FERS Deferred Retirement versus FERS Postponed Retirement

Here in the Washington, DC area, many federal employees make lifetime careers out of federal service. It’s common to see people with 20-30 years or more of service.

However, many federal employees often had careers prior to joining civil service, either in the military or in another sector all together. For them, FERS benefits is more complicated, especially as it relates to their retirement.

If you haven’t reached full retirement eligibility, you’ve likely heard about how you can use a FERS deferred retirement, where you separate from service but defer your pension until later.

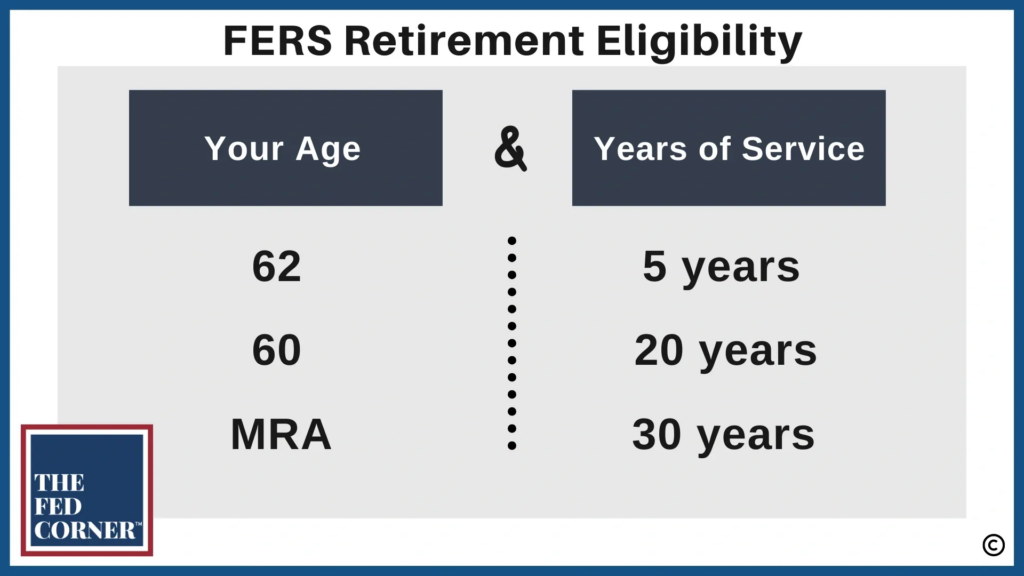

Let’s briefly review the normal FERS retirement rules. Below is a chart for eligibility to retire on an immediate and unreduced FERS retirement:

If you’re thinking about leaving federal service, it’s critical that you understand your choices before you leave. Many decisions may be “set in stone” once you separate from service.

If you have not yet reached one of the age and years of creditable service requirements for an immediate retirement, then you have the option of taking a FERS Deferred retirement. However, in some cases, you may also be eligible for a FERS Postponed retirement as well.

They sound similar, but the rules and benefits granted are completely different. In most cases, you should elect for a FERS Postponed retirement if you are eligible.

FERS Deferred Retirement vs FERS Postponed Retirement

The difference between the two is whether or not you’ll be eligible to carry FEHB into retirement. If you elect a FERS Deferred retirement, you cannot keep FEHB into retirement when you turn on your pension. This benefit is permanently removed.

So why doesn’t everyone elect a FERS Postponed retirement instead? Not everyone is eligible for this type of retirement. There is an exception to the rules called the MRA+10 retirement.

Maintaining FEHB into retirement requires that you meet certain conditions, one of them being that you are eligible for an immediate retirement. The MRA+10 retirement is technically an immediate retirement available to you.

This rule implies that if you’ve reached your Minimum Retirement Age (MRA) and you have at least 10 years of creditable service, then you are eligible for an immediate retirement under the MRA+10 rules and eligible for the FERS Postponed retirement. MRA is typically between 55-57 years old.

If you also maintained FEHB during your last 5 years of service, electing a FERS Postponed retirement will allow you to also restart FEHB again when you decide to take your pension.

The FERS Deferred retirement does not allow you to keep FEHB when you file for your pension because under these rules, you are technically not eligible for an immediate pension. To be eligible for FERS Deferred retirement, you must have at least 5 years of creditable service and you must leave your FERS contributions in the system. You can separate from service immediately and access your pension when you reach a specific age. With 5-9 years, that age is 62, as shown by the chart above.

Once you have your 10th year of creditable service, you become eligible for the MRA+10 rules once you hit your minimum retirement age. But there’s a catch.

MRA+10

If you retire under the MRA+10 rules, your pension will be permanently reduced by 5% for every year you are under 62. This reduction can be significant and has a major impact on your FERS pension income. You must remember, cost-of-living-adjustments (COLAs) are based on your pension amount. The higher your pension is when you take it, the more money that COLAs add to your income. And every year, the figure compounds from a higher amount.

People choose to delay their Social Security benefits for the same reason. We’ve done the math: ensuring you earn the maximum possible may provide you with hundreds of thousands of dollars in extra income during the course of your retirement.

If you do choose to wait until 62 to file for your pension, you will not have FEHB coverage between separating from service and 62. You should consider the additional costs of private health insurance if your spouse does not also have health insurance coverage.

Are you retiring soon?

If you’re approaching retirement, you need to consider all of the complexities in your FERS benefits system. FERS Deferred retirement and FERS Postponed retirement is just one of the myriad variables from which you must choose.

Mistakes can be costly and are often irrevocable, to make sure that you fully understand all of your benefit options before making them, and more importantly, how those options will impact the rest of your financial future. Let us know if we can be helpful.