Is the FERS Annuity Supplement Eliminated Under OBBBA?

The FERS annuity supplement, also known as the Special Retirement Supplement (or “bridge” benefit), which helps certain federal employees by providing a Social Security–like payment until age 62, has been on the chop block all year.

There has been a lot of back and forth on what this bill contains. Here’s what’s happening under the One Big Beautiful Bill Act (OBBBA):

What the Law (House‑passed H.R. 1 under OBBBA) Proposes

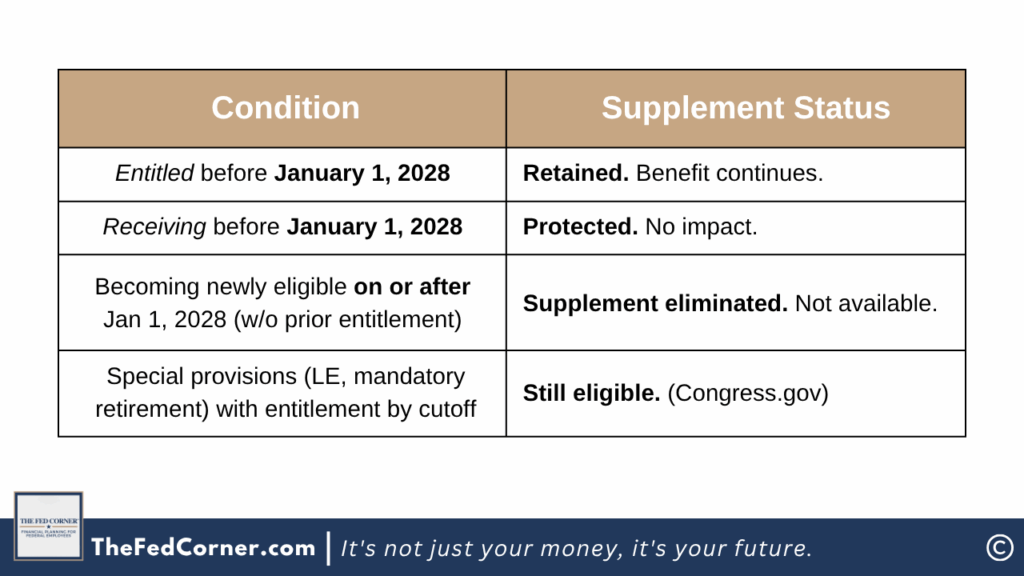

- The bill includes a provision to eliminate the FERS annuity supplement for most employees effective January 1, 2028

- The elimination applies only to new retirees whose entitlement begins on or after that cutoff date. Employees already entitled to the supplement before January 1, 2028—including those retiring early under immediate rules or in certain special categories—are expected to keep their eligibility

- Employees already receiving the supplement, or those who will have turned 62 by December 31, 2027, are unaffected

- Certain groups—like federal law enforcement officers, firefighters, air traffic controllers, mandatory retirees—are expected to remain eligible even if retiring before age 62 after that date

What That Means for You

Next Steps & Things to Watch

The exact legal definitions (e.g. what counts as being “entitled” by the cutoff date) may be clarified as time goes on, but we believe the standard definitions apply

If you’re planning early retirement (especially if targeting a date around or after 2028), you may want to consider your eligibility before the cutoff date—or plan accordingly in case the supplement is removed. This means getting your financial planning in order before you start making any decisions.