How Does Coronavirus Affect My TSP?

Historical View of Pandemics

As you have already heard, Coronavirus has become an international issue that is sweeping the globe. Many countries have issued boarder restrictions and cancellations of public events. Companies have shut down their retail locations and many have had issues in supply. Consequently, this makes investors in the markets nervous about the sustainability of the ever growing economy boom that we’ve experienced over the last decade. It is said that there are decades where nothing happens and there are weeks where decades happen. The last decade has been great for investors, but uneventful in the sense that there hasn’t really been too much going on in the markets. These last few weeks have certainly made up for the global economy having relatively low volatility, and now we’re seeing swings in the markets as much as 20%.

Just last week, the S&P500 index daily returns were as follows: -9%, +5%, -5%, -10%, +9%1. This amount of volatility is enough to cause anyone to rethink why they’re invested in the markets. The S&P 500 is an index that measures the stock prices of the largest 500 companies, and commonly used as a form of measuring the broad US markets. In your TSP, the equivalent of this would be the TSP C Fund (common stock index investment fund)2.

When Federal employees think about how they should be reacting when it comes to their TSP account and other investments (or 401K if your spouse works in the private sector), it would be imprudent to attempt to predict what the future will hold. There is a lot of uncertainty in regards to the actual impact that this virus will have on companies globally, or for how long that impact will last. This uncertainty is precisely why the markets have been behaving as they have in the past few weeks. Fear and uncertainty are two major drivers of investor behavior and can certainly be credited for the recent market swings that we’ve experienced lately.

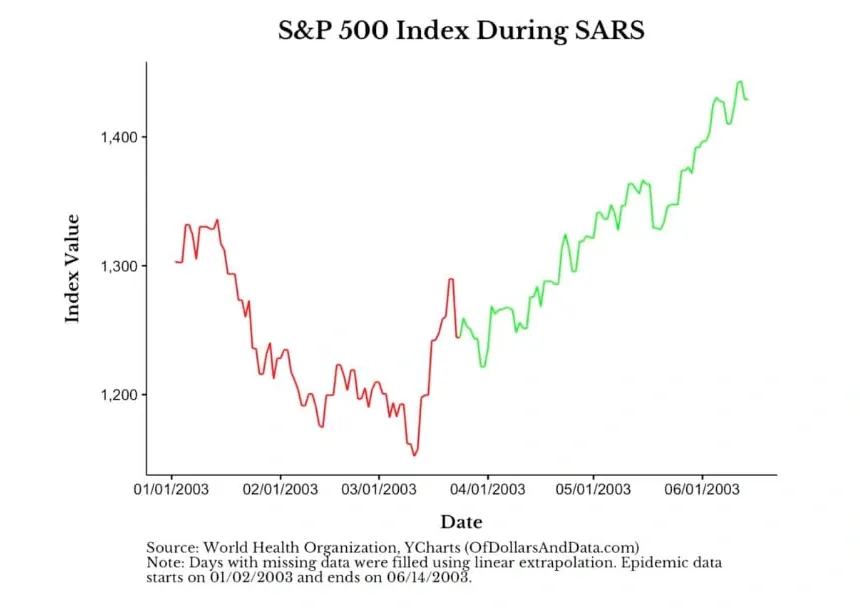

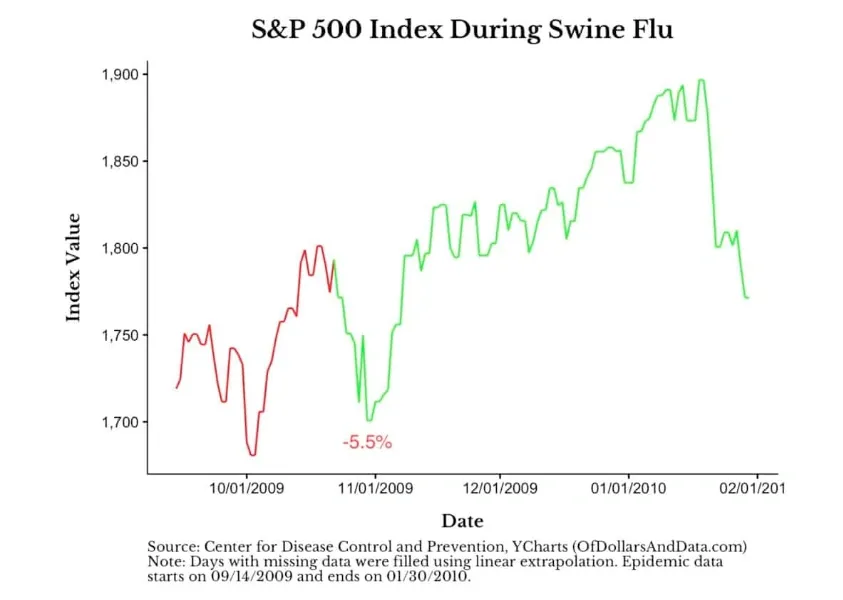

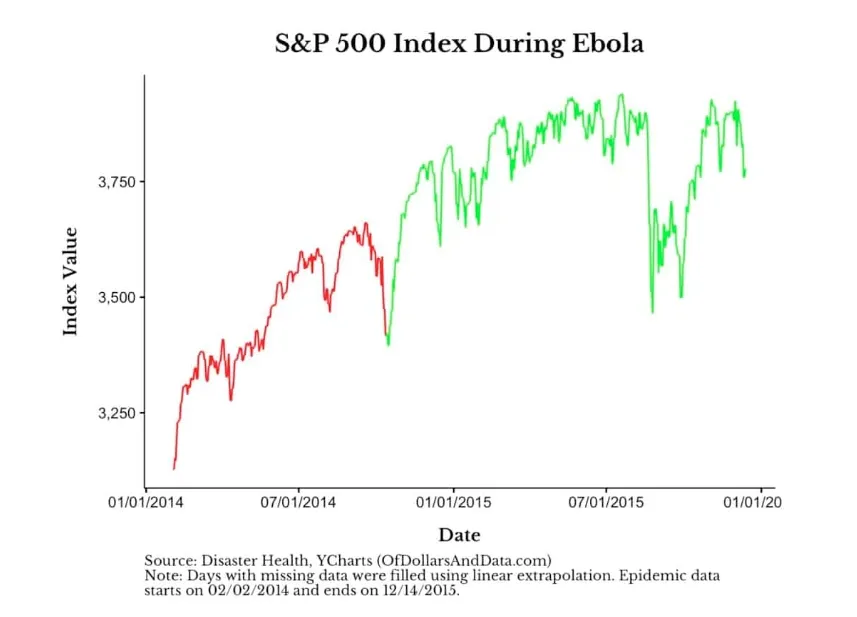

While it’s hard to predict the future, we can take a look at how the markets have reacted to past pandemics, specifically the most commonly remembered: SARS, Swine Flu, and Ebola.

I’ll spare you the details from the research we did, but the common theme here is that each of these outbreaks had an initial downturn in the market, sometimes pretty significant, but all recovered to higher values in due time. This doesn’t mean that the beginning, and even the in-between wasn’t pretty difficult to deal with. The account value swings were deeply painful and personal to everyone, much like what we are experiencing right now. In measuring the S&P500 (remember, essentially the TSP C Fund), the initial selloff led to nearly a 14% decline in the first couple of months during SARS. The red portion of the line indicates the time frame when the cases were increasing up to its peak, and the green is when we began to see recovery, according to the World Health Organization. The same methodology continues with the Swine Flu graph and the Ebola graph.

If history is our guideline, we can conclude that it’s no surprise that the markets are experiencing this level of volatility in response to the Coronavirus and other economic factors. Historically, the world as we knew it did not end, and markets made their recovery in the following months and continued to grow to where they are today. We can’t predict the future and the past is certainly no guarantee that history will repeat itself, but the probability of this world coming to an end because of this is undeniably low, and the markets should recover their values as the global economy pushes past this troubling time. Continuing with our theory that the world won’t end, this means that we will be tapping into our TSP accounts in the future and our behaviors today will have tremendous impact on our economic safety in the future.

Should You Make Changes to Your TSP?

We’ve established that it’s probable that the global economy will not collapse in light of the Coronavirus, but that still leaves us with the question of whether or not we should be making changes right now to our TSP. There is not a single blanket answer to this question because each Federal employee has their own individual circumstances, but there are some general principles that good investors can follow to maximize their chances of success.

Risk Tolerance

The first thing the Federal employee should do in determining whether changes in their TSP are warranted is to determine their risk tolerance. This is a technical term for defining how much potential loss you as an investor can financially handle, as well as determining how much market movement you can safely stomach. In other words, what is your aptitude and attitude towards handling risk and volatility. I want you to remember those two words whenever thinking about what types of investments you should be in.

You may be ready to retire as a Federal employee within the next five years and you’re concerned that your TSP account didn’t grow fast enough, so you want to move 100% of your TSP into the C Fund. Your attitude towards risk is high, but the problem is that your aptitude may not be as high as your attitude is. Here’s why: if you’re retiring in five years, you might need to start accessing your TSP funds to help pay for expenses when you’re no longer working, especially while waiting for your pension to start. If you’re invested heavily in stocks and the markets have volatile times such as these, you might be forced to sell some of your TSP investments to get the cash that you need if you don’t have any other sources of funds. Selling investments to generate cash while the markets are low is usually the worst time to be selling those investments. Not only was your TSP value down, but you also took money out of the account, further reducing its value.

On the other hand, you may be a younger employee with plenty of time for the markets to recover their lost value, so your aptitude to handle risk and volatility is high, but if your account value dropping by 20%, rising by 10%, dropping by 30%, back up by 15% – keeps you up at night because of how anxious it’s making you, your attitude towards that amount of risk and volatility is lower than your ability to take that risk, and you probably shouldn’t be as aggressively invested.

Knee-Jerk Responses

Now that we’ve talked briefly about how a Federal employee should determine their risk tolerance, it’s important to note that any changes an employee makes to their TSP should be planned and intentional. This is one of the foundational principles of good investor behavior. Knee-jerk responses to what’s going on in the stock markets very often cause more harm than it does good. It’s extremely challenging for anyone to anticipate whether the markets have further to fall, or if we are at the bottom right now. Hindsight is always 20-20, but in the moment, we’re feeling emotions about the fact that our TSP account values are down and our gut response is usually to stop the bleeding.

But what if you’re not selling, you’re just reallocating? The act of reallocating, say for example to move the 25% C Fund that you have into another fund, by the very nature at which this process is done, you are effectively selling the C Fund and buying the new one. This is why that a sudden reallocation of your TSP can be harmful too if your timing isn’t optimal. If the recent market volatility was too much for you to handle because of how soon you’re retiring, then you were likely not invested properly in the first place.

There’s another issue with not having properly planned your investment allocation, and it comes at a time where you might need to withdraw your money. I’ve mentioned this in other columns I’ve written: it is my opinion that the TSP is a great accumulation tool, but it has its limitations when you are pulling your money out. The TSP does not let you pick which funds you will be selling in order to withdraw money. It will proportionally sell each fund in your TSP account. Remember when I said selling your investments in a down market is among the worst things you can do? This comes into play here. If you have the C Fund inside your TSP, it tends to be volatile when markets are moving up and down. By requesting a distribution when the markets are down, you are effectively selling your C Fund in a down market. It takes much more market performance to recover your account from the double whammy of a market downturn combined with a withdraw. Good financial planning would involve having some liquid assets available to you in the event that the markets were rocky and you needed some cash.

Short-Term Versus Long-Term

By design, the TSP is considered a long-term investment vehicle, much like a 401K, IRA, 403b, etc., because it is a retirement account. This means that you generally have a longer time horizon before you need to touch the money in your TSP or other retirement accounts, and this flexibility generally allows you to take on more risk because if you’re invested in good companies, you will certainly experience volatility, but over the long-term those companies tend to trend upwards as the economy grows.

The danger comes when you’re looking at the short-term. If you’re going to need access to your money in the next few years, then you may not want to be invested in stocks of companies like the S&P500 (C Fund). This is due to the fact that if we happen to be in a year where the markets are not performing as well (such as right now), AND you need to access your money, you’re forced to sell at a much lower amount. So for money that you know you’ll need sooner, a better investment would be a TSP fund that is much less aggressive, or perhaps utilizing your other investments or savings to meet those short-term income cash needs.

If time is on your side, should you care about how much up or how much down your TSP funds went every other month? Perhaps, especially if it’s causing you anxiety and stress, but you can certainly consider taking on more risk for more potential reward if you have many years before you need to access your money. The short-term up and down doesn’t have to worry you as much if you don’t plan on touching that money until a longer period of time in the future. You should be honest with yourself so that you set yourself up for success. You don’t want to put yourself in a position where you’re tempted to make a change that could impact your long-term plan simply based on short-term circumstances.

Working Towards a Proper TSP Allocation

There are a variety of factors that play into crafting the right allocation in your TSP account. I encourage the Federal employee to take all of their finances into consideration. If your spouse works in the private sector, you should consider what they are invested in too if you consolidate your finances. You should also consider your other investments accounts. You might have old 401Ks or IRAs that you still own investments in. You should also consider what types of income you have available to you. This goes back to how soon you need access to your TSP money. If you know you and your spouse both have a substantial pensions relative to your income needs, then perhaps you can afford to be a little more aggressive. Perhaps your spouse is still working and generating an income. The point is, your life has many moving parts and they should be considered in your total financial picture. It’s also helpful to work with an advisor so that you can develop a financial plan that works for your life in a variety of different conditions.

In Summary

As you can see, there are many factors when considering how to properly build an allocation of investments in your TSP or other investment accounts. The Coronavirus is certainly having an impact on our global economy and it’s having an impact on your investment accounts like your TSP. The good news is that it’s highly unlikely that this is the end of it all, and we’ll likely see the other side of this storm. Having a financial plan in place helps you to weather the volatility of stormy markets because it helps you to plan properly for a variety of market types. It helps to ensure that you have your short-term, mid-term, and long-term finances set properly.

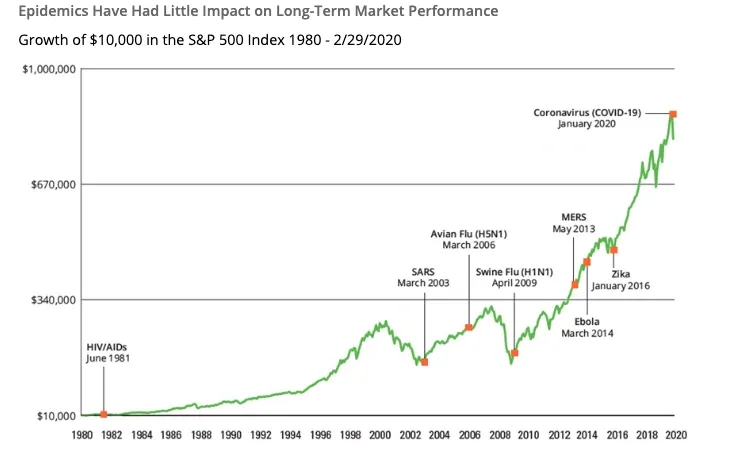

When deciding how to allocate your TSP, make sure you’re honest with yourself. The stock markets are driven by greed and fear and the Federal employee must be careful to recognize those emotions in themselves. I wanted to leave you with one final chart; data sources from the WHO, Kaiser Foundation, Morningstar, and Hartford Funds. The start dates for each epidemic was determined by the first report of cases in at least two countries.

You can see that historically, each event had its phase when the markets were rocky and volatile, but continued on to make a full recovery and into much higher ground. I show this not to promise you anything, but as a means to illustrate that over the long-term these types of events have had little impact on market performance. In the short term, it causes craziness. In determining how to allocate your TSP, remember your attitude and your aptitude for risk and market volatility, how much time you have until you need your money, and remember to consider more than just your TSP account. After all, it’s not just your money, it’s your future.