FEHB Maximizing Strategies

FEHB can be a complicated benefit. Many feds choose inaction come open season simply because it’s too much work to research anything else than they already have.

But over the years of working with federal employees, we have realized that many are leaving money on the table by not maximizing this incredible benefit.

We’re going to discuss one of the most misunderstood benefits that you have as a federal employee so that you can maximize your benefit. Towards the end, we briefly cover the big debate of Medicare vs FEHB.

The first thing you need to make sure you’ve got down is to understand the small details.

Understanding FEHB Details

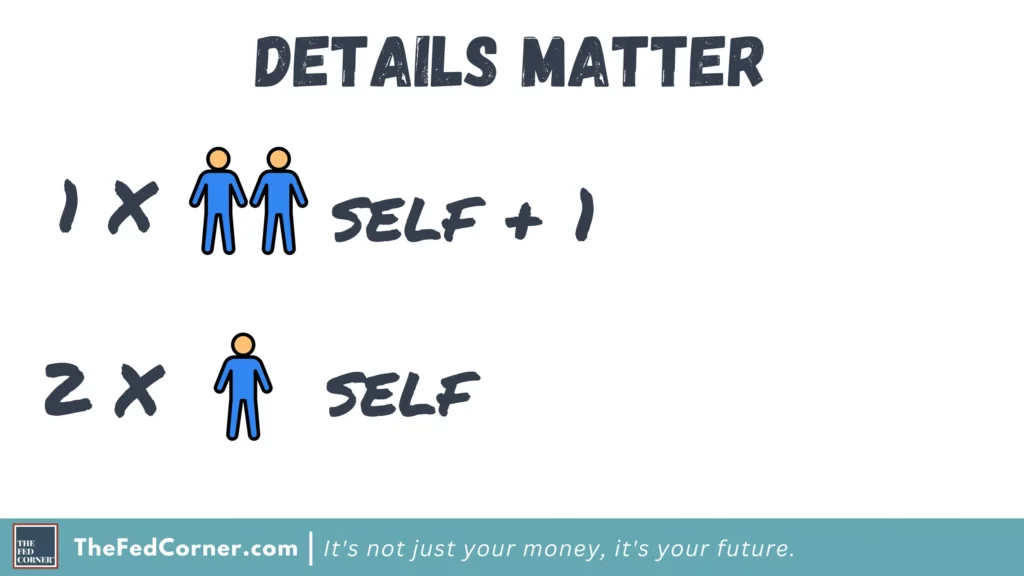

For most plans, the government covers roughly 75% of the premiums for you, and you cover the rest. Something dual-fed families should consider is whether a self plus one plan is better or worse than TWO self plans. There are cases in which the coverage is the same but the cost is less in doing two self plans.

Not only is there a cost reduction, but this also allows you change your coverages on an individual need. You or your spouse may need different levels of coverage for health care, and you don’t need to pay the higher amount for both of you.

The other consideration comes if one of you are retiring prior to the other. When you’re working, FEHB premiums come out of your paycheck tax-free. In retirement, your FEHB premiums are AFTER-TAX.

If you know that you’re retiring but your spouse isn’t, then you should consider staying on your spouses plan since it will be pre-tax. Eventually, their FEHB premiums will be post-tax as well, but you can maximize your savings in the meantime. Just make sure you’re careful about rules to carry FEHB into retirement.

Picking the Best FEHB Plan Type

How do you pick the best health insurance type? There are hundreds of options available to federal employees under FEHB. How can you look through all of them to make a choice?

Start with what kind of plan best fits your needs. This is why we put together our FREE annual Open Season Guide. It talks through some of the considerations for each kind of plan, whether it’s a high deductible plan, HMO, PPO, etc.

You can use our guide in conjunction with OPM’s FEHB Comparison tool. The guide helps you determine the kind of plan that best fits your family’s need, and then you can filter out all of the plans that aren’t relevant.

Some plans are more restrictive than others and require that you see a primary care physician before going to see anyone else. Others allow you to see specialists without needing that referral.

Something to note is that coverages will change every year. The changes may be small, but they’re present nevertheless. It’s important that each year you consider what your health care needs might be, then look through your health care plan benefits to ensure that your plan is still meeting those needs.

Sometimes health insurance carriers stop covering a specific prescription. Other times doctors will drop certain health insurance carriers from their group of accepted insurance companies. These are things that you need to check before you reenroll into another year of the same FEHB plan.

Tax Free Money with HSA/FSA

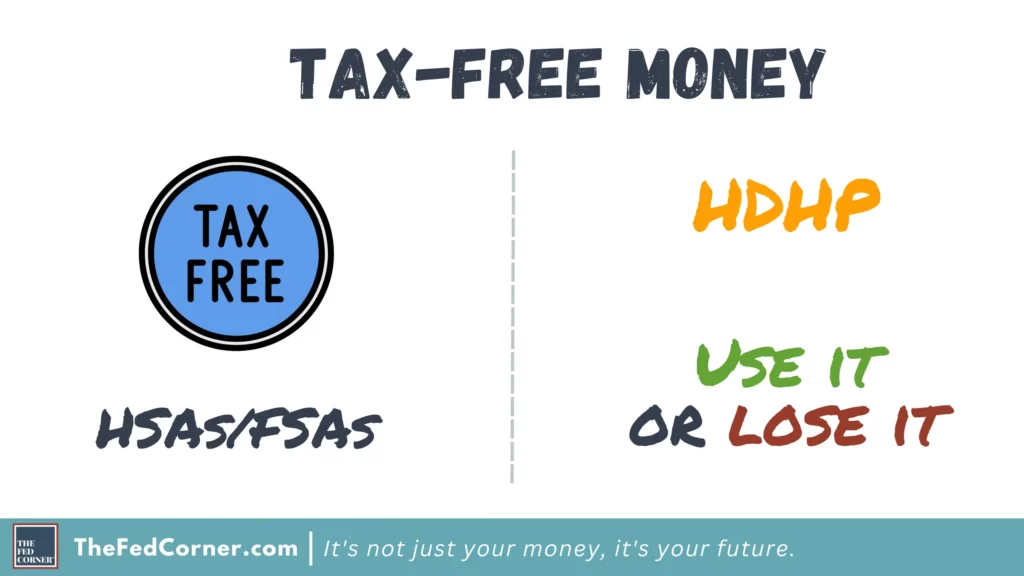

The next thing you need to know about is that you might be leaving money on the table if you’re not using an HSA or FSA.

An HSA and FSA are both types of accounts that you can put money inside and those dollars are reduced from your taxes, just like a TSP contribution. However, they also allow you to use the money immediately for qualified health expenses. The money comes out completely tax free when doing this.

HSA’s do require a high deductible plan. This is something you should consider within the context of your health. If you regularly use your health care providers, maybe the high deductible plan isn’t right for you. You may wish to have a different plan.

But if you don’t use doctors much, then you should consider using this. There are annual limits to how much you can put in, but it’s still a nice sum of money to get tax-free.

The big difference between the FSA and HSA is that your HSA can be carried forward forever, whereas your FSA has to be used or you lose it. There’s a limited amount of time you can hold money in an FSA before it resets, so you want to make sure you’re not putting more money inside an FSA than you can realistically use. The HSA should be maxed, as it belongs to you forever.

Save Money with Dental and Vision

The first consideration is making sure you aren’t picking up the more comprehensive plan ever year. Sometimes you may have a year that you need higher dental care, others you might want to reduce the coverage again and save yourself some money.

There are also some FEHB health plans that have some limited amount of dental and vision coverage. While not comprehensive or widely available, if your needs aren’t either, you should consider whether having an additional dental and vision plan are necessary.

Generally, we don’t recommend picking an FEHB plan because of its dental and vision coverage. Pick your FEHB plan because of its medical coverage, and if it happens to have appropriate dental and vision coverage for your family, then that’s just a bonus you should know about.

Most of our clients have found they wanted the additional coverage for the nominal price increase, but it’s worth checking as you look through your benefits.

FEHB versus Medicare

This next part may be one of the most contested—the age old FEHB versus Medicare question.

As a federal employee, you have the option of stay with only FEHB in retirement if you qualify for it, which we get into in other videos and articles.

But you also have the ability to take just Medicare, or also a combination of Medicare with FEHB.

Like we tell our clients, this choice is highly personal, and dependent on a few factors. The first thing you should know is that your FEHB health plan will no longer be the primary provider. Medicare becomes first.

With Medicare, it covers about 80% of the expenses, and ordinarily, Americans have to purchase supplemental insurance for the rest. As a federal employee, FEHB happens to be great supplemental insurance coverage. In some cases FEHB can become cheaper since Medicare is picking up the bulk of the expenses.

It doesn’t come without costs, however. Medicare Part B, which is the health insurance as people mostly know, has a monthly premium. That price depends on how much taxable income you have each year.

Remember that your FERS pension and Social Security are both taxed, as are traditional retirement assets like your Traditional TSP, IRAs, 401ks, etc. This means your Medicare premiums can spike quickly if you’re not careful.

We’ve received an immense amount of feedback requesting additional content on Medicare versus FEHB. We will be creating more videos and articles, to make sure to subscribe to our newsletter under the Resources tab.