How to Invest TSP During All-Time High Markets

The S&P closed at over 5,000 for the first time ever and many federal employees are worried about what comes next. Many find themselves asking important questions like:

- Is a recession still a risk?

- Should I be investing at the top of the market?

- Is it time to go to cash and wait for the next crash?

- Has the inflation issue been resolved?

- What do I do if I’m retiring soon?

In this article, we cover a bit of history to provide context, explore time-tested approaches, and discuss the nuances of a portfolio for federal employees who are in or headed into retirement.

Context is Everything

We’ve been here before. All-time highs are nothing new. Past is not always prologue, to be sure, but it is reasonable to assume that, in the long run, the economy and its temperamental sibling (the markets) are likely to behave as they have in the past.

I want to point out that at the end of 2008, the S&P500 was around 800, the Dow Jones Industrial Average (DJIA) was just under 9,000, and the NASDAQ was around 1,500.

As of February 9th, 2024:

- The S&P500 was over 5,000

- The DJIA was around 38,500

- The NASDAQ was almost 16,000

The entire way up there has been many reasons to get out of the markets, to stay in the G fund, because another recession was coming, Covid, Brexit, the Fed, elections; you name it.

2023 was desperately needed to recover from the damage brought by the pandemic. If someone wasn’t invested, they missed out on that growth, and they should consider the impact to their plan 10, 15, or more years from now. Remember, it is time, not timing, that matters most.

As such, we can create an investment strategy with high probabilities of their behaving like we need them to because asset classes have characteristics that make them what they are.

Discerning the Signal from the Noise

“This time is different”, is the eternal cry of the perma-bears. It’s no surprise that people are expecting another correction soon. This is what drives attention, and frankly, they’ll be right at some point. Even a broken clock…

There’s always something looming. That’s why there is risk when investing in equities (C, S, and I funds). For accepting that risk, investors have the opportunity of participating in the long-term accretion of the global markets and build (or sustain) their financial independence. There was a key word in the sentence—participating. This requires that you be invested.

Even bonds and cash (F and G funds) have their own set of unique risks—just ask anyone recently who didn’t realize that bonds could be negative double digits in a year.

Is the S&P500 growth unbalanced? Absolutely. If you didn’t know, roughly 75% of the growth offered in the S&P500 last year was provided by only 7 stocks. The other 490+ stocks were left in the dust. Queue the headline “tech bubble”.

We can’t possibly know if tech stocks are going to sell-off soon. There’s no shame in this either. That would require a crystal ball. Are they overvalued from a technical analysis perspective? Absolutely, but they have been many times over the last 16 years, and look at where we are today.

We’ll soon be hearing about how the elections are going to throw the markets for a loop, and undoubtably many federal employees will flock to the G fund for haven.

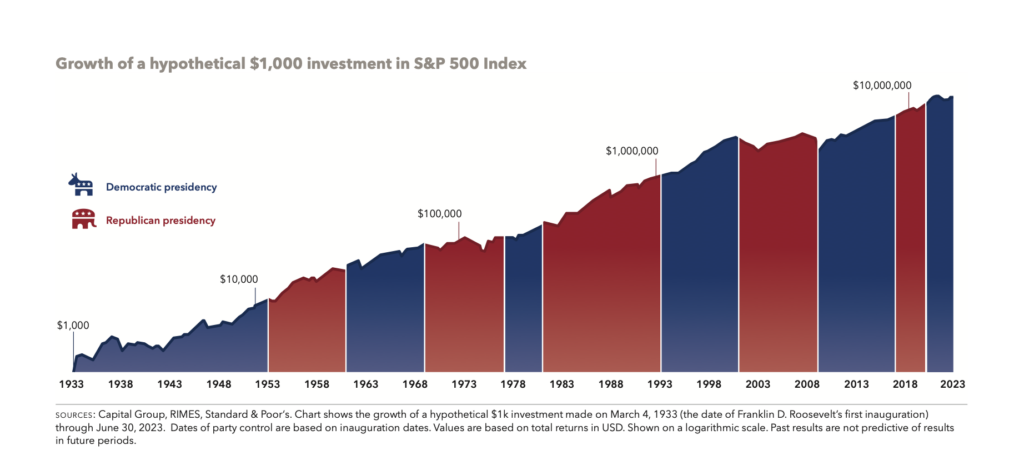

Check this out this graphic below from Capital Group. Since the 1930s, US stocks have trended upward regardless of what was happening at the White House. Yes, some volatility can always be expected when there’s uncertainty. But markets have always bounced back.

Allocations in Retirement

There’s no doubt that there has a been a ton of volatility between 2008 and now. As you may know, volatility can create challenges inside a retirement plan.

But volatility itself is not the problem either—the problem is in how you’re set up for volatility, and the actions that you take (or don’t take) during the ups and downs. That’s where federal retirees often get themselves into trouble.

Remember that volatility is risk in the short term but opportunity in the long run. If you miss out on just 10 of the best performing days in a year, you lose out on most of the growth for that year.

In fact, if you were retired during these last 16 years, there were plenty of times that you could have made moves that delivered a fatal blow to your retirement plan. Being aggressive and staying aggressive through it all is your least likely path towards success.

So how can federal employees gain the confidence to stay invested through turbulent markets?

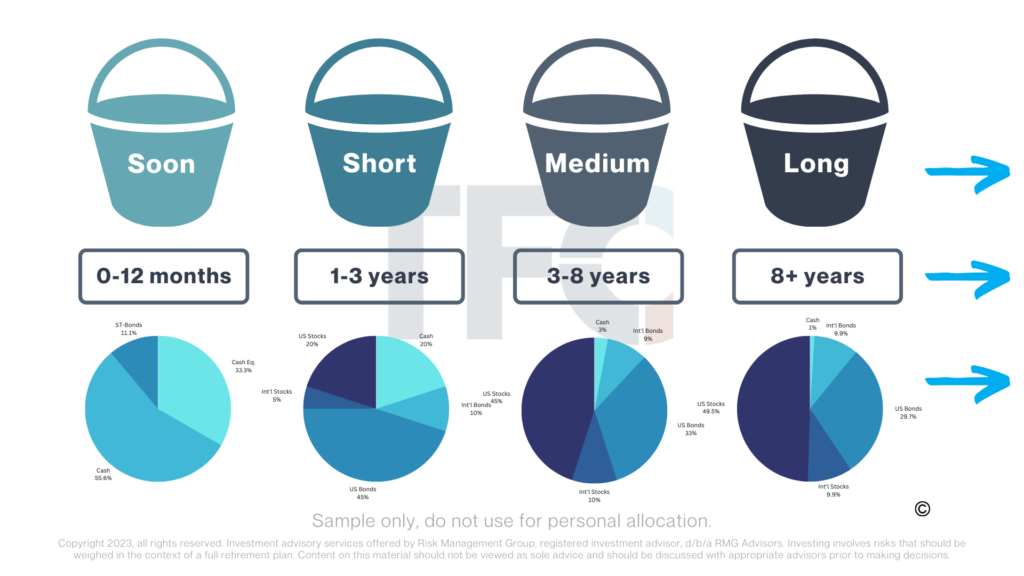

While there are countless retirement income strategies suited for all sorts of circumstances, one we often find successful for many federal employees is taking a bucketed approach to investments.

This strategy itself is not novel. We’ve been using this with our clients for many years, and over the years I’ve written extensively about how it works. But as with most parts of retirement planning, the concepts may be simple to understand, although more challenging to implement correctly.

To start, consider that your portfolio has many jobs in retirement. Its job is not solely focused on growth anymore. Growth is still necessary, but so is sustainability and efficiency.

There are asset classes that will help you replace spending, outpace inflation, and help make sure you don’t run out of money. But there are also other asset classes designed to create stability for you along the way. This is especially important if you’re going make withdrawals from your portfolio.

Bear markets (down 20% or more) are part of the investment cycle and are expected and invited as often as twice in a decade. While waiting for the markets to recover can be a good strategy, if all your money is invested in something that gets reduced by 30-40%? How long is it going to take you to recover back to even?

What happens if you’re taking withdrawals at the same time? That makes the situation much worse. In fact, that’s one of the biggest risks to a retirement plan, and in econ-speak it’s called sequence of returns risk. Being too aggressive puts you on the other end of the spectrum.

Next, think about your portfolio in terms different jobs it needs to accomplish. You can begin to assign time horizons to sections of your wealth. Here’s an example:

In theory, the more time you have before that bucket is tapped, the more tolerance for volatility it has. And note that sometimes different buckets can be different accounts.

For example, Roth accounts should generally be growth-focused since they have the best tax-preference. Depending on how large your Roth is, it may make up a long or ultra-long bucket in your overall portfolio.

This provides you with flexibility in being able to choose which bucket to draw from and when so that you’re maximizing the longevity and tax efficiency of your portfolio.

With this structure in mind, you can begin to create your own family’s buckets according to your individualized needs. Then, the next time the markets begin to sell-off, you can be comfortable with your investment system knowing that your wealth is optimized for your goals.

Your plan and the proper implementation of it matters so much more than trying to get the timing right of the next bear market. So turn off the news and get to planning this year, because it’s not just your money, it’s your future.