How Chasing TSP Fund Returns Will Ruin Your Wealth

The markets have recovered nicely from the bottom of 2022, and many federal employees have begun shifting their TSP allocations accordingly.

When markets are going up, as investors we want to participate in that growth, especially after a year like 2022.

When stocks are doing well, we often see federal employees move heavily into the C, S, or I funds. This year is no exception. In a recent article on FedSmith, TSP participants have moved billions of dollars around, flocking heavily towards the I fund.

This isn’t random; when the TSP posts fund gains we often see TSP participants began chasing after those gains.

But what seems logical may sometimes be one of the worst things you can do. This behavior could actually decimate your retirement savings if you’re not careful.

Understanding the Danger

You may or may not know this, but much of the markets are trading ahead of the present day. What does this mean?

Have you ever noticed that sometimes there’s bad news in the economy, like persistently high inflation, and the markets barely react? Why is that? To oversimplify, the markets live in the future. How is this possible?

When large financial institutions like mutual funds, hedge funds, foundations, etc., decide on their trades, they’re forward-looking in terms of their analysis of the markets. The idea is that you want to buy or sell a stock (or sector within the market) because your analysis leads you to believe that it will either go up or down in the future within a time period.

The economic law of supply and demand is the predominant factor that drives stock market prices. If you see a part of the markets going up in price (like the I fund), that means there has already been sufficiently massive enough demand for that sector (in this example, international) to cause the price to rise.

But here’s the problem: by the time you recognize the huge demand illustrated by the TSP’s performance, the money has been made.

Here’s a recent example: the S&P is up almost 20% from its bottom last year. How long after the bottom was it until federal employees felt comfortable moving back to stocks? For you to have participated in all of this growth, you would have needed to invest in the C fund last September.

Think about how you felt back then? Were you ready to get back into the C fund again? Of course not. The economic news was horrible at the time and everyone was calling for a recession. Why would you go to the C fund?

Today, much of the growth has already been had. Sure, there may always be more room for growth, as it is impossible for one to truly know where is the top of the markets. There’s no shame in this either, as claiming to know (or actions that prove the same) would be market-timing behavior. In other words, speculating when to get in or out of parts of the markets when you feel the time is right.

When you consider market timing just that way—as speculation—you see that it isn’t something one ought to do with one’s core capital. Taking all of one’s goal-oriented money in or out of the market is no different from putting it all in a hot stock, or trend. That is, you’re not seeking long-term accretion of intrinsic value—which is the very definition of investing—but trying to profit from a temporary change in the wind.

We just discussed how market pricing is based on expected future earnings, so how can your feelings be aligned with reality? What is the cost of your being wrong? This is a series of trial-and-error that millions of aspiring retirees have learned the hard way over the years.

“What’s the market going to do?” Here’s a hint: the economy won’t tell you.

What To Do Instead

If we can’t predict what the markets will do, and we can’t know what the economy will hold, then how do people invest successfully? By not mistaking noises as signals.

Take care not to confuse the dismissive tone towards analyzing the economy and markets with a lack thereof. Studying economics and the current relevant factors is incredibly important, because it tells us a lot about risk. Having the appropriate demeanor speaks to resolve, not rigidity.

If you have many years before retirement, don’t worry about the short-term temperamental behaviors of the teenager-like stock market. You’re not drawing from your money for a long time, and vehicles like the C, S, and I fund offer you the opportunity for tremendous long-term growth. Having stayed invested during 2020 [when the world was ending] allowed you to benefit greatly, making the massive declines at the time nothing more than a blip in hindsight.

If you have five years or less until retirement, your game plan needs to be different. That “blip” was a bomb, and it changed the trajectory of many retirement plans.

The behaviors that lead to financial independence look very different than those that sustain financial independence.

- Remaining financially independent for life after service boils down predominantly on risk management.

- How much risk are you taking?

- Is it too much? Too little? The right kinds of risks?

- Which investment and planning choices align your financial objectives with the highest likelihood of success? At which given points in time?

- How does the risk of a recession change my financial independence? What can/should I do about it?

- How do you make sure your trajectory is still on track to your ideal future?

The markets and the economy have seasons which means various elements have different levels of risk at different times.

For example, not investing in growth-oriented stocks could mean that your wealth doesn’t keep up with your spending/inflation in retirement. Simultaneously, investing in growth-oriented stocks could also mean that you have too much volatility in your portfolio, and subject yourself to sequence of returns risk.

Consistently managing the risk between seemingly opposing goals is the entire game. Behold, this is retirement planning.

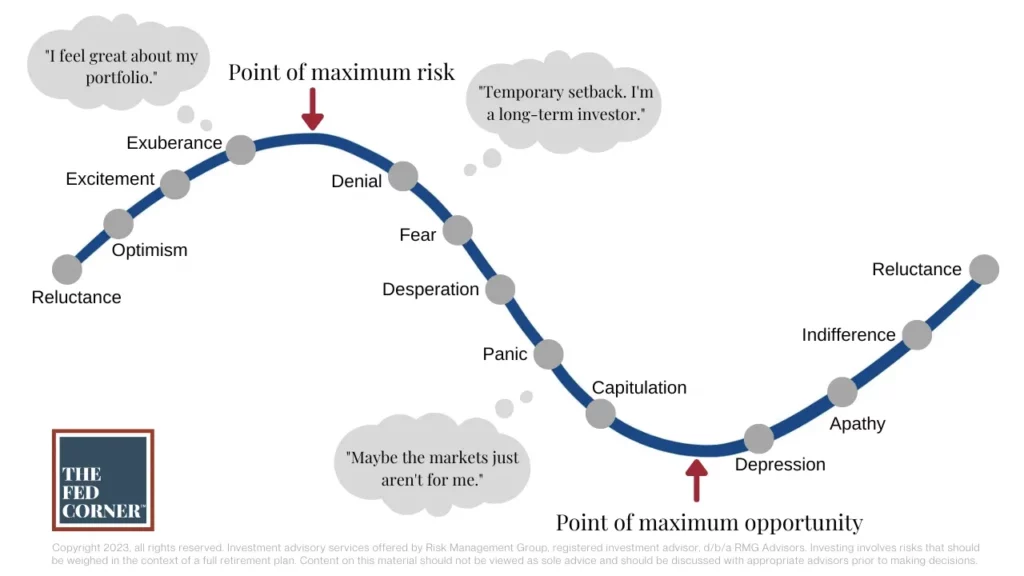

I couldn’t do this article without bringing back my all-time favorite graphic. What this image illustrates is happening right now. We are seeing it manifest in real time as federal employees pour back to stocks.

The big questions are where is the next top, and are you properly set up to withstand whatever comes around this next bend in the road? Are you properly managing your risk?

If you don’t know what the impact to your financial independence is in various scenarios of your life or in the economy, then you’ve got some work to do.

The only way to properly set your investment plan is by going through the planning. Think about it: when is the last time you got in your car and started driving before you knew where you were going? Investing is similar.

You need to plan through your objectives and timelines to understand which allocation, scenario, plan, strategy, tactic, etc. and combination therein, will help you achieve those objectives.

And when you do so correctly, you get to live your lives how our clients have come to enjoy—uninterrupted by the tantrums of the financial world around us.

You owe it to yourself to feel the same way. After all, it’s not just your money, it’s your future.

If you want more resources like this, check out this link.