How High Interest Rates Affect Your Retirement

If you follow economic news, then it’s no surprise to you that the Federal Reserve has been increasing interest rates for most of last year.

But other than mortgages and loans having higher rates, and earning more in savings accounts, rising rates can impact you in a lot of other ways too. If rates rise too much or too fast, it can send an economy into a recession.

The reason the Fed raises interest rates is because inflation was too high. Rising rates is one of the tools it uses to combat inflation.

After a year of increasing interest rates, we are starting to see the impact to the economy. Many tech companies have already begun large scale layoffs which is in response to the hike in rates and subsequent economic cycle we are in.

If you follow our other content, you’ll recall that I regularly remind federal employees to differentiate between the markets and the economy. However, rising rates has a direct impact to both, and it’s imperative to understand how you need to adjust your retirement planning.

There’s little that’s worse to an economy than run-away inflation. We can look at examples of other countries all around the world where this has happened.

Simplistically, they make money more expensive by rising interest rates, which is essentially the cost of borrowing money. If borrowing becomes more expensive, that means corporate profits get reduced, which means they’ll slow down production, and eventually it helps to slow down inflation.

Reduced corporate profits means their stock price may be negatively impacted writ large. And sure enough, last year was testimony of this. But there’s more to it, and this part is important.

If interest rates remain higher—the one thing on which economists agree is the future—it means that corporations will be stuck with higher costs of doing business. If it costs more to do business, they’ll have to slow down production. What does this mean for their stock prices going forward? What does it mean for the markets at large?

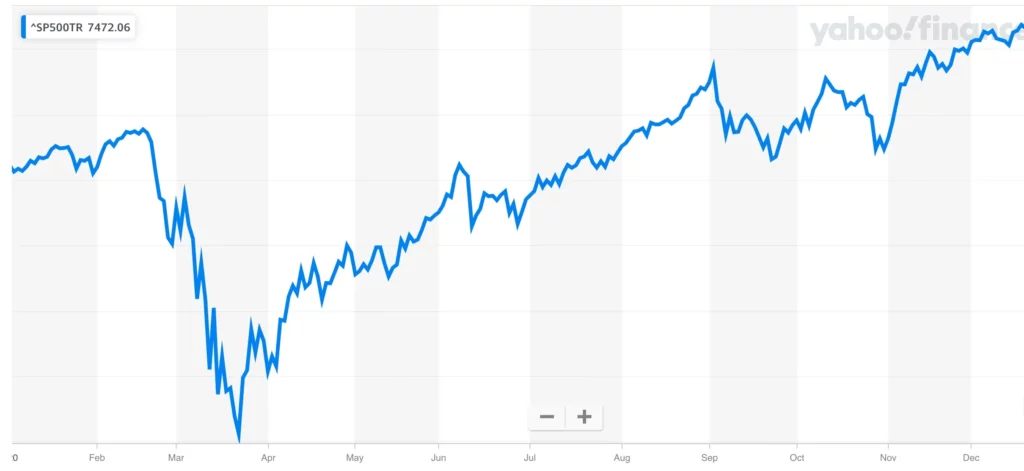

Companies are going to have to adjust to this new way of doing business, and this could take a little bit of time. American investors are not used to this. Think back to the second half of 2020.

Timeframe Jan 2020 to Dec 2020.

When the markets crashed in February – March because of COVID, the stage was set for the economy to recover. And as soon as we figured out that COVID wasn’t the next plague, the markets ripped. Interest rates were taken down to nearly nothing (free money…almost), which makes doing business very easy. This was intentional.

That’s not the situation we’re in now, and you need to consider the possibility of a slower recovery in your retirement plan. The economy needs time to adjust to the new environment.

Bonds Also Suffer

People use bonds as a braking system in their portfolios. It helps reduce that volatility, especially if you’re within 5 years of retiring. It helps to generate income for use in retirement.

A bond is basically a form of debt, only you’re not the one with the debt, the company who sold the bond owes you that money back. With a mortgage, you’re in debt to a bank and you pay it back slowly with interest. Bonds work in a similar way.

You gave a company—perhaps a government—a loan, and you received a bond. If you hold that bond until maturity, you receive your money back and will have earned interest along the way.

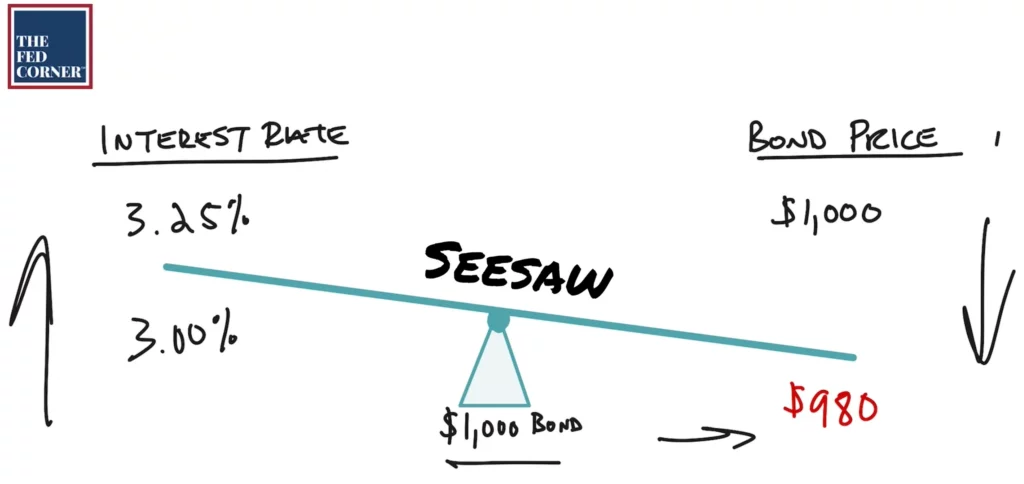

If interest rates are rising, what does that do to the value of the bond that you hold? It goes down in price.

Think of it as this: let’s assume you lend money to a company by buying their bond, and it pays you 3% interest in return. In the meantime, interest rates are rising, making borrowing money more expensive. Six months later, I lend money to the same company, only now it’s more expensive because rates have gone up, and now they’re paying 5% for the same amount of money.

What do you think it does to the value of your bond? Mine pays 5% and yours pays 3%. Which one is worth more? Rising interest rates have an inverse relationship to the price of bonds.

An easy way to remember this is to think of a seesaw. As rates go up, the other side, which is the price of the bond, goes down. And vice versa.

This is why we saw double-digit declines in bonds last year as well. The same bonds used for stability can be subject to higher volatility during periods of high interest rates. One way you can help protect against this is by holding a bond to its maturity.

But is it better to hold it or swap it for a different one that’s paying more in the meantime? How frequently should you be checking this? And regardless of your choice, did your investment outpace inflation?

Remember, outpacing inflation is whole point of investing. You must outpace inflation otherwise you’re still losing purchasing power, and over time this means you might not earn enough returns to be able to continue to maintain your lifestyle.

Over years of helping people retire, we’ve found that one of the best things you can do is to structure your portfolio in a way that can address inflation risk as well as interest rate risk. Not all investments have the same functions.

Your money should be broken up into piles that have different jobs, and you can learn more about how to set this up so that you give yourself the best chance of a successful retirement. After all it’s not just your money, it’s your future.