Assets You Should NEVER Put in Trust

Trusts are not just for the ultra-wealthy. It’s true that they’re often used to protect against estate taxes and avoiding probate, but a trust can do so much more.

Most federal employees would be well suited to have a simple trust in place, but seldom do people know about what not put in trust or risk creating challenges.

People often think that once their trust document is created, they need to re-register everything they own and put it into the trust. However, there are some very specific assets that you may not want to put into trust because as doing so could cause tax or legal issues. What assets should you put in trust? Should you avoid certain assets?

Retirement Accounts in Trust

Retirement accounts (TSP, IRA, 401k, 403b, etc.) are in fact trust agreements by themselves. This means that re-registering your retirement accounts into your trust’s name would effectuate a trust within a trust.

There are beneficiaries elected, just like there would be in a trust, which allows you to preselect who receives your assets upon death and thereby avoiding probate.

If you put your retirement accounts into a trust, you may be essentially liquidating the asset for retitling, which means that it could be a taxable event. This would be equivalent to taking out your entire traditional (pre-tax) TSP and paying taxes on all of it in one year.

In general, you want to leave your IRAs, TSP, or other retirement accounts in their own name, either yours or your spouse’s name, and do not put them in trust.

Sometimes people will name the trust as the beneficiary of retirement accounts, which allows the trust to have some control over how the beneficiary can get the money.

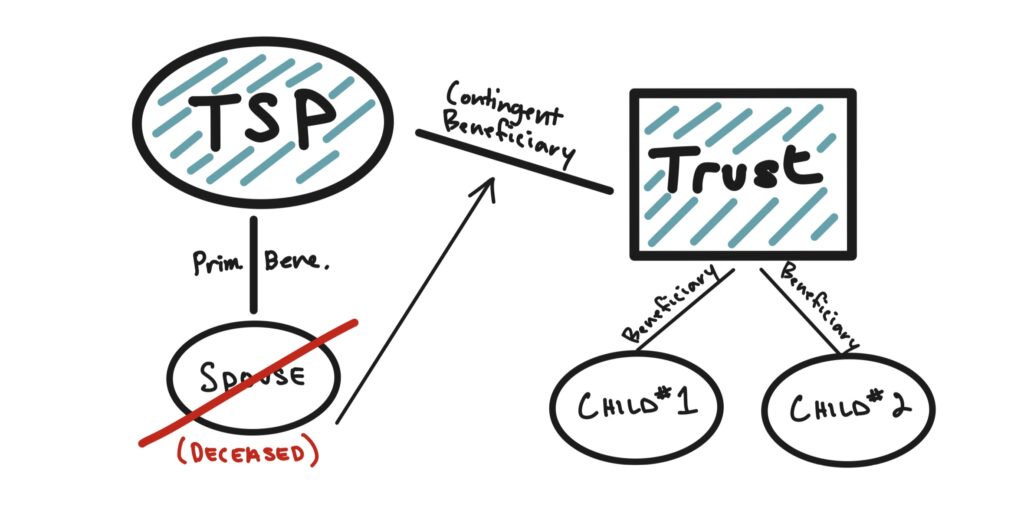

For example, your TSP or IRAs all have a beneficiary, which most people name as their spouse. Contingent beneficiaries, those who stand to inherit if the primary beneficiary cannot inherit, is most often elected as the children.

This could be problematic. Let’s say you and your spouse both pass away. Your kids could receive those assets outright and directly. What if your kids are in college, or even in their 20s? You may not want your children outright inheriting hundreds of thousands or millions of dollars. If your kids are minors, they cannot inherit at all.

Perhaps you might design your trust so that they don’t receive their inheritance until at least 35 years old, or maybe a portion of it can only be used for the purchase of a home until a certain age, or any other form of control mechanism. This helps pass on your family’s stewardship values.

To help protect your family’s wealth, we often see feds leave their retirement accounts to their spouse, and then the trust as contingent beneficiary. Then, the trust could have rules in place to help ensure the kids use the money in a responsible manner.

There are also some additional tax considerations about how RMDs must be taken if a non-spouse is inheriting, so make sure you’re working with appropriate financial, tax, and legal advisors.

Land, Water, or Air

The next asset you should avoid putting in trust are vehicles, like cars, boats, and others. There are a few reasons for this.

The first reason is that titles can be easily changed to your beneficiaries without probate. Most estate executors can easily accomplish this with only a death certificate so there is no need to go through the hassle of changing your car’s registration to a trust.

All that’s generally required is to simply put language in your documents about which beneficiaries you want for your vehicles, and the trustee/executor can easily take care of it.

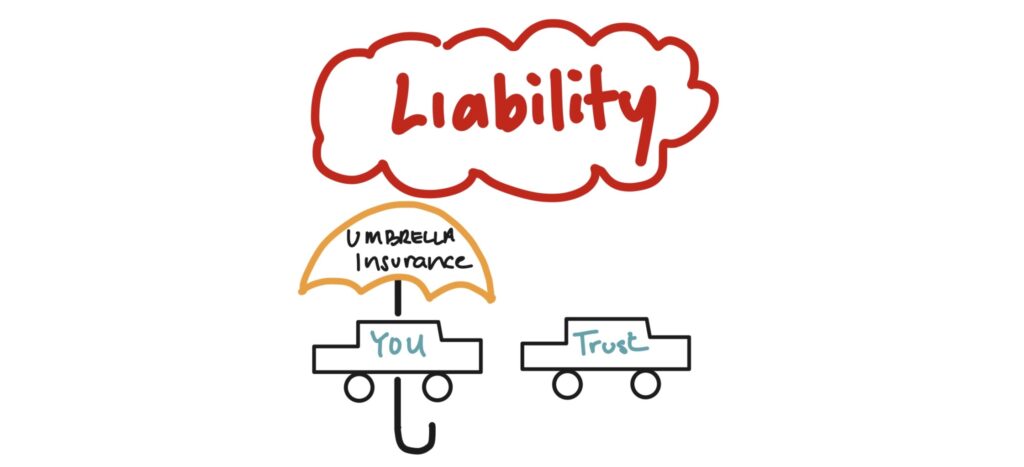

But beyond this, there’s another important reason to avoid putting a vehicle in trust. When you retitle your vehicle into the name of your trust, you’re making it obvious that you have a family trust established. Why is this a problem?

Let’s assume you’re in a car accident and it was your fault. If I were the attorney representing the other party, I’d be alerted to the fact that your car was in trust, and any potential lawsuit could name your trust as the defendant. This is true even if someone else is driving your car (think kids).

So, if you want to keep your trust out of liability—which is one of the goals in using a trust—then make sure you avoid putting vehicles in the name of your living trust.

Insurance Policies in Trust

Another asset to avoid putting into trust is a life insurance policy. Just like your retirement accounts, you can name your trust as the contingent beneficiary, or primary if you’re unmarried, again so that the kids are not getting a giant check that they—or their future spouses—could be irresponsible with.

The one exception to this is if your estate may be large enough to trigger estate taxes. Currently, the limit is over $13M, but it will eventually reduce again (as soon as 2026 with the expiration of TCJA). There may also be separate state specific laws. If you die early with seven-figure portfolio, one or two homes, and also have large life insurance policies, then you could have an estate tax problem.

In these cases, you can consider an irrevocable life insurance trust, known as an ILIT, which is a separate trust from your living trust and makes it its own separate entity, thus removing it from your estate.

When it comes to insurance and estate planning, I highly suggest you find the right professionals. Changing ownership of life insurance policies can trigger a “Transfer for Value” event, which could make the entire life insurance death benefit taxable. You want to avoid this at any cost. Improperly implementing an estate plan could be devastating.

It’s important that you get your trust funded, otherwise it is quite literally a piece of a paper that does nothing for you, but your legal/estate planning is just one piece of your retirement plan. Don’t wait until it’s too late to do the planning; after all it’s not just your money, it’s your future.