Biggest Roth Mistakes of 2023

Roth accounts have become incredibly popular lately, and for good reason. For one, the current tax rates we’re in are set to expire in a few years once the Tax Cuts and Jobs Act expires. If there are not tax law changes until then, we will reverse to the original pre-law higher rates.

Federal employees are taking advantage of strategies like Roth conversions and various others to make use of the time left in lower brackets. But while it’s great that they’re using it, we’re seeing many families make costly mistakes that could have been avoided.

In this piece, we’ll discuss some of the biggest mistakes we see so that you can avoid them too.

Not Factoring Time Left for Roth Conversions

The first big mistake we’ve seen is not factoring the amount of time that you have to convert. There are two groups of people for whom this could become a problem.

The first is someone who just retired, let’s say they’re 62 years old, and has a lot of years to use Roth conversion before they’re required to take minimum distributions (RMD).

We often see people make the mistake of converting too aggressively on the front end, meaning they didn’t adequately spread out filling their taxable income over the years before RMDs.

This could mean they push themselves into higher tax brackets a little too early and miss opportunity to convert at lower rates just the very next year.

On the flip side is that this could be someone who waited too long to convert and is now stuck having to do larger conversations and not minimizing their taxes.

Remember you only have a finite number of years to convert taxes are a lower rate before your RMDs start and increase your taxes again.

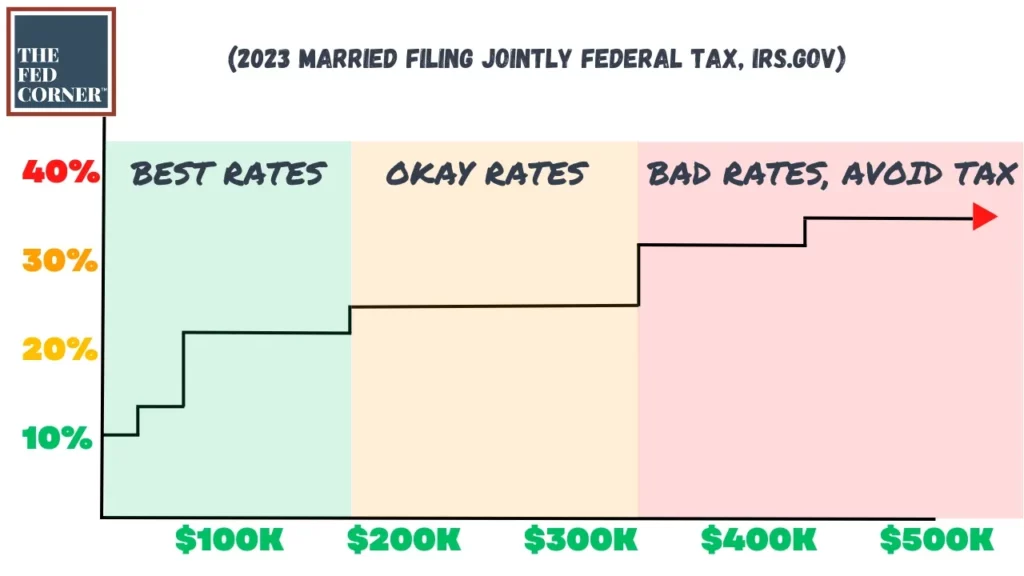

The US has what’s called a progressive tax system. This means that as you increase your income, the tax on any income above a certain level is going to be at a higher level.

If you’re doing Roth conversions, you can immediately see how there are zones in which it makes sense to pay taxes, and then others where it doesn’t. As a retiree starts making Roth conversions, they begin pushing themselves into the difference zones, and paying more taxes.

In our first example, sometimes we see people with many years to convert performing such conversions too much all up front, which means they push themselves into the yellow or red zone. If they had spread it out over longer years, maybe they could have stayed in the green, or paid less into the yellow or red zones.

For example, if a family’s retirement plan calls for making $250K of Roth conversion during their tax planning window, it would not be prudent to do it all at once. You could easily be pushed into the red zone. Alternatively, spreading out those $250K conversions over as many years allows them to keep their income tax as low as possible.

Conversely, we also see older families who are trying to catch up for missed years of Roth conversions. Doing bigger Roth conversions means they may have pushed themselves into the yellow or red zone, depending on their financial position.

Failing to Factor How to Pay for Taxes

The second common mistakes we see families make is failing to factor that paying taxes on Roth conversions could incur more taxes.

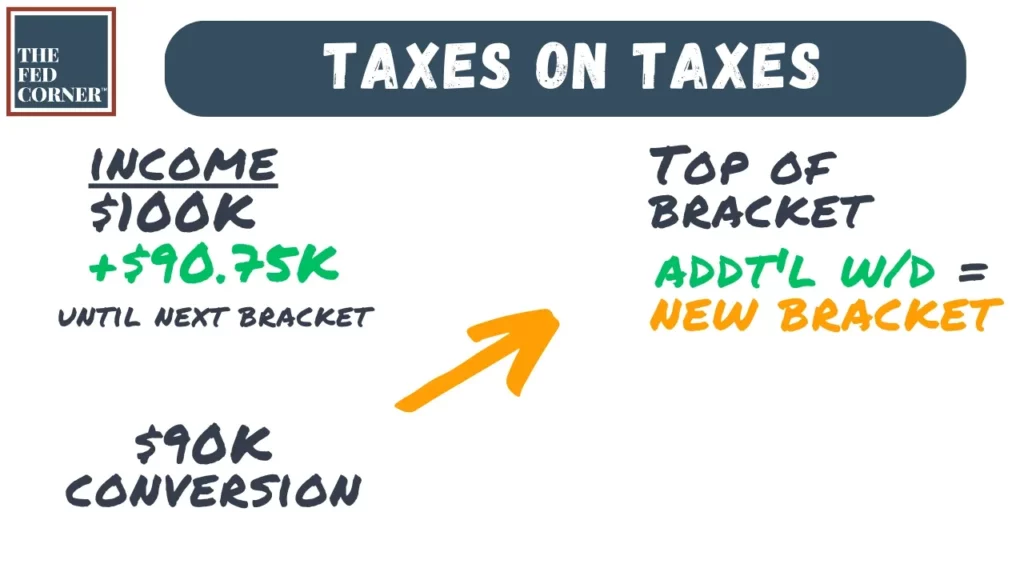

Retirees need to think about how they’re going to pay the taxes for that conversion. Many people “max the bracket” without considering how the progressive system works. The next dollar created in taxable income is taxed at the new bracket.

How will you fund the tax payment when it comes due? You can withhold it from the Roth conversion itself, which we generally suggest avoiding, or you can pay for it with after-tax dollars.

Withholding taxes means the sum of money growing tax-deferred (now tax-free) gets reduced by the taxes. How much more growth do you need to have to make up for the slower compounding?

Let’s take a family that has $100K in taxable income. That means their next bracket starts at another $90K or so, for 2023 married filing jointly. If they do a full $90K conversion, now they’re at the top of their bracket.

If they need to take more money to pay for the taxes, that can be additional taxable income depending on where the money comes from. If they don’t have after-tax monies for the tax—or any other larger expenses that comes up—this could mean they’re forced to take money at higher tax rates.

Failing to Consider Social Security and Medicare

The next mistake we commonly see is failing to consider how this impacts your Social Security and Medicare.

The amount of your Social Security that is taxed depends on your income levels. Most of you reading this won’t have a 0% tax on Social Security just by virtue of your FERS pension. But depending on your wealth, it’s possible that only 50% of your Social Security is taxed. Conversions can increase your income to the level where how you owe much more taxes on your Social Security benefit as well. That said, most of our clients are already paying taxes on 85% of their Social Security and this is a less relevant factor.

The other component is how it factors into Medicare Part B. The premiums are based your taxable income levels as well. If you push your income up haphazardly, you may have caused your Part B premiums to increase.

If you’re on TriCare, you must take Medicare Part B, whereas FEHB enrollees have an option. Most of our readers choose to take Part B and therefore should factor this into their plans.

Investing the Roth Incorrectly

The next costly mistake we often see is not investing the Roth properly.

When you grow your money in non-Roth accounts, there is always taxes on it, whether it’s capital gains in non-retirement accounts or income tax in retirement accounts. The more growth you have, the more taxes you’ll owe at some point.

Why not go for the most growth inside the most tax-efficient vehicle? The Roth.

This is the kind of advance planning that you should incorporate as you learn about how to design a proper retirement plan. We go deeper into the details of retirement portfolio construction in this article, so make sure you check that one out next.