All Successful Retirement Plan Have These

Making the decision to move into retirement is the biggest business decision that you make for your family. There is a lot to consider, and even more at stake. Over years of helping federal employees with their retirements, we’ve seen what works well and have identified some of the biggest influencers of success.

Retirement planning is a process, not an event. Sure, there are series of events that involve looking at financial modeling, projections, strategy development, etc. and they often involve reports known as a “retirement plan”.

But the ongoing success of a retirement plan is not made real by simply having a plan. It is made real by the process of implementing your plan over time. Like your health, the ongoing maintenance of eating well, being physically fit, and regular check-ups ensure there are not challenges awaiting you. What gets measured gets strengthened and improved, and your financial independence is no different.

Risk Management

No risk, no return. This is a core tenet in investing. But risk does not always equal return. In fact, when you’re retired, preserving what you’ve built and making sure it lasts the rest of your lifetime is significantly more important than investing for a lot of growth.

Our clients want to know that they can count on their portfolios to supplement their FERS pension and Social Security, and that regardless of what happens in the markets, they can continue to live their lives uninterrupted.

Another big risk many retirement plans fail to address is healthcare. Folks, your health is a big expense, and it gets bigger the further into retirement you go.

We’ve had clients in long term care facilities that cost close to $100K annually for the care that they needed—the DC metropolitan is expensive. But regardless of where you live, this kind of expense can be a torpedo to a retirement plan, and it’s a risk that you must factor.

But that’s not the only place where there’s risk. Where else is there risk for retirees? The risk of not growing your money fast enough to replace what you spend and outpace inflation is a big one. Simply put, it is the risk of running out of money before running out of time.

This is one reason I take issue with labeling the TSP’s G fund as a “safe” investment. It is safe from volatility, but not at all safe in helping you to sustain your lifestyle through retirement.

The cost of your daily lifestyle goes up over time. Your ability to keep up with such costs and maintain a pile of money from which to make withdrawals needs to outpace both your draws and inflation.

If your wealth stays stagnant, or worse, doesn’t grow fast enough, you will eventually run into trouble.

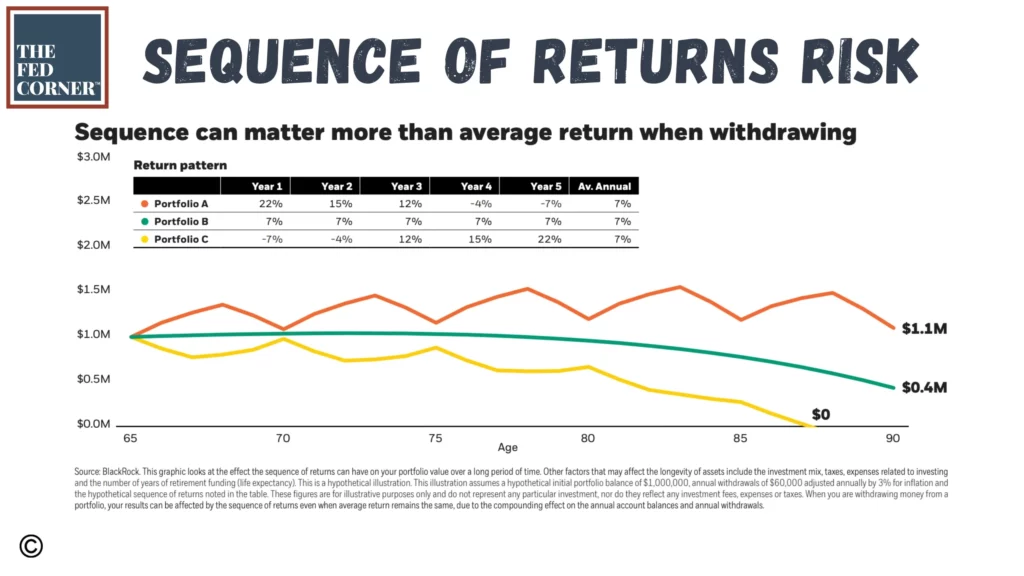

There is a brilliant graphic from Blackrock that helps illustrate this point. Not being invested properly will influence the sequence of your portfolio’s returns. The sequence of your returns is critical in retirement.

When a portfolio is in decumulation mode (retirement), this single variable can quite literally destroy a plan by itself. The model below shows three portfolios, all three with the same annualized return, but differing sequences along the way. See the results.

Efficiency

Efficiency is something that belongs in every retirement plan in a variety of different ways. Mainly: low tax, low load.

First, there is efficiency in your overall plan. How organized is your plan? Do you have accounts everywhere? Have you taken the time to pull together all the information needed in a proper retirement plan or are you grabbing portions at a time? Is information up to date? Are laws factored current?

When families come to work with us, we give them a list of everything that’s needed to us to create a strong retirement plan. Financial planning is GIGO: garbage in, garbage out–if your inputs to the plan were done incorrectly, then the results of your models will also be incorrect.

But there’s also efficiency in your taxes. When you retire, that’s the first time in your life where you have full control over your taxes. Sure, your FERS pension and Social Security will be taxed, but the bulk of your retirement income gets to be designed however you want.

Having full control of how you design your income plan for retirement means that you can have incredible tax efficiency and savings along the way. Every dollar saved in taxes is money that you get to spend on your retirement or reinvest instead.

Another place where you need efficiency is in your portfolio. I lost track of how many people I spoke to last year that had inefficiency investments inside taxable accounts.

Last year was the true test. Many families saw massive portfolio drops due to the markets correcting. Not only did they lose value, but many families also had to pay taxes on top. Not good. The worst part is that it was completely avoidable.

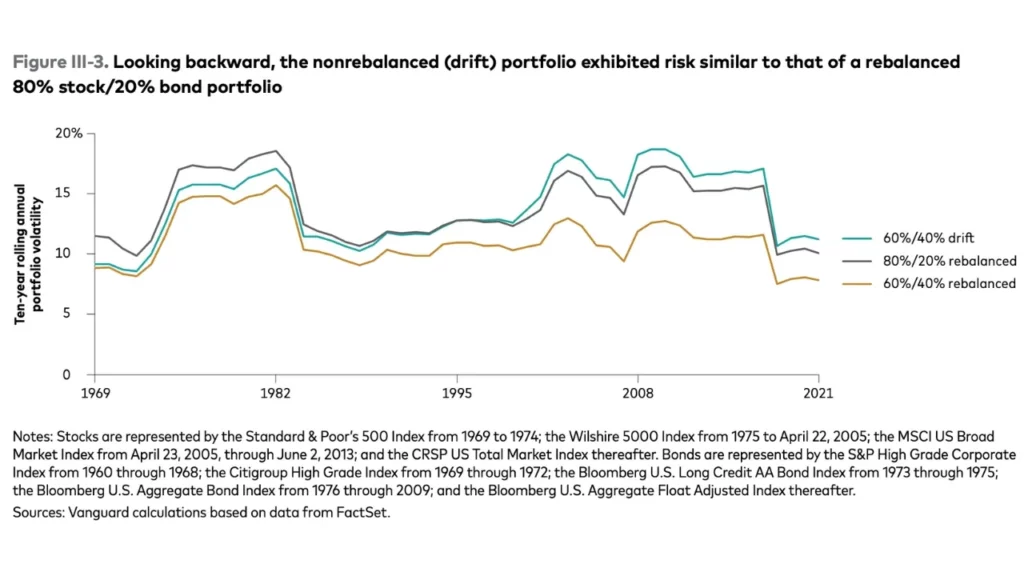

In your portfolio there is also a matter of being efficient with your risk-adjusted return. The graphic below from Vanguard illustrates three portfolios: two 60/40 portfolios, and one 80/20 portfolio (stocks/bonds).

The 80/20 portfolio (gray line) is more aggressive than both of the 60/40 portfolios (blue and yellow lines), has more opportunity for growth, and therefore should be more volatile.

However, we see that if properly implemented, this higher-growth potential 80/20 portfolio (gray line) shared similar volatility than a more conservative 60/40 portfolio (blue line) that was not properly implemented.

Not only did the blue-line 60/40 portfolio have higher volatility and higher risk, but it alsohad less opportunity for growth compared to the 80/20 given the stock to bond ratio. Better growth for less volatility was available for properly maintained 80/20 portfolio.

And if high growth were not the objective—as is the case for most retirees—then a well implemented 60/40 portfolio (yellow line) carried significantly less volatility than a poorly implemented 60/40 portfolio (blue line).

The importance of the planning process cannot be overstated.

Willingness To Take Risk

Discussing risk management and suggesting that one should take risk in the same breath seems counterintuitive.

It goes without saying that all investing has risk involved, including the loss of principal, but there should always be parts of your portfolio that are invested for some level of growth. Most retirements last for similar lengths of an entire career.

If you’ve read our other articles on the structure of portfolios, you’ll recognize the concept of taking a bucketed approach to your wealth. Without going into detail again, the concept is simple.

If you set up your wealth to be doing several jobs at once, you can allow the growth “buckets” to do just that—grow. With growth comes volatility. If you need your money during volatile markets, you risk selling investments at a loss to raise cash.

That’s where the more conservative “buckets” come into play. By design, they would be more conservative, and using investments specifically designed to generate cashflow and provide liquidity.

Doing so allows your cashflow to remain interrupted by the volatility that comes with growing your wealth. As stated, simple, but not easy.

Why not just have all your portfolio generating income? After all, you are in retirement.

Say we have an annualized 3% inflation, and factor that inflation for a decade. If your money does not outpace inflation and is flat, you can expect your money to have roughly 30% less purchasing power over that time frame.

That’s a third less lifestyle that your money can support. As such, federal employees should have parts of their money that can be inflation-fighting and growing for them, so that future-you can have the same kind of spending power that today-you does.

Education

The decisions you make are influenced by your knowledge. If we say to a client, “We think you should be invested more like this”, we want to make sure to take an educational approach in helping them understand the reasons why.

There are a few reasons for this. Having a solid understanding can give you the peace of mind knowing that you have a game plan in place. This, in turn, makes it so that there is less risk of your wanting to abandon the strategy if the markets misbehave.

A good investment plan doesn’t mean there won’t be volatility; it means that level of volatility is factored in towards still achieving your goals.

A successful retirement is not just about getting the maximum growth. Successful plans require the ability to withstand an appropriate amount of volatility.

But beside the economics, is a sense of fulfillment and overall satisfaction that needs to be a part of it. Having the continual sense of financial independence is a big part of feeling good about your retirement.

You can have the most financially successful retirement plan but if you’re constantly in fear of running out of money, or you just aren’t settled into a place of comfort, then I’d argue your retirement plan needs adjusting.

True retirement planning meets in the middle of both science and art, and that’s why all plans should be created differently.

If it were always a matter of only maximizing the money, here’s your plan: take Social Security at age 70, invest 100% in stocks, and never retire. Clearly there’s more finesse required, so make sure to account for variables beyond just the numbers. After all it’s not just your money, it’s your future.