This Federal Employee Saved $200K+ with THIS

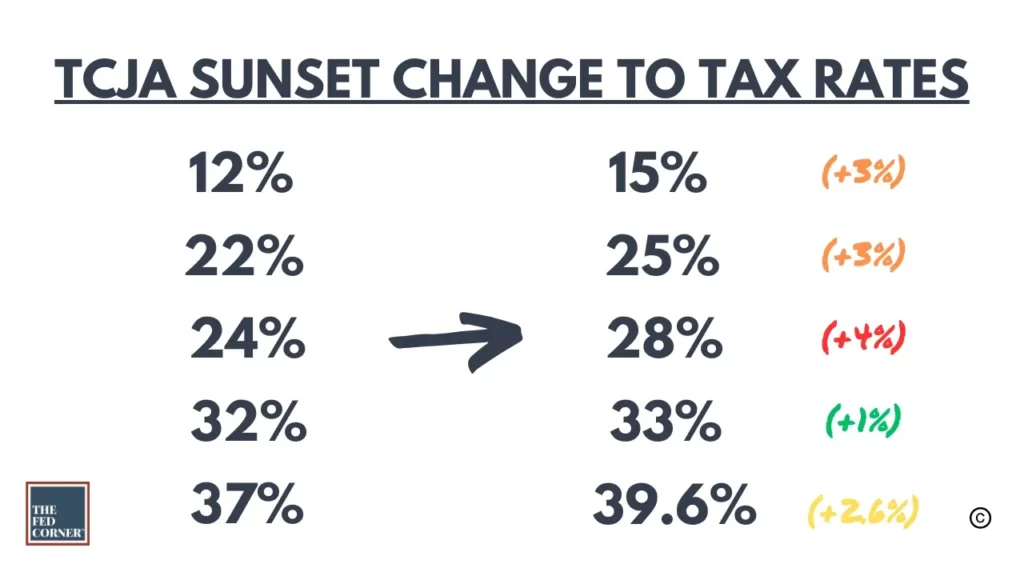

The Roth TSP is becoming increasingly popular every year. This is not surprising. The Tax Cuts and Jobs Act (TCJA) temporarily reduced rates and presents an opportunity for federal employees to pay less taxes on their income now.

For those not familiar with the law, it contains a sunset provision which means that rates will go back to the higher levels once the law sunsets in 2026 and if no law changes are introduced. Here’s what you can expect:

As financial planners, we look for opportunities whenever possible. The Roth can easily be one of the most valuable planning tools that a federal employee has available.

If you’re still working, how will your tax liability change if the law sunsets? Does it make more sense for you to maximize your Roth TSP use over the next couple of years while rates are lower?

If you’re retiring, will the changes to your overall income make using the Roth TSP now a mistake? How about performing Roth conversions?

Roth-planning isn’t a new topic, and for some it may not be a good idea at all. But too many families have neglected to incorporate this powerful tool into their own planning. In this column, we’ll explore the following:

- How you can use the Roth to your advantage

- A real case illustrating the benefit of proper Roth-planning

- When you should avoid using the Roth in your own plan

Setting the Stage

Let’s briefly cover the Roth and some general planning concepts that will help you better understand the case study shown later in this column.

When discussing retirement accounts, there are two main tax-statuses to consider here: Traditional (pre-tax) and Roth (tax-free). When you make TSP contributions, you opt to make them to either your Traditional bucket or your Roth bucket.

All things equal, having $1M inside the Roth TSP is undoubtably better than having $1M inside the Traditional TSP, as every dollar inside the Traditional bucket is first reduced by taxes before you get to use it. They both grow without being taxed along the way, but the Traditional has taxes taken out once you make a withdrawal from that account. The same is true for Traditional 401(k), IRA, etc.

Now, a slightly more complex planning principle is something called the time value of money (TVM). In its simplest form, it basically means that a sum of money right now is worth more than the sum in the future. This is because there is an opportunity cost of not having had the money now to grow it further, if you receive it later.

When considering a withdrawal from a Traditional (pre-tax) retirement account, you must always remove more money than you need to also cover the taxes. If you need $5,000/mo from your Traditional TSP, you may need to take out an extra ~$1,100/mo to cover federal income tax if you’re in the 22% bracket (state taxes and general tax planning will influence this figure further).

That’s $13,200 more in annual distributions. Those are dollars that never have the opportunity to continue compounding and growing for you. When you extrapolate this extra sum of money growing compounded over a full 30-year retirement, how much less wealth stayed in your family?

More importantly, money that grew inside a Roth-type of retirement account is now completely tax-free. If you hadn’t owed any taxes on your salary over your decades-long career, how much more money would you likely have right now?

Real Case Study

Let’s explore a retirement plan that incorporates the concepts outlined above. Below you’ll find screenshots of the planning systems that we use with clients so that they can see the impact of their financial decisions.

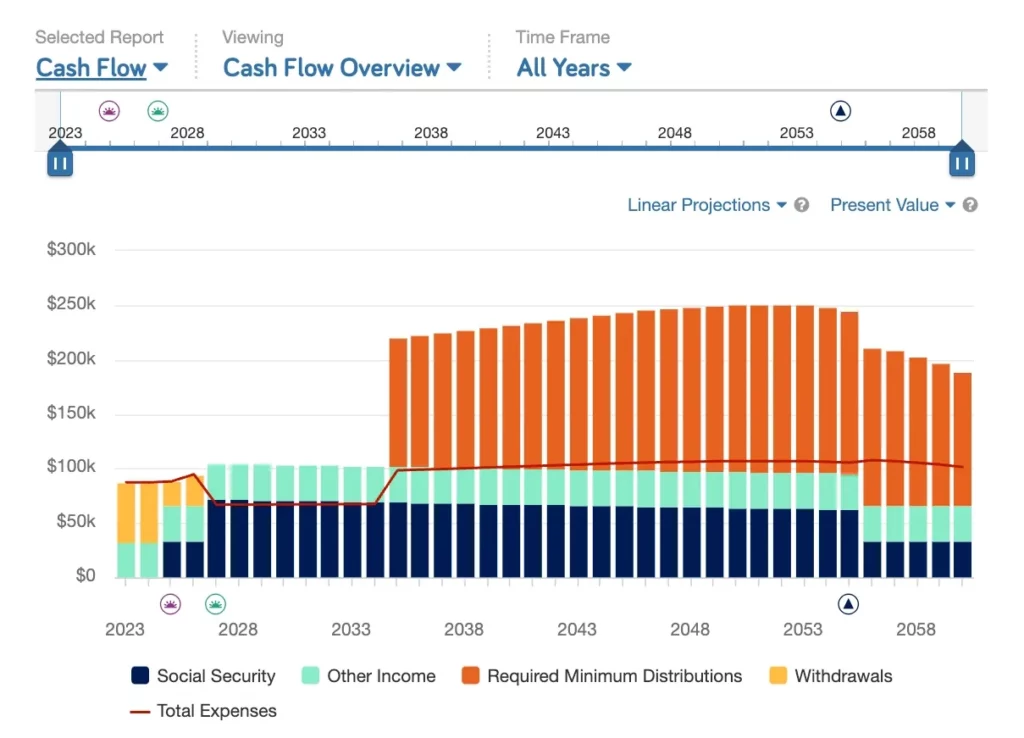

The first chart represents a cashflow report, that shows us exactly how their retirement income is going to look like.

We have pensions and withdrawals in green and yellow, Social Security in navy, and then the orange is something called Required Minimum Distributions, or RMDs. The red line represents their expense levels (outflows) over time.

The yellow (portfolio withdrawals) turns orange when they become required minimum distributions (RMD). This particular family had accumulated a healthy amount inside Traditional (pre-tax) retirement accounts and were projected to have high minimum distributions required later in life.

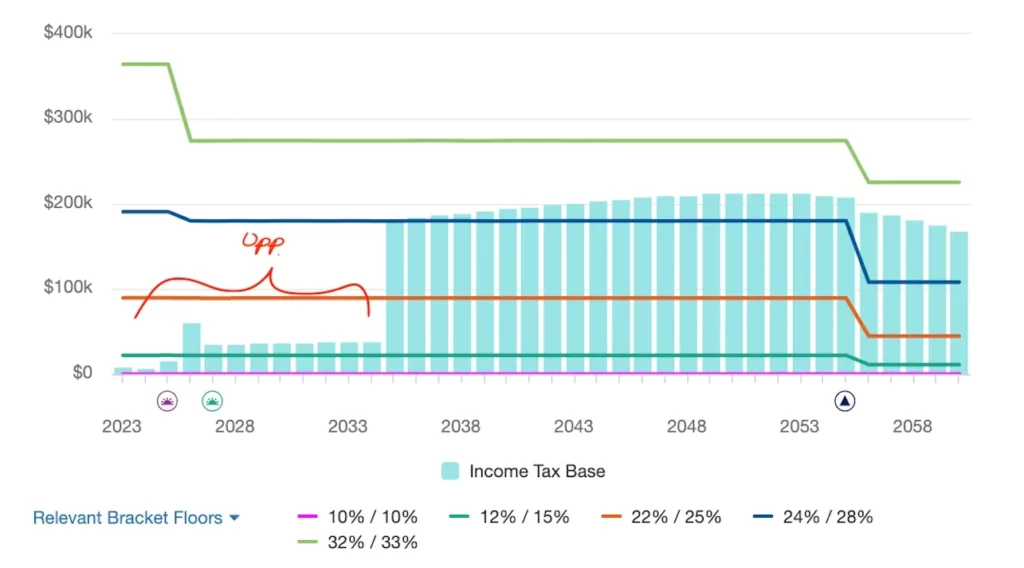

The chart below shows the data in another way by representing the family’s annual taxable income. The different colored horizontal lines represent the point in which their taxable income hits a higher tax bracket threshold.

With after-tax savings, a pension, and Social Security, they were able to support their modest lifestyle without generating much in income tax. But that all changes when their RMDs begin.

We can see that they’re immediately pushed into higher income brackets for the remainder of their lives. This not only impacts their TSP withdrawals, but it also means that their FERS pension now has a larger tax-bite coming out each month.

But what’s immediately apparent here is that there is the zone of opportunity early retirement, and what we call their “Tax Planning Window”. This is indicated by the red bracket.

If they implement accelerated withdrawals from retirement accounts early in retirement so that they fill the green and orange tax brackets, then not only do they take advantage of the currently reduced tax rates, but they also reduce their future RMDs which are projected to be pushed into the blue 24%/28% bracket.

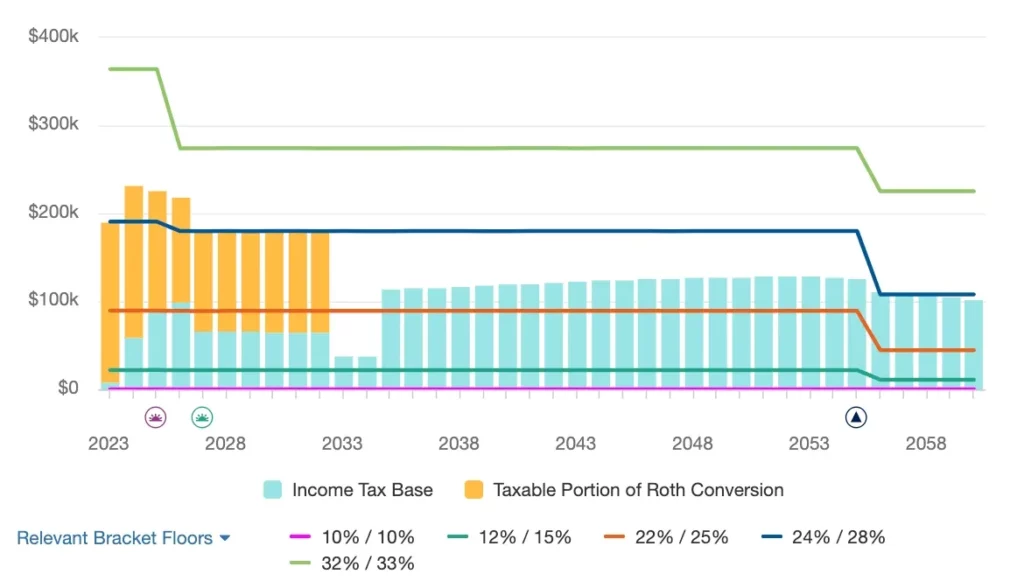

For this family, we have a strategy built into the system to implement Roth conversions to fill up their tax brackets sooner and get some of that Traditional retirement money into Roth status so that it can grow tax-free. The results are incredible.

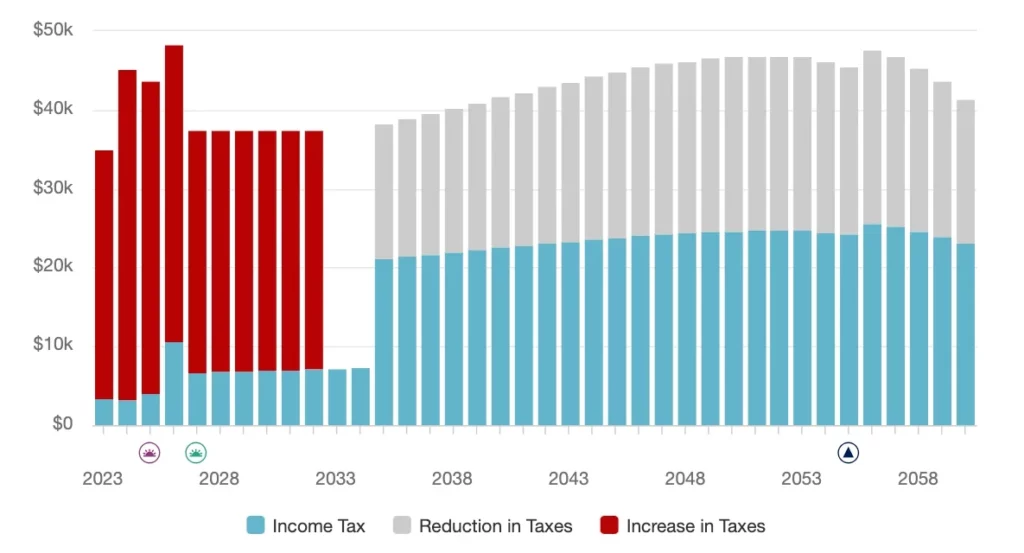

Obviously, we have an increase in taxes in early retirement, as indicated by the yellow bars. This filled their green and orange tax brackets, as well as pushing through the blue bracket for a few years. But paying the taxes now has a major positive impact to their plan.

Remember that the blue brackets are currently 4% lower now than they will be in the future if the law sunsets. While they’re paying more tax now, it’s at a lower rate, and you’ll observe that this family is now able to stay within the orange bracket for the rest of their lives instead of being pushed into higher tax brackets for most of retirement. The chart below shows the total tax liability, with the gray bars indicating the reduction in taxes.

The results speak for themselves. Not only is this family projected to reduce their taxes by almost $200,000, but their assets now get to grow and compound completely tax-free.

This reduces future RMDs which significantly reduces their taxes throughout retirement as seen in gray. This money that would have been used for taxes also now gets to be reinvested, which means growth continues for longer, and their portfolio is projected to have an increase of $1M in additional assets over the course of their retirement.

If this doesn’t encourage you to start doing tax-planning and running projections in your retirement plan, I’m not certain what will. There’s a tax implication with virtually every financial decision you make, so taxes are a major part of a retirement plan.

Additional Perspectives

If you think that owing a cumulative $1M in taxes over a retirement is unfathomable, consider how much an entire 30+ year retirement costs altogether. This depends on lifestyle of course, but depending on your earnings, you might receive over $1M of income during that time just from Social Security by itself. A $30K/year Social Security benefit over 30 years equates to $900K of income, and that’s without factoring in cost-of-living-adjustments (COLA) along the way.

If your spouse qualifies for a similar Social Security, now you’re at $2M of income just from Social Security. Now factor in a FERS pension, portfolio withdrawals, and inflation rising values the whole time. While certainly considered affluent, it’s not outlandish to recognize that a retirement can cost several millions of dollars over time.

This truly puts a $1M tax liability into perspective, and quantifies the massive value offered by doing this kind of planning in your retirement. Take the time to consider it in your own plan, because it’s not just your money, it’s your future.

If you’re interested in this kind of content, you can find more of our team’s thoughts here.