How To Avoid the TSP G-Fund Trap

The G-Fund has become incredibly popular over the last couple of months. This is not surprising as federal employees panic over the fact that their TSP values continue to decline. Investors look to stop their losses by moving cash into the G-Fund.

By selling the more aggressive investments of C/S/I-Funds after sustaining losses and moving the proceeds into the G-Fund, you may be effectively making those losses permanent. This is particularly true if you unsuccessfully redeploy back into growing investments at a lower cost.

Those same losses you were trying to prevent have now been memorialized by no longer having the opportunity to regrow because they are in the non-growth G-Fund.

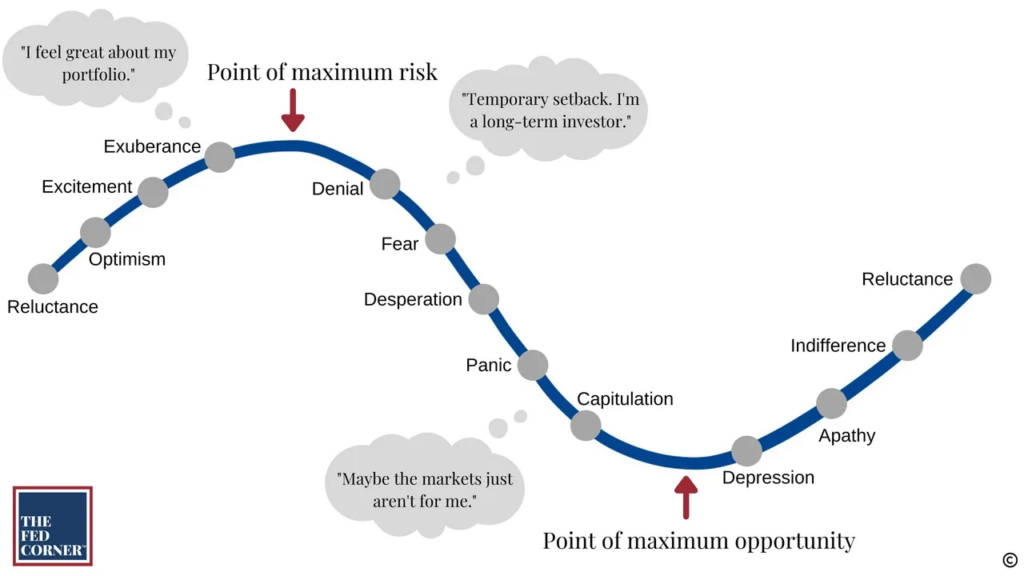

Now, the G-Fund is an important part of the TSP investments, but let’s look at what we’ve learned from the investor emotion cycle graph.

At the risk of sounding like a broken record, I cannot stress how important it is for you to internalize the principles it has to offer.

Consider this: what if the bottom of the market was June 16th, when the S&P500 was down almost 24% at one point? How do you know that it was the bottom? Were you ready then to put your cash to work again? If not, are you ready now?

Let’s look at history: the summer of 1982, when the market became convinced that inflation had died, or was just dead enough, interest rates collapsed, and the equity markets soared over on a dime and closed the year 20% up. Investors in cash never got a chance to catch up.

As Fidelity’s Peter Lynch so memorably said, “The real key to making money in stocks is not to get scared out of them.”

As investors, we can’t control the markets, but we can control how we participate in them. How we participate in them determines the short, mid and long turn results of our financial picture.

If you’re retired or close to it, you must develop a withdrawal strategy: a plan with which investments will support your lifestyle, as well as a tax strategy surround those choices.

If you have taxable accounts, you should be managing the capital gains and harvesting losses along the way. If using retirement money, you should consider how far into a tax bracket you’re pushing yourself, as well as its impact to Medicare premiums if you take Medicare.

You can also be looking at Roth conversions when markets are down, as well as determining the right blend of after-tax, tax-deferred, and tax-free that should make up your withdrawals. If you do not have a plan in place for when the stock market declines, you risk not having a sustainable retirement.

It’s not a matter of if the markets go down, it’s a matter of when. Markets are cyclical in nature and must cool off and reduce in value at some point of the cycle. This is a normal part of the economic and market cycles.

This decline will last as long as it does, and you can harm your financial future by not having an appropriate allocation to deal with it. And once this is over, there will be another one someday. Your ability to be prepared both now and for future ones depends on how well you’ve planned, and how well you’ve executed upon that plan.

Volatility is traumatic in the short term, but the secret of wealth creation in the long run. We’ve been waiting for this bear. When he’s sated, we can go back to the growth portion of our program which is always bigger and more fun.

Because at some point in every significant market decline, while the entire world is terrified of being caught in a further market crash, risk begins to shift under your feet.

And that is when having stayed true to the investment policy that was so strategically put together pays off. The timelines, the investments, the modalities and strategy of how to accomplish your goals—these are the pillars from which to build your financial success.

This plan should be designed to help you achieve a life of financial independence, free from the burden of economic fear, and proud of the legacy you leave behind. After all it’s not just your money, it’s your future.