can’t hurt, right?

Another one: many have kids, and they may even be financially independent. If that’s you, then you probably already know that kids are never fully off your payroll. I promise your heart is going to melt if/when you have grandkids.

As (grand)parents, we want to be able to help as best as we can, and that can certainly be doable, but I often remind retirees that their financial independence should come first. If they become a burden later in life because they weren’t smart about their money along the way, that’s not helpful to anyone.

How about cars? How often do you find yourself switching cars? Maybe you keep cars for 15 years, or maybe you change them sooner. This is big one that we rarely see incorporated into retirement plans, especially if you pay cash for cars.

Many of us also have aging parents that we help look after. If their health has gotten worse, you might find yourself doing a lot more trips that can equal to thousands of dollars.

Wedding season, anyone? Surely the grandkids must have their higher education paid for, or you’re ecstatic that your kid got into grad school, and now you want to help them afford it.

Please hear my heart on this: we’re not saying that you shouldn’t take care of your family—on the contrary. Your family is one of the most important things in life, but the point is that you need to make sure that you consider whether you’re helping or hurting in the long run.

One-time expenses are seldom a single torpedo that destroys a retirement, but a culmination of one-time expenses equates to a lifetime of overspending, which is easily something that can force you into an encore career.

Drawing the line becomes easier if you’ve done the modeling and planning to help understand where that invisible line exists. Many one-time expenses can be afforded if planned for correctly. Seldom are they nota factor when they are a surprise.

It is better to plan for it and not need it than to not consider it and then be faced with a tougher choice to make. This is particularly true in the first stage of retirement.

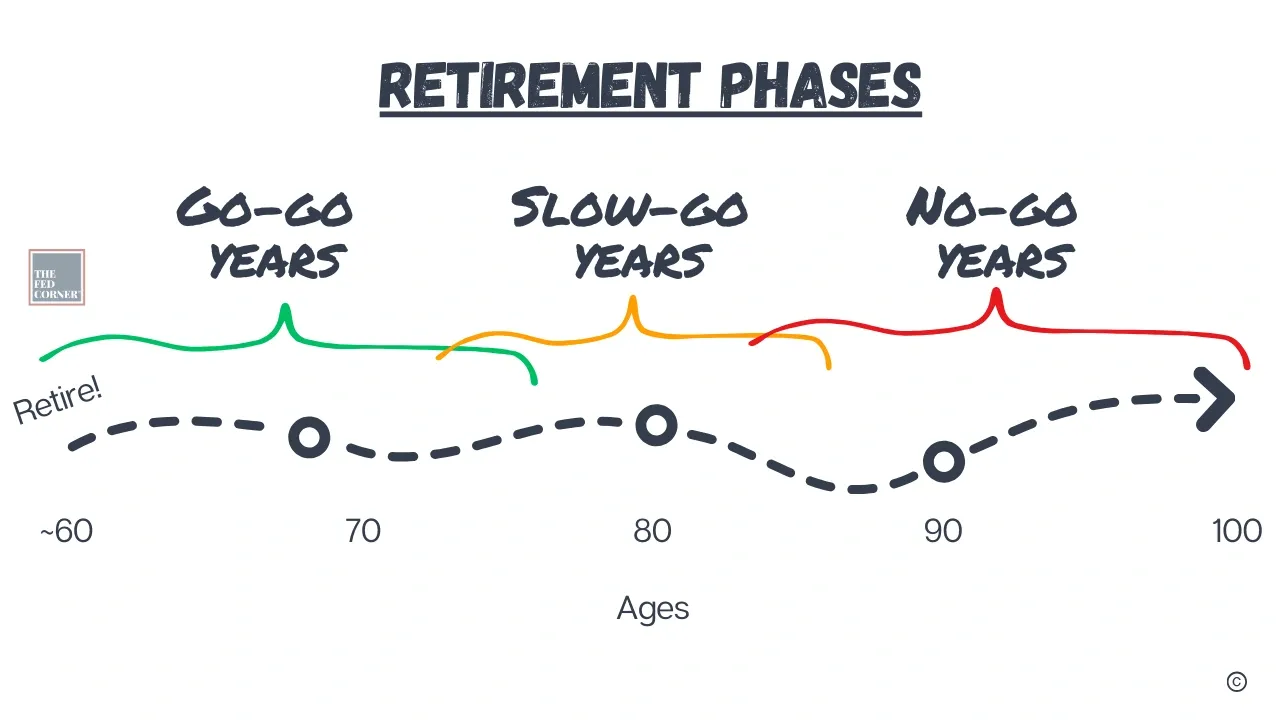

We call these the go-go years, because that’s when we see people generally experience these kinds of expenses. The kids are old enough, you’ve got a lot of time, energy, and money, and you’re excited about this new season of your life.

We’re excited for you too, but let’s make sure you’re setting your trajectory towards success in the long term.

Late Life Healthcare (LTC)

There is a lot of research that suggests a family will need around $300K for extended healthcare in retirement. According to HHS, close to 70% of us are going to experience some kind of long term care need in retirement.

We’ve looked over a lot of retirement plans and one of the biggest areas that’s missed is how the cost of healthcare could impact a plan.

What happens if you need a higher level of care later in life? If you don’t plan for this prior to or in early retirement, the costs can often become prohibitive.

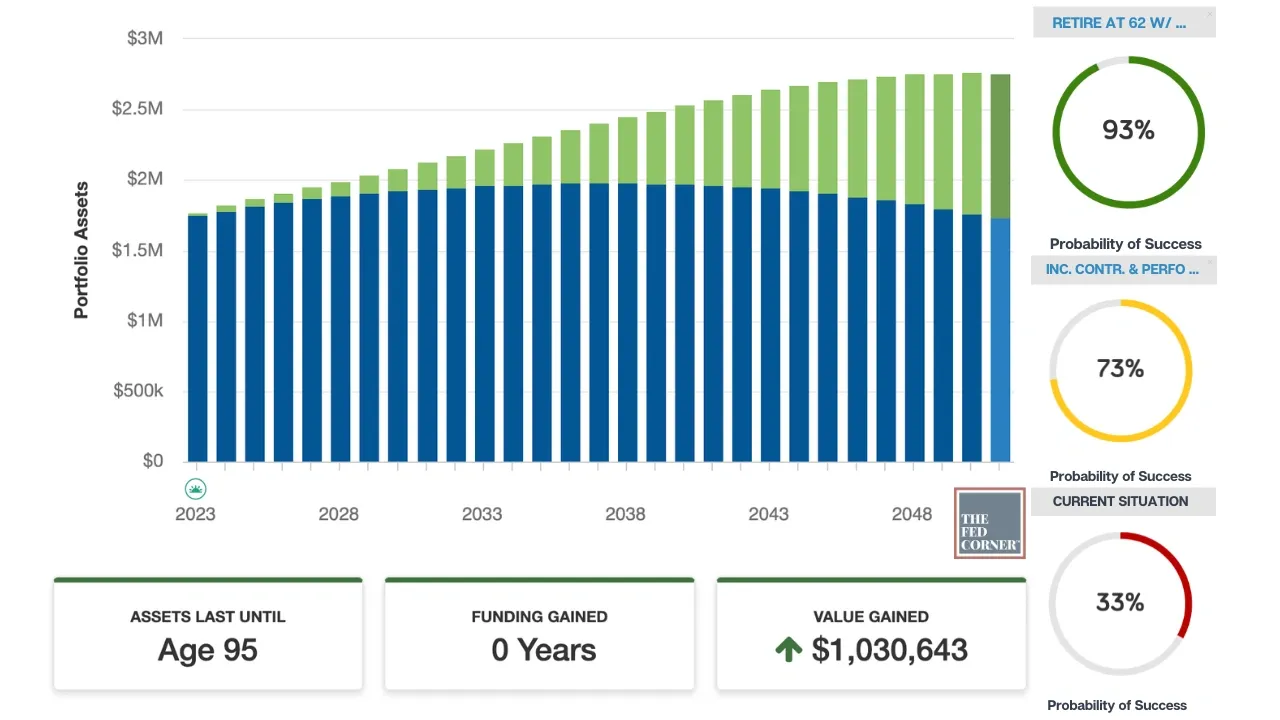

One tool we use to help model the impact are “what-if” scenarios. What if you need support to the tune of $5K/month for a few years at your age 75 or 80? This could be as simple as in-home assistance to help you take care of things after an injury. But what if you have a greater need?

Some of our clients have experienced significant health challenges in late life that required moving to an assisted living facility. These can get expensive—fast. Here in the DC metropolitan area, some cost $100K/year for that type of service. Can your plan afford this in the future? Have you done some modeling to see the impact? Here’s an example of what you can consider:

To many feds’ surprises, health insurance will not cover ongoing long term care. There are some expenses covered up to a point, and then the rest is on you. It’s up to you to determine how you will address this need, whether self-insuring or passing on the risk to an insurance company.

Medicare Creep

The next commonly overlooked expense is how Medicare costs can creep up on you if you’re not careful. There are a few ways that this happens.

Maintaining FEHB in retirement allows you to forego taking Medicare Part B, but we find many feds still have both. If you’re on TRICARE, then you are required to take Part B in retirement.

Many don’t realize that there is a $1,600 deductible on Part A. Medicare says that it’s “per benefit period”, which sounds like it’s annual, but in fact is defined as beginning the day you’re admitted to the hospital. If you have a recurring health challenge, you could end up in the hospital multiple times within the same year. Additional coverage through FEHB may kick in, but make sure to understand your plan’s benefits.

The more significant is with Part B. This is the “main” health insurance. Feds with FEHB in retirement that take Part B will have Medicare as the primary health insurance, with FEHB covering the supplemental. Part B comes with premiums.

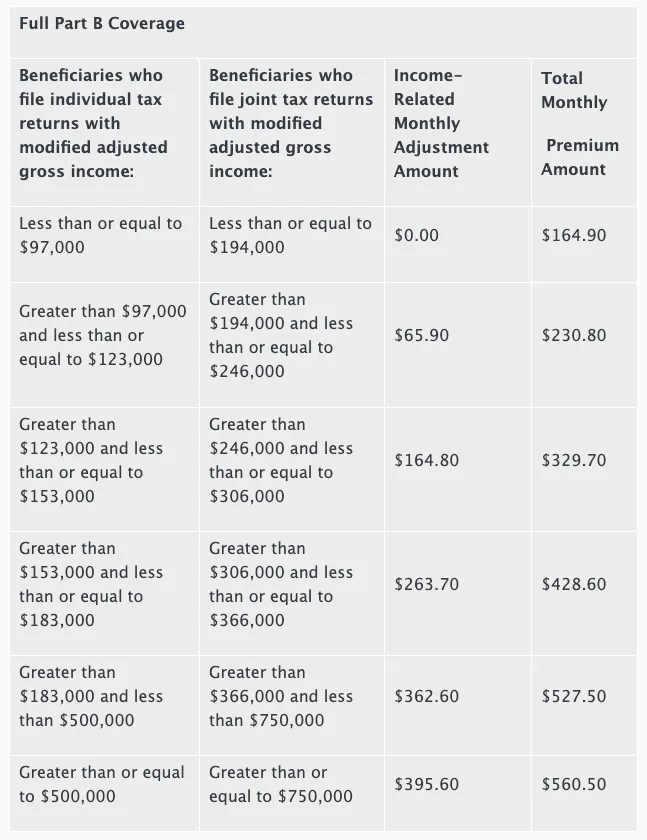

The more taxable income you have, the higher your insurance premium is going to be. In some cases, it can be as high as $400+/month. That’s $800/month for both you and a spouse.

Most federal retirees are unlikely to have that level of taxable income, but sometimes there are things in life that can trigger this, like the sale of a home. Part B premiums are based on your modified adjusted gross income, or MAGI.

Remember that your FERS pension is fully taxable like a salary, so you automatically start off with a base of taxable income as a federal annuitant. Then any Traditional TSP/IRA/401k withdrawals also add to your MAGI. Note that RMDs are required withdrawals and therefore increase your MAGI.

Generating capital gains from your portfolio will also impact your MAGI, as will making haphazard withdrawals from your Traditional (pre-tax) retirement accounts. This is why strategies like tax-loss harvesting and creating an appropriate retirement income system are so important.

If you cross the income threshold by just $1, you can expect a $65-$100/month increase for each Part B premium. This is known as your income-related monthly adjustment amount, or IRMAA. Here is a table from Medicare on Part B premiums for 2023:

The Cost to Maintain Your Home

Unless your “forever home” is a new construction, then your home will show its age as you progress through retirement. Anyone that owns an older home will tell you that by the time they finish fixing one thing, the next thing is broken too.

Some retirees find that their home maintenance costs start to creep up on them. They might love their quaint house, but are the costs creating a higher burn rate on your cash? Do you still need a home as big as your current one?

Depending on how old your house is, have you built in the cost of repairing your home? New appliances over the years? Renovations or improvements to help you live better and more supported at home?

When it rains, it pours, and it always seems that costs all wait to appear and surprise you together. If you end up having a $20K to $30K renovation that has to happen in the same year on top of your normal expenses, your “one-time” expenses, and a bad year in the markets—how does your plan account for this?

Retirement rarely plays out in the straight line that we imagine. That’s why making sure you’re always still on track is important. As we often tell our clients, planning is a process, not an event. Take the time to make sure you do the proper planning for your family, because it’s not just your money, it’s your future.