Federal Retirement Red Flags to Avoid

When designing a retirement, there are certain things that can put a lot of stress on the plan that you have in place. When this happens, it can lead to a significantly more anxiety and worry and could make you feel less financially safe in retirement.

Over years of helping federal employees retire, we’ve seen several red flags that can do significant damage to your retirement plan. Fortunately, catching these early enough may give you the time to course-correct and adjust your trajectory back towards success.

One factor that’s helpful with this is identifying the red flags is to make sure you identify them early and avoid them as best as one can. In this article, we’ll cover several red flags that we’ve seen in federal retirement plans and what to do when you spot them.

Red Flag 1

The first red flag to watch out for is when your whole portfolio is in pre-tax retirement accounts. This would be the Traditional TSP, as well as Traditional IRAs, 401Ks, 403b, etc.

We’re often asked why this is a red flag. Remember, pre-tax retirement money comes to you as taxable income, just like your salary when working. When you start using your money in retirement, taxes are a major factor. Anything you spend on taxes is less money left for you to grow and spend yourself.

When every dollar that you own must first be reduced by federal and possibly state income taxes, you may find yourself have almost a third less money by the time it gets to your bank account.

For example, let’s assume someone is taking out $2,000/mo from their Traditional TSP. They could owe $600 in federal and state taxes (assuming federal/state brackets at 24/6 percent), and they’d only receive $1,400/mo in their bank.

But wait, there’s more. By taking out more money to cover the taxes on the full $2,000, there is also now taxes owed on the extra money withdrawn as well.

To $2,000 in their bank account, they may need to take out $2,857 so that after paying taxes there is still $2,000 left to deposit. The additional $857/mo is a whopping 42.9% higher withdrawal that this person had to make from their portfolio.

This higher rate of withdrawal will impact the longevity of a portfolio, as well as taxes, Medicare costs, and various other components.

Here are a few tips that you can use to fix this. First, if you aren’t yet retired, you have the opportunity to begin saving outside of your retirement accounts as well. You can do this in individual or joint accounts, and those dollars can be invested and growing for you too. You can even use the Roth TSP (or backdoor Roth contributions), just be sure to check with your appropriate professionals as Roth planning can quickly create complications.

If you’re close to retirement or already retired, then you can do income projections to see where your tax brackets will be in the future. Maybe you have an opportunity to take advantage of converting some of that taxable money now at lower tax rates, before reaching your minimum distribution age, which requires pulling out money that’s fully taxable.

Remember, the current tax laws are set to sunset in a few years, and you may have a limited window of lower taxes between now and then.

Red Flag 2

The next red flag we often see is when people make big decisions without first checking their retirement plans.

What’s a big decision? Retiring, renovating your home, moving, purchasing a new home/car/boat/(other expensive hobby), buying insurance, changing investments; the list goes on.

There are myriad actions a person can take that will change the trajectory of their wealth. Wouldn’t you like to know what the impact is prior to doing so? I know I would.

Sometimes a decision can have a ripple effect in your plan that will manifest itself years later, sometimes even decades. Retirement plans don’t fail overnight. There are influencing factors that redirect ones’ trajectory, and retirement planning is helping make sure you are still on track towards your ideal future.

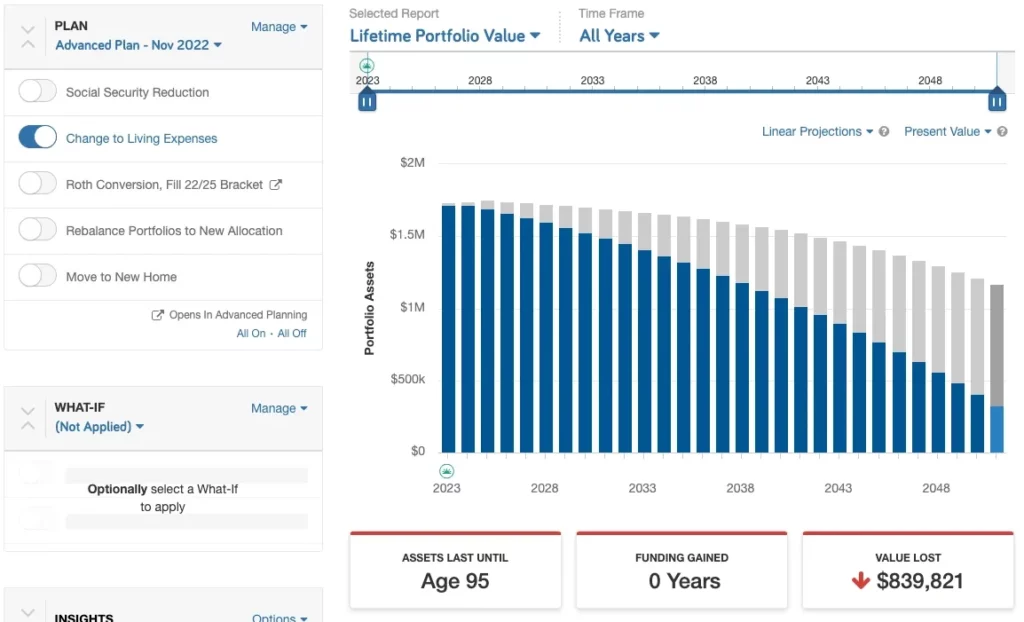

This is a screenshot from our planning system when we’re working with clients. I encourage you to watch the video for a better illustration.

In this scenario, we increased spending by $2,000/month from their retirement date onward, and we can see the impact that actually implementing such a change can have.

There are thousands of possibilities and combinations of strategies that you can see as a federal retiree, like increase spending but moving to a smaller home, or rebalancing your portfolio to a new allocation, or cutting down spending for a few years to support a big renovation in your home.

Understanding the impact of these decisions prior to making them can quite literally save your retirement plan. This kind of forward-looking planning can help you have greater confidence in your plan and the decisions you’re making, well in advance of ever taking any action.

Red Flag 3

The next red flag to be aware of is a portfolio that is not keeping up with inflation and spending in retirement. Many federal employees get much more conservative when they get to retirement, and that makes sense. Retirees are looking for security and ways to protect their wealth.

But the issue is that inflation slowly eats away at your portfolio, and if you factor in the fact that you’ll likely be drawing from it as well, you could end up in a situation where your portfolio is in trouble.

For example, let’s assume we have a $2M family portfolio this year that includes both spouse’s retirement accounts and brokerage accounts. Now let’s assume half of it ($1M) is in a conservative cash position to protect the principal, which seemed sensible since they’re retired.

At the end of the year, the account balance didn’t lose money as it was in cash so it still has $1M. But it might have lost $30K or $40K in purchasing power because of inflation.

Now, we know that inflation is a constant, and that it doesn’t noticeably change prices every year, but once prices do change, they can change pretty rapidly.

Remember how fast the cost of living rose for everything last year? That’s how inflation jumps tends to appear. If you leave that $1M sitting for a decade, with a 3% annualized inflation you’re looking at $300K in lost purchasing power: a third of the account.

Here’s how you can fix this: in order to maintain your net worth throughout retirement, you could have asset classes that have historically done well against inflation to help protect you from this.

Remember that higher-than-expected inflation is one of the four major economic seasons that we can go through, so making sure you’re set up correctly is important.

The “magic number” to be able to stay retired is different for everyone, and so how can you have less stress knowing that everything will be fine? Our clients tell us that going through the planning together helps them to feel more grounded in the decisions they’re making. I encourage to seek that for your family too.

A successful retirement plan isn’t only about making sure you’re economically okay; it’s also about making sure you have the peace of mind to enjoy this new season of life. After all it’s not just your money, it’s your future.