Retiring Early? Postponed Versus Deferred Federal Retirement

Postponing or deferring your FERS retirement sounds like it accomplishes the same thing. The truth is, they are very different from one another.

The circumstances leading up to either will likely influence which one makes the most sense for you. If your federal career will allow you to have an immediate, unreduced pension, stop reading here. This article is not for you.

But if you became a fed later in your career, typically because you were in the military or worked in the private sector the first portion of your life, OR if you have years that were not “creditable” (you were contracted, operating on grant money, an intern, etc.) then read on because this article could save you from making significant mistakes.

FERS Postponed

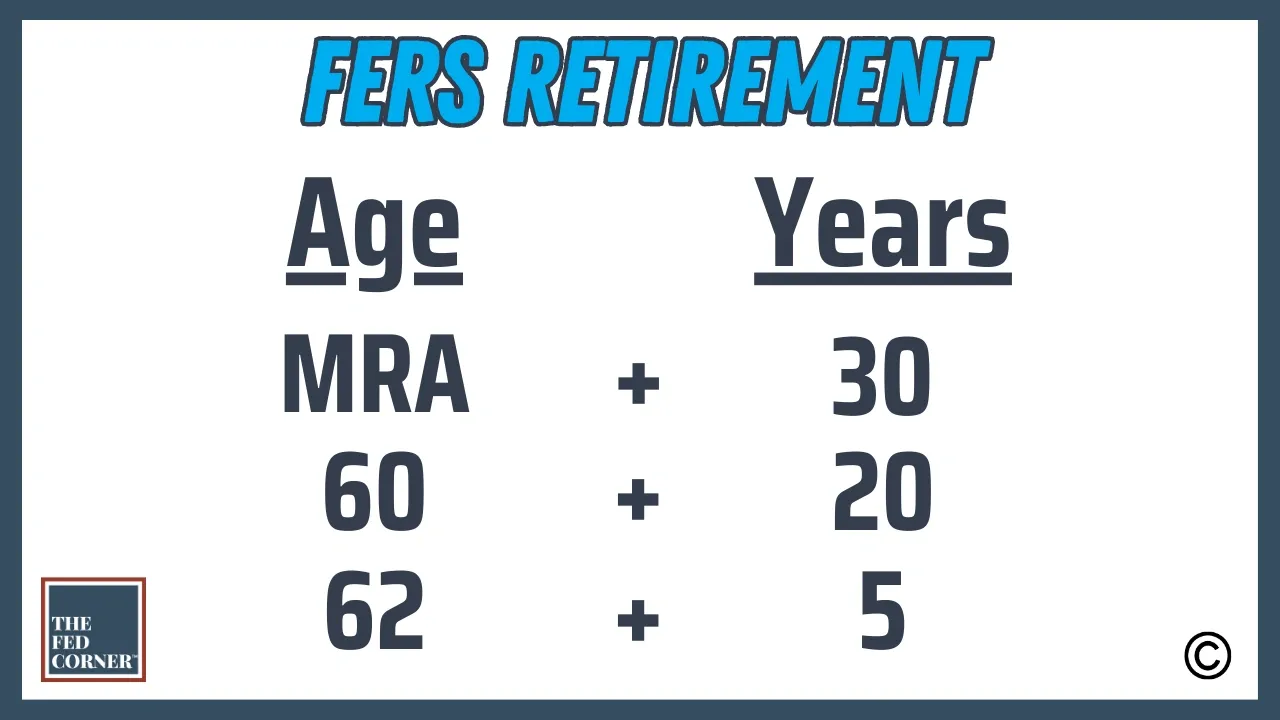

The best way to understand the difference between them and which you should pick is to first look at what it takes to qualify for an immediate retirement.

Hitting any of these milestones means you can retire immediately and receive your full unreduced benefits.

So, what happens if you haven’t met these markers? Maybe you’re just shy of 20 years, and you want to leave your agency before you turn 62 years old.

That’s where you have a few options, like whether to Defer or Postpone your FERS retirement.

But before we discuss those two, you also have a third option, which is the MRA + 10 milestone. It’ll make sense why I’m covering this in just a moment. I encourage you to watch the video as it is more easily understood illustrated.

Under MRA + 10, you must have at least 10 years of creditable service and have reached your Minimum Retirement Age (MRA). Under this rule, you’re able to separate from service and still keep your benefits.

You’re fully vested in your federal benefits by the time you reach your MRA if you have 10 years of creditable service, and you can leave at this point if you want.

In fact, you’re eligible for an immediate retirement, but because you’ve not reached the full milestones required for an immediate AND unreduced pension, you’ll see a reduction to your FERS pension.

The reduction is 5% reduction per year under your age 62. So, if you’re 60, that’s 2 years prior to 62: a permanent 10% reduction to your pension. If you’re 58, that’s a 20% permanent reduction.

What if you still want your full FERS pension instead? You can either work the necessary time, but what if you have a job offer elsewhere that you just can’t pass up?

Or what if you’re simply tired of working? Maybe you’ve saved enough money and just want to retire.

This next part is also more clearly visualized within the video.

If you’re coming up to your MRA and you have 10 years, you can retire but with the penalty. But the way around this penalty is to postpone your pension until a future date.

Postpone until when? Refer to our immediate FERS Retirement chart. You don’t have 30 years, you don’t have 20, but you do have at least 5 if you’re considering MRA + 10.

With 5, you must be at least age 62, so you would postpone your benefits until age 62. Doing so would mean that you not be subject to the 5% penalty, as your pension wouldn’t start until your age 62, when the 5% penalty is phased out.

Losing FEHB and FEGLI

The critical piece that you must remember is that you’re postponing all your benefits. That means you won’t have FEHB health insurance because you stopped being a fed, and you also postponed your retirement, so your FEHB is postponed too.

If you’re considering this, you need to also consider how you’ll be covered for health insurance during this time. Some people use their spouse’s insurance, others just buy private. Whatever you do, just make sure you’re planning for this.

FERS Deferred Retirement

With a deferred retirement, this is when you probably don’t have the MRA + 10 under your belt, so it means you either have less than 10 years or you’re not old enough.

Unfortunately, you’re not eligible under any of the rules, so you must defer your benefits.

So, at 62 years old, if you have 5 years you can get a pension, but your other benefits like FEHB and FEGLI won’t be there for you.

Folks, please pay close attention to your circumstance. The rules surrounding federal benefits are complex, and some situations (like this one) require extreme care to make sure you’re not making big mistakes.

Make sure you’re acquiring your SF-50s and other documents from eOPF before you leave so that you can understand what your options are. This also helps you correct any issues, like a few years missing from your records.

Feel free to reach out to us with any questions.