Understanding VERA and Early Retirement: Can You Afford to Retire?

New information emerges regularly about the deferred resignation program, and after the court upheld the deadline, resignation offers are officially closed. However, the landscape has recently shifted with some agencies issuing Voluntary Early Retirement Authority (VERA) announcements. This has completely changed the conversation for many employees who were presented with the resignation offer.

VERA makes an employee eligible for immediate retirement despite not having achieved both the age and number of years in service to qualify under normal retirement rules. Regardless, the big question now is: can you actually afford to retire early and still be financially secure?

Let’s break down the key considerations for those contemplating early retirement under VERA and other options, using a real-world example to illustrate how different choices impact long-term financial security.

Understanding MRA+10 and VERA: Key Differences

Initially, OPM’s resignation offer had little incentive, especially with uncertainty around its standing. Now, with VERA as a potential option, many federal employees are reconsidering early retirement.

The two major options available for those close to retirement are either an MRA+10 Retirement or VERA (Voluntary Early Retirement Authority).

MRA+10 Retirement

This applies when a federal employee has reached their Minimum Retirement Age (MRA) (usually 56 or 57 years old) but does not yet have the required years of service for an immediate retirement.

Under MRA+10, employees have two choices:

- Take a reduced pension immediately but maintain FEHB

- Postpone retirement benefits until they meet full eligibility requirements to maintain both a full pension and FEHB

Here’s a breakdown of when employees can access their full pension based on service years:

- 10-19 years of service: Pension is postponed until age 62

- 20-29 years of service: Pension is postponed until age 60

It’s important to note that postponing retirement benefits means that you no longer have FEHB coverage until later when you file for benefits again. How will you afford healthcare? Purchasing insurance on the marketplace can be an option, but it’s often costly. Make sure you’ve carefully factored this cost into your retirement plan and how to cover it, even if markets aren’t doing well.

There are a couple of other considerations for MRA+10. First, to maintain FEHB eligibility, employees must have been enrolled in FEHB for at least five consecutive years, including their final day of service.

Beyond this, the FERS supplement, or special retirement supplement, is not available under MRA+10 retirement. This can be a major financial factor for those relying on it as bridge income before Social Security kicks in. Federal employees considering MRA+10 retirement should account for higher cash needs.

VERA: The Early Retirement Game-Changer

Unlike MRA+10, VERA allows for an immediate, unreduced pension and continued access to FEHB for those who qualify. Here’s what you need to be eligible:

- 50 years old with 20 years of service

- Any age with 25 years of service

The benefits of VERA are several. First, it’s a program that’s been around for quite some time, unlike the resignation program. You get immediate pension eligibility (no reductions for early retirement) once OPM adjudicates your final figures, continued FEHB benefits if eligibility rules are met, and you have eligibility for the Special Retirement Supplement (SRS), although it does not begin until reaching MRA.

However, just because you are eligible doesn’t mean it’s the right financial decision. One critical consideration is access to TSP funds. Normally, federal employees who separate from service at age 55 or older can access their TSP penalty-free.

However, under a VERA, if you retire before the year you turn 55, TSP withdrawals are subject to early withdrawal penalties until age 59.5. This can create a major cash flow challenge if not planned for properly.

What Does Early Retirement Look Like Financially?

Now that we know the rules, let’s walk through an example based on a real client scenario. This case study helps illustrate the financial impact of early retirement and how various strategies can mitigate risks.

Case Study: Mr. and Mrs. Test Client

- Originally planned to retire at 62 years old

- Accumulated wealth steadily and hold $1.4M between their TSP and 401k accounts, as well as $300K between Savings, Checking, and a brokerage account

- The federal employee earns near the top of the GS scale, and their spouse earns about roughly half of that.

- Social Security filings dates are assumed to be 67 (FRA)

- Total monthly expenses are right around $10K/mo all in

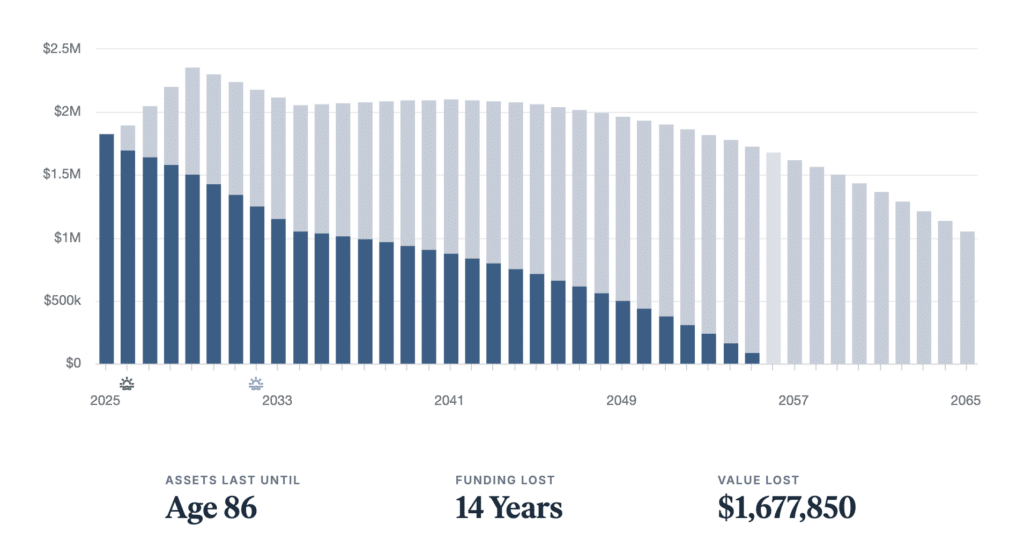

Despite having a strong retirement plan in the beginning (grayed out portion), an early federal retirement means that they lose several years of planned income, as well as a reduced overall FERS pension due to less years of service and losing the 10% benefit of retiring with 20+ years at 62.

The screenshot below is a projection of the anticipated impact of the earlier retirement.

It’s clear that this plan is not feasible, and they would need to make some changes for their plan to have a better chance of being successful. In my discussions with this client, we explored a few alternative solutions.

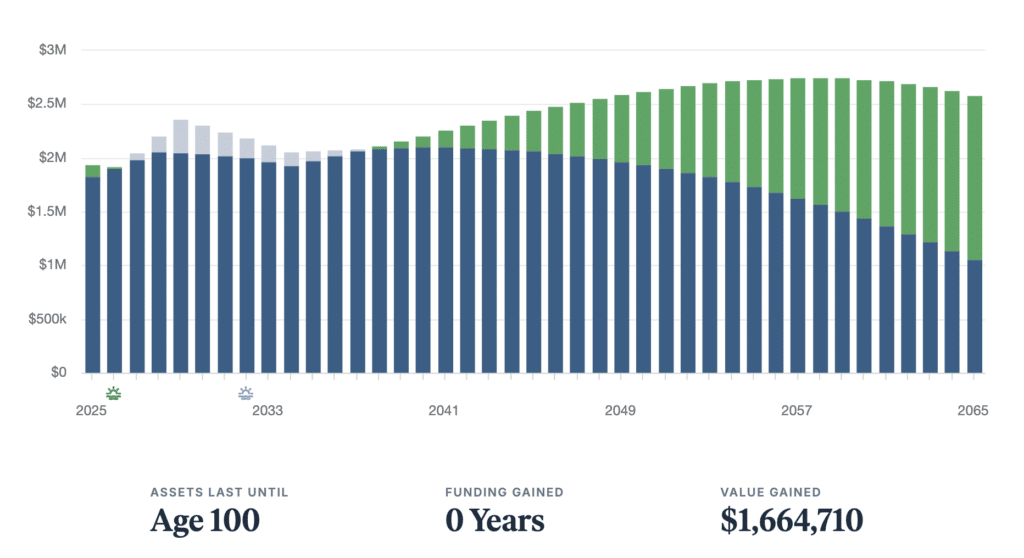

- Part-time income for 3 years: Working at 50% salary ($90K annually) to ease into retirement

- Portfolio rebalancing: Creating a conservative investment bucket to provide reliable income to fill the gaps

- Tax-efficient withdrawal strategy: Structuring withdrawals to minimize tax liabilities and protect long-term wealth

The additional part-time income just wasn’t enough to allow them to retire immediately. The plan still had a less than 50% probability of lasting throughout retirement.

However, the combination of generating income from work and the portfolio, plus taking advantage of the tax laws and making tax-aware withdrawals gave them just the boost they needed.

With increased probabilities of success, this couple felt much more confident about what they needed to implement in their plan to help them execute an earlier retirement plan.

While VERA offers an exciting opportunity, the loss of earning years can have a long-term impact. It’s crucial to evaluate your cash flow, retirement savings, and potential strategies before making a decision.

With limited time, I know that it may be difficult for you to pull together a full retirement plan, but I hope that these examples help you start thinking differently about your financial well-being.

If you are considering early retirement, now is the time to assess your financial plan and ensure you are making the best choice for your future.

Last note: the retirement example is an illustration of the conversations I’ve had with real clients over the last few weeks. I oversimplified the details in this discussion for the sake of simplicity, and there are variables in their plan that may not be present in your own, so make sure to check with your own planners prior to making any decisions.

Stay wise, and stay wealthy.