10 Things You Should Know About Bear Markets

The stock market has been on a 3-year winning streak. But with tech sinking further into bear market territory, could the selloff signal a larger market correction on the horizon in 2022? We’re expected to see 3 to 4 interest rate hikes by the Fed this year. Rate hikes means bonds suffer, so exposure to equities becomes even more important. But owning more equities subjects you to higher risk and if we see a bear market this year, you’ll be that much more susceptible.

Except for those who have ice in their veins, we’re presented with the indisputable truth that persevering through turbulent markets is only made possibly by having a formalized investment policy that has been planned out in advanced. This allows an investor to know the reasonably acceptable level of risk they can take, and how much of a pullback they can sustain before it jeopardizes their goals and forces them to adjust their portfolios.

If we see a serious shift in the direction of the markets, are you prepared? Tech stocks are very volatile, offering the potential for a lot of growth but also cause a lot of damage when falling. Many of the indices, like the S&P500 (think C-Fund), experienced strong returns last year because tech stocks made up such a large portion of its holdings. 8 out of the top 10 holdings behave like traditional tech stocks regardless of their actual sector category. To be clear, this is not a forecast.

The savvy investor must remain focused on certain fundamental truths about the economy, the markets, and bear markets in general. We know that the economy cannot be consistently correctly forecasted, and the only way to be reasonably sure we’re meeting our financial goals is not to time the markets, but rather find its moments of opportunities and invest according to our financial plan. We can infer that the best time to have a plan is now, so that you can begin to align your wealth to your goals in a way that’s meaningful.

Bear Market Defined

A bear market is defined as a reduction of 20% or more in the price of a stock or index. This is a normal part of the economic cycle. Ever-growing economies would not be healthy. But just because volatility is normal, it doesn’t make it easy to handle. Living through bear markets can be tough, and surviving it is too. As investors, we’re subject to the emotional roller coaster of volatile markets. In the decades we’ve guided families towards financial independence, the most successful investors are those who have a plan to fall back to when everything looks like it’s heading in the wrong direction.

Everyone has felt it at some point. You see a headline about something going on in the markets or the economy and you’re tempted to make changes to your portfolio. You check your TSP balance to notice that your account is down 15%, and you wrestle with yourself on whether to sell from the C, S, and I funds and invest in the G and F funds instead.

But ask yourself, on what are these changes based? Are they decisions bred from fundamental and technical analyses of the markets and the economy as a whole? Are they based on realigning your portfolio to your plan? If not, then this desire to make changes is most often based on one of two things: greed or fear. And the closer you are to retirement, the harder it is to stay on course.

Misled “Experts”

To make matters worse, the media (and really, all forms of consumable content) is littered with stock pickers and market timers that lack both the experience and knowledge to be giving advice yet produce a message with such conviction that sometimes it sounds like compelling arguments. Alphas, betas, standard deviations and finding the mythological creature of the perfect hedge against the markets — it perpetuates the challenge.

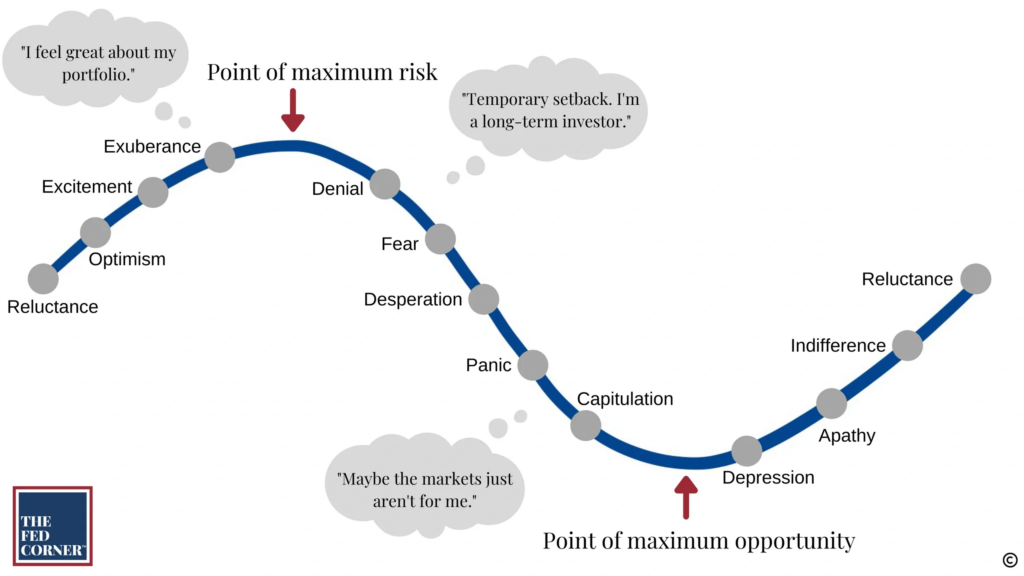

Remember one thing: most of these stock pundits are edutainers and are in the business of selling winning headlines and not winning financial advice. This image below is one of our favorites and does a nice job of showing the emotional cycle that investors face:

Investor Emotion Cycle

This image below is one of our favorites and does a nice job of showing the emotional cycle that investors face:

Here are ten facts you should remember as you become better investors:

- Watch for 20%: Market cycles are measured from peak to trough, so a stock index officially reaches bear territory when the closing price drops at least 20% from its most recent high. A new bull market begins when the closing price gains 20% from its low.

- Historically, stocks lose 36% on average in a bear market. By contrast, stocks gain 114% on average during a bull market*.

- Bear markets are normal. There have been 26 bear markets in the S&P 500 Index since 1928. However, there have also been 27 bull markets—and stocks have risen significantly over the long term.

- As of December 15th, 2021, half of the S&P 500 Index’s strongest days in the last 20 years occurred during a bear market. Another 34% of the market’s best days took place in the first two months of a bull market—before it was clear a bull market had begun. In other words, the best way to weather a downturn could be to stay invested since it’s difficult to time the market’s recovery.

- Every 3.6 years: That’s the long-term average frequency between bear markets. Though many consider the bull market that ended in 2020 to be the longest on record, the bull that ran from December 1987 until the dot-com crash in March 2000 is technically the longest (a drop of 19.9% in 1990 nearly derailed that bull, but just missed the bear threshold).

- Bear markets have been less frequent since World War II. Between 1928 and 1945 there were 12 bear markets, or one about every 1.4 years. Since 1945, there have been 14; one about every 5.4 years.

- Bear markets tend to be shorter-lived. The average length of a bear market is 289 days, or about 9.6 months. That’s significantly shorter than the average length of a bull market, which is 991 days or 2.7 years.

- A bear market doesn’t indicate an economic recession. There have been 26 bear markets since 1929, but only 15 recessions during that time according to NBER. Bear markets often go hand in hand with a slowing economy, but a declining market doesn’t necessarily mean a recession is looming.

- Assuming you’re an investor for 50 years, you can expect to live through roughly 14 bear markets. Although it can be difficult to watch your portfolio dip with the market, it’s important to keep in mind that downturns have always been a temporary part of the process, and an opportunity for the greatest success. Each part of your life requires a different strategy throughout the bear market.

- Bear markets can be painful, but overall, markets are positive a majority of the time. Of the last 92 years of market history, bear markets have comprised only about 20.6 of those years. Making the wrong investment decisions at the wrong time can be crippling to your financial independence. Having a financial plan in place helps you weather the storm.

Diversification

Simply being diversified doesn’t ensure a profit or protect against a loss in declining market. But a plan that was crafted as the blueprint for your family’s wealth can help you to withstand the turbulence and focus on the endgame.

Individual investors are too optimistic

The data has shown that the average investor’s return relative to the overall markets is significantly less. The reasons behind this have as much to do with training and experience as they do with biological drivers. In a study by Natixis, the average investor is significantly more bullish; optimistic about their expected returns in the markets, compared to professional managers.

Outperforming the markets should never be your goal, but a buy-and-hold strategy rarely fits the needs of all families either. Having a plan allows you to memorialize what you’re working towards and determine exactly how much growth on your portfolio you’ll need to accomplish everything you’d like. That becomes your investment plan, and the living guide from which you should be making your decisions toward a future of dignity and independence.

I leave you to ponder the words of two legend investors:

Peter Lynch of Fidelity, “Far more money has been lost by people preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

Charlie Munger of Berkshire, who just turned 98 years old by the way, “If you’re not willing to react with equanimity to a market price decline of 50% two or three times a century you’re not fit to be a common shareholder and you deserve the mediocre result you’re going to get compared to the people who do have the temperament, who can be more philosophical about these market fluctuations.”

It’s been said that failing to plan is planning to fail. Sounds like a new year’s resolution to me. Happy planning in 2022.

Sources: National Bureau of Economic Research, Ned Davis Research, Natixis Global Survey of Individual Investors, Hartford Funds