When is the best age to retire as a federal employee?

This question is debated across America and everyone seems to have a different answer. When should you retire? As a federal employee there are details you need to know that will impact your financial safety.

These are things like making sure you’re fully qualified for your FERS annuity pension, continuing FEHB through retirement, making sure you’ve saved enough, etc.

But figuring out when you’re both financially and emotionally ready to retire is a whole new discussion.

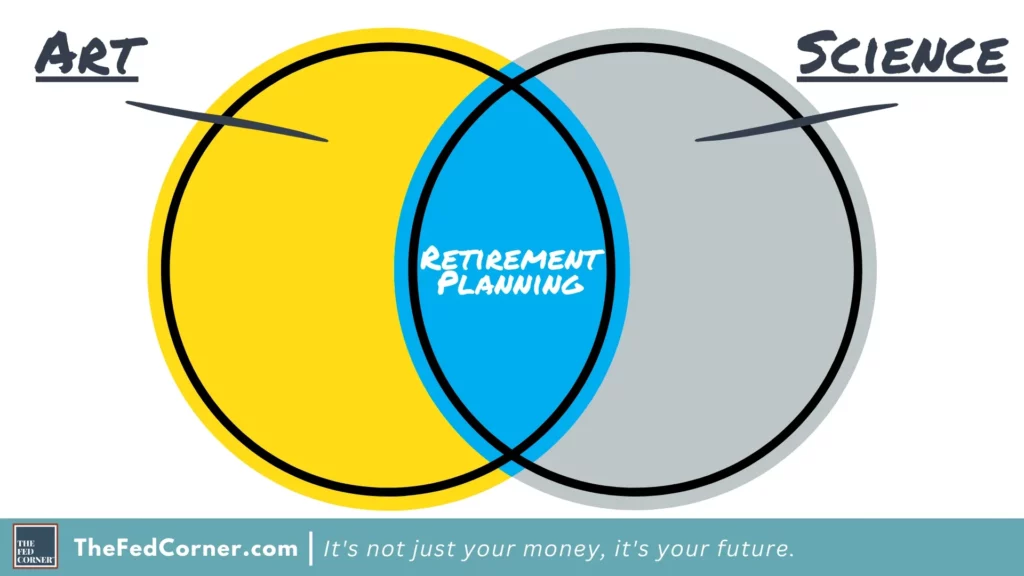

You see retirement planning is both Art and Science.

The science component is the numbers and financial planning. These are things like:

- Financial modeling and projections

- Identifying how much can you spend each month in retirement

- Determining how you should be invested

- Identifying which investments will generate the income you need

- How to manage your tax-bracket and reduce your taxes

- Etc.

But the art component considers things like:

- How do I want to spend the time I have left?

- What have I always wanted to do that I’ve not been able?

- How can I have less anxiety about my finances?

- How do I finance the activities that really make me happy? Sailing, traveling, etc.

- How can I help supporting my kids/grandkids? What kind of legacy do I want to leave?

A good retirement plan will come up with solutions to meet in the middle. For example: maybe working a few extra years just isn’t worth the stress to you. As a result, how do you need to shift your finances to help you retirement sooner?

Or maybe you’re already retired, and you’re not feeling comfortable with the way things look in our economy and in your wealth. Perhaps it’s making you be more conservative. Maybe it’s made you feel anxious about the costs of doing the traveling or whatever you really wanted to be doing.

How can you get a sense for where things are, and reorganize you wealth in a way that will allow you to keep your financial dignity and independence?

For me, I’m a numbers-person, which makes sense since I’m a financial planner. But over the years in helping federal employees retire, we found that when people can understand how their choices will impact their economic safety, then they can better make decisions about what to do, like when to retire.

Retiring Early

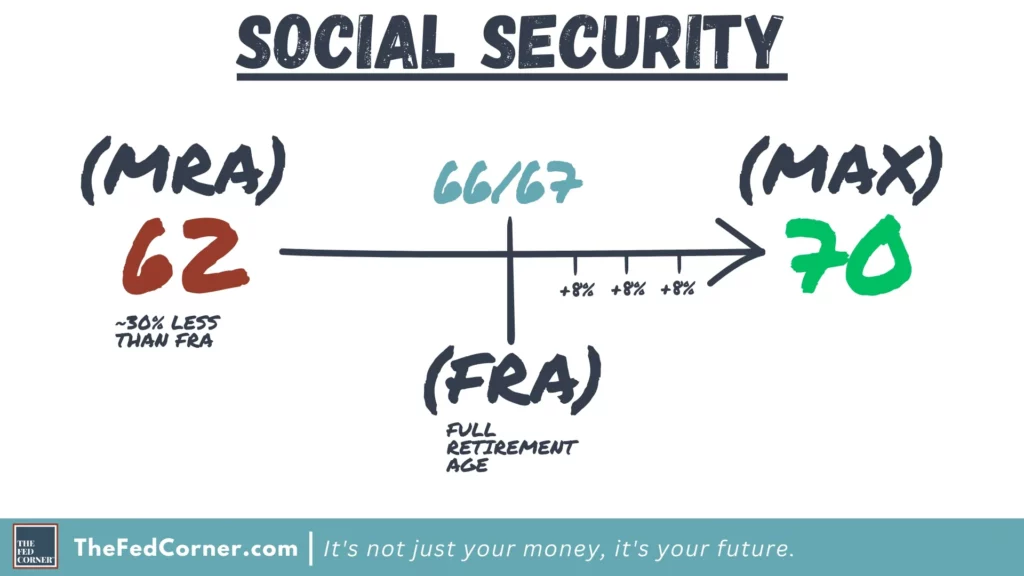

Let’s say you’re looking to retire a bit earlier. If you retire prior to 62, you have to understand that you won’t have your Social Security benefit available to you. Even at 62, that’s considered your minimum retirement age, or MRA.

It’s called this for a reason. This is the earliest you can access your Social Security benefit, and it comes at a cost.

Throughout your whole career, you’ve paid into the Social Security system, and the full benefit that you’re entitled to is available at your FRA, or full retirement age.

Notice the two markers: minimum retirement, full retirement.

Your FRA is somewhere between your age 66 or 67 depending on when you were born. If you take it at your MRA, you’re getting as much as 30% less than what you’re entitled to, and this reduction is permanent.

If you wait beyond your FRA, you’re rewarded for waiting. You can increase it by 8% above your FRA benefit each year. It maxes out at your age 70, so don’t wait longer beyond age 70.

When to take Social Security is yet another debate. Should you take it as early as possible to have the most years of income? Or should you wait as long as you can to earn the biggest monthly amount?

Mathematically, we can model out the point at which the two lines cross, which is the date when it will have made sense to wait to file.

- PLANNING TIP: In most cases, it’s around 13 years, or age 83 if you wait until 70. It will have made more economic sense (science) to file later if you live this long or longer. But on the other hand, you didn’t get any Social Security benefit for all of those years, and did not get to enjoy spending it (art).

Sometimes the additional benefit amount isn’t going to be life-changing for you, and so you’d rather have the income now.

The lesson to remember is that you should be using financial modeling to understand what that decision does to your wealth.

FERS Annuity Pension

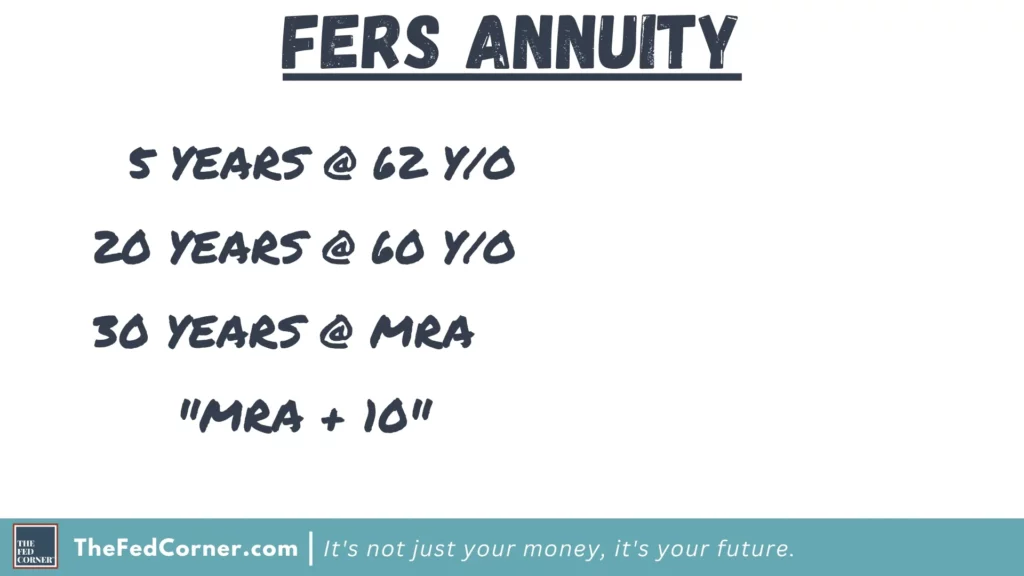

It’s important that you make sure that you’re not leaving any benefits on the table. These are the “mile-markers” that you need to achieve to be eligible for your benefits. Under this special MRA +10 rule, your pension is reduced, but you can still access your benefits.

Maybe you inherited money, or you’ve been a really good saver and the reduction of your pension isn’t going to cause issues.

Great. Make sure you factor that into the plan. That’s incorporating both art and science into your retirement planning.

But you should also consider the opportunity cost of your money continuing to grow for you. If you’ve not been able to save as much as you would’ve liked, perhaps looking at the numbers can help you figure out how much longer you might want to work for to afford the retirement you’d like to have.

And there are other things like understanding how the Cost-of-Living-Adjustment (COLA) works. They only start when you turn 62 years old so if you retire sooner, how does that hurt your pension? It may not seem like a lot, but inflation is the silent retirement plan killer.

For most federal employees, we’ve found that between Social Security and their FERS pension, that covers about half of their lifestyle expenses. So their portfolio has to come in for the rest.

So as you think about retirement, have you saved enough in order to be able to stop working and have your portfolio cover half of your expense? You might be retired for 30 years, so it’s important that you do some planning to see what that can look like.

This is an example of what modeling can look like. This is just a screenshot from the software we use to plan with our clients, and it’s really helpful because you can build in variables like retiring early or rebalancing your portfolio to see the potential impact in real time.

I encourage you to do this level of planning when you think about your retirement. Our clients understand they really only have one shot at retirement, you can’t get it wrong, so it’s prudent to make sure that you’re doing the right things along the way.

And I can’t believe I haven’t talked about this more but we have FREE newsletter that has more content like this, so if you happened upon this article and you’re not on that list, now is your chance.

And we hate spam, so all you’ll get from us are planning tips and links to other helpful resources.

If you found any of this helpful, consider sharing it with a friend. If you want to talk to us about where you stand for retirement, feel free to send us a message.