Is Social Security Being Reduced?

Over the last few months there’s been a lot of talk around Social Security and the issues with the amount of money within the fund. In essence, the amount of money coming out of the Social Security fund is increasing faster than the amount of money going in. This has created sustainability concerns could create issues for retirees going forward.

The Congressional Budget Office warns that “…workers may see a 23% reduction in promised Social Security benefits by 2034 if there aren’t changes made.”

This is a big deal. There are millions of Americans that rely heavily on their Social Security benefits to be able to live.

The Academy of Actuaries also offered perspective, “If timely changes are not made, cutting benefits for future beneficiaries only may not be enough to achieve solvency…Instead, benefits for those retirees already receiving benefits may have to be cut, or Social Security’s income may need to be increased.”

For many people, Social Security is only a part of their retirement income but it’s still an important part, and a reduction in the benefits could be life changing.

In an effort to show the possible impact to a retirement plan, we created a sample retirement plan so that you could see what a reduction in Social Security could do. Our hope is that federal employees will be able to understand the impact as they consider their own planning.

We’ll also briefly discuss how this might impact your decision of when to file for Social Security benefits as well as some possible solutions being introduced.

Breaking Down the Numbers

If we assume a $30,000 Social Security benefit, a reduction of 23% would equate to $6,900 in less Social Security income each year (30,000 x 0.23).

If your retirement lasts 30 years, that’s $207,000 in Social Security benefits never received (6,900 x 30). It gets worse. That figure is without any Cost-of-Living Adjustments. If we factor in yearly COLAs to your Social Security benefit, the amount less received is even larger.

How would we calculate the compounded future value of an inflation-adjusted benefit? If you enjoy mathematical problems, google the formula for future value compounded and give it a try.

I prefer to use to our financial planning software because it allows us to do it faster as well as incorporate various additional factors simultaneously, like:

- a portfolio

- retirement expenses

- taxes

- what-if scenarios

- and various others

If you’re reading this article, I encourage you to watch the video for the illustration and visualization of the impact in the reduction of Social Security.

Some important details to note before we jump into the results:

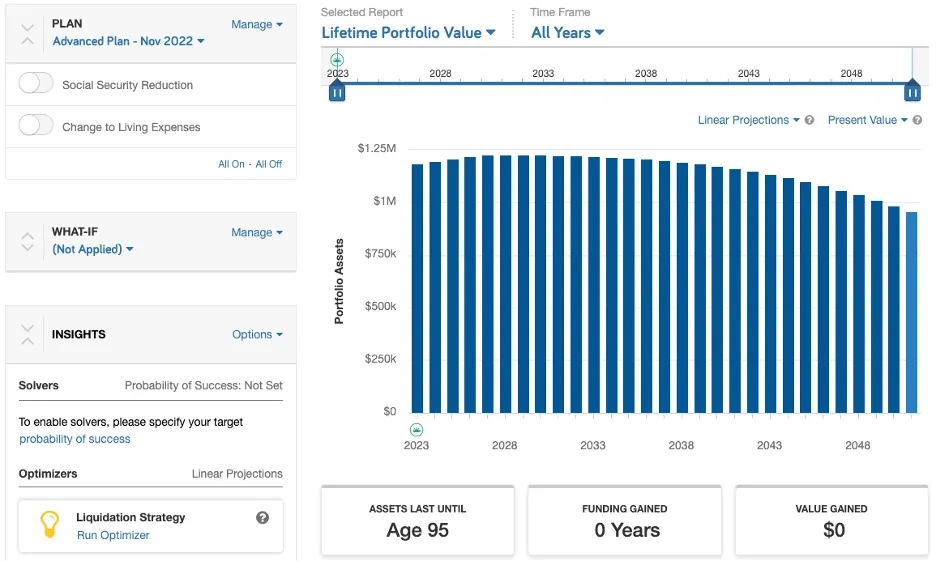

These blue bars represent a portfolio’s value over time, and these toggles on the left are changes that we can build into the retirement plan. The Social Security reduction in question is built-in.

Some other built-in assumptions are a FERS pension based on $155K at 20 years (non-bonused), annual Social Security benefit of $30K, annualized inflation rate of two and a half percent, annualized linear growth of around six percent, and monthly distributions of around six thousand dollars. Consider that these distributions are pre-tax, so the net-after-tax amount for actual “spending” is considerably less. Your mileage will vary with this cashflow level depending on your lifestyle and where you live, but it’s modest here in the Washington, DC area.

We use a linear annualized model because it offers trajectories and trends which are critical when analyzing data in economics. It also goes without saying that one should not rely on a single snapshot of their projected plan. It takes maintenance to continually redirect a plan’s trajectory towards its ideal future.

With stable markets, we can see that this sample plan is currently sustainable. It doesn’t appear to have any critical issues going on like overspending.

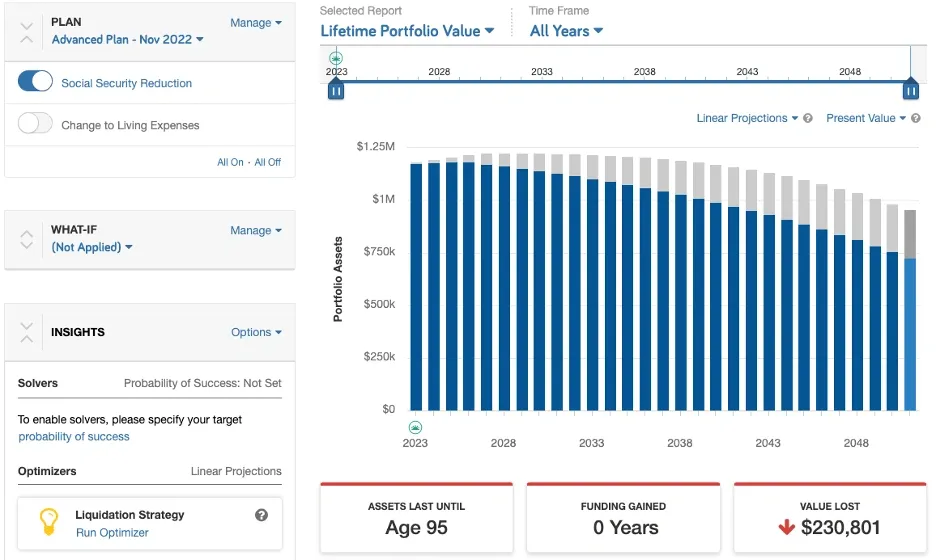

Now let’s turn on the toggle for the Social Security reduction to see the impact.

We see a visible impact to this plan. Does it look like it’s in danger? A year of bad returns or other variables could certainly derail this plan, but as is, it looks like it’s going to be fine. But don’t get comfortable yet.

Of note: the reason the decline accelerates as time goes on is because of Required Minimum Distributions (RMD). Even if you don’t spend the full RMD, taxes come out and never get reinvested, so you’re left with less money each year.

The Devil in the Details

The initial projections appear to turn out okay, but what’s the likelihood of there never being another bear market, or someone’s spending rates remaining unchanged their whole lives? That’s not how retirement works.

Over the years of helping federal employees with their retirement, we’ve come to deeply understand how the economics of life will change in ways that were never planned for.

This is why the process of planning is so much more valuable than having a single plan you looked at once or twice. Your life will change, and without adjustments, these minor changes can have significant impact to your financial well-being.

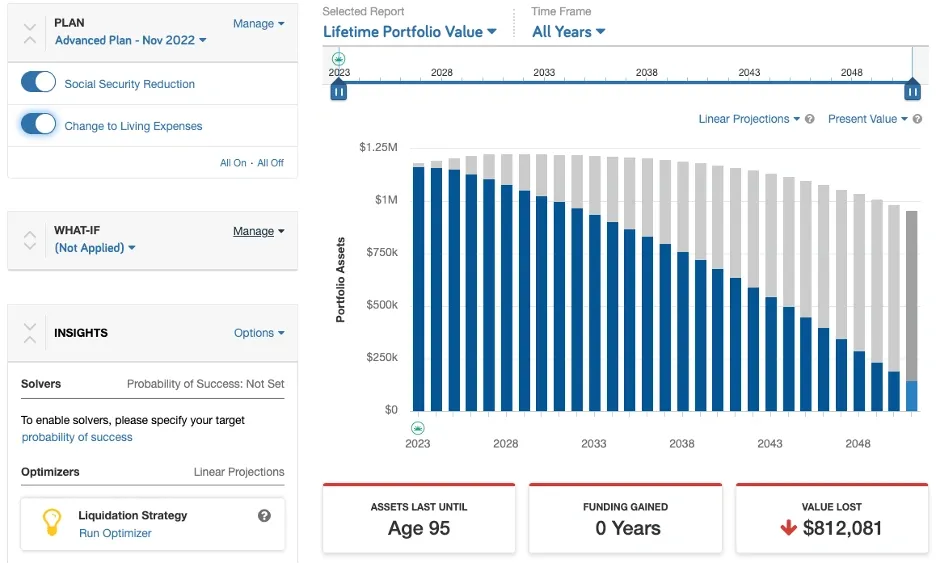

For instance, let’s take our sample plan from above and slightly increase spending. We built-in a toggle to increase spending by around $900 per month.

If you think about how you’ll be spending time in retirement, this kind of extra spending is easily done, especially considering that you may owe taxes on these funds as well.

This plan is now in serious trouble and would have to implement changes to set it back on track. When a plan looks like this, generally all it takes is a bear market, or a couple years of high medical expenses, and it could run out of money much earlier.

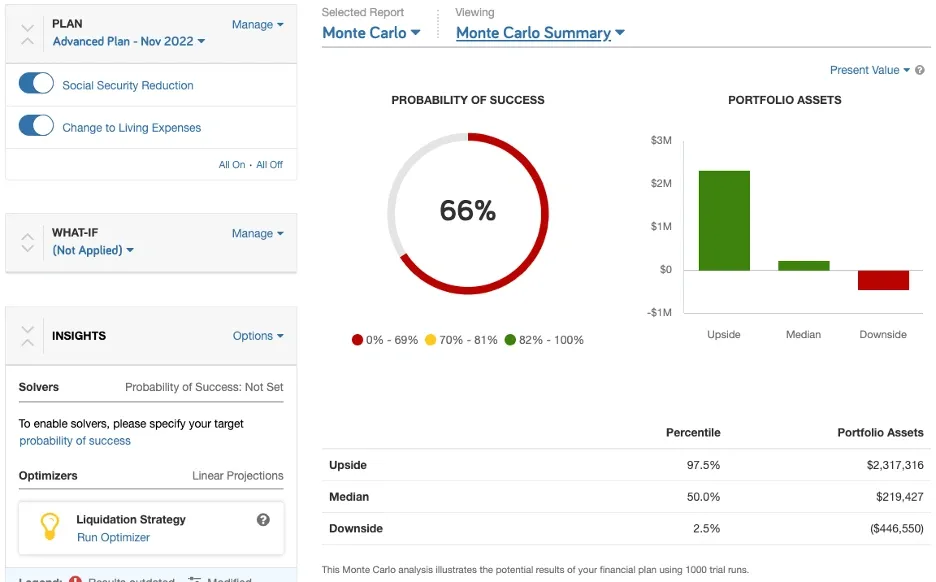

When we apply at a Monte Carlo analysis, it returns a 66% probability of success. If this sample plan were one of our real clients, we would be in crisis planning at this stage and looking at all possible solutions to correct its course.

Application Towards Federal Retirement Planning

This exercise was designed to illustrate the possible impact of a reduced Social Security. This does not mean that you should immediately panic. In fact, we’ve been able to help our clients successfully plan through some extremely challenging situations.

My hope is that this exercise illustrates the importance of taking the time to maintain your retirement plans. When our team runs into a situation that looks like the above, we start asking questions like:

- What are the variables that need to be changed in order to put this family back on the right track?

- How quickly can a plan in danger turn into a permanent problem?

- Should there be changes to their investment plan?

- Do we need to address their balance sheet differently?

- Are there opportunities elsewhere in the plan that can help improve trajectory?

These are real questions that need to be worked through, so the conversations around a Social Security reduction means that families may need to go back to the drawing board to prepare in case this is something that becomes a reality.

If your retirement projections have included full Social Security benefits (everyone’s did), this is something that needs to be addressed in your projections.

Practically speaking, this could mean that you must reduce your spending in retirement, possibly change your investment strategy, or a myriad of other factors.

The most important thing in retirement is that you maintain your options. If you plan for something and it doesn’t work out, what are the variables that you can change to reposition yourself on track?

Does This Impact When We Should File for Social Security?

Deciding when to file for your Social Security benefits involves many considerations. The one factor I want to bring up here is that if you wait until later to file and the benefit is reduced, would you have wanted to be earning the unaffected amount between now and then?

On the other hand, if you take it early at your MRA (or minimum retirement age, which is age 62), you receive a reduced amount for taking it early, by as much as around 30% less than the benefit you’re entitled to. Would a further reduction be reducing an already reduced amount? That could be tragic to have so little Social Security income.

What we don’t yet know is how they would implement these reductions if introduced. The reality is that there would likely be a combination of tactics used to address the issue. Some argue only future benefits would be impacted. Others claims even those currently receiving benefits would be impacted. This problem is also not unique to the United States. There are other countries experiencing similar problems. The U.S. may look to others to see how the issue is being handled.

What we know so far is that a consideration towards increasing the payroll taxes, increasing the eligibility ages, or a combination of both, stands to reason as the most probable course of action. When and how is yet to be determined.

I’m always curious to hear different perspectives, so share your thoughts below this article. Would you find yourself taking Social Security early or delayed? How would you suggest we should address this lack of funding issue?

Do you think it’s an inflated risk? Even if you do, wouldn’t it be prudent to try to plan ahead? After all it’s not just your money, it’s your future.