Are We Headed for a Recession?

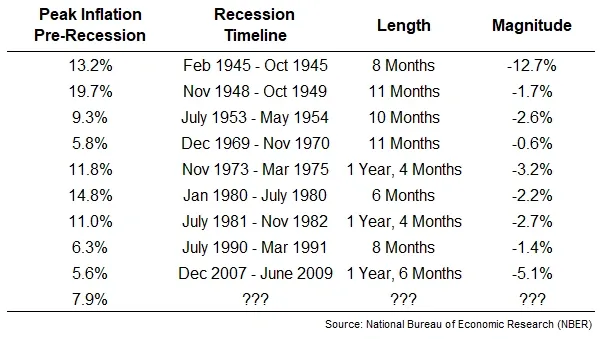

With inflation as high as it’s been, economists are all on recession watch. Check any of your favorite economic news stations and you’ll find that that word getting some serious traction. Historically, inflation spikes as high as our recent ones were followed by recessions shortly after.

Making matters worse, the yield-curve continues to flatten. For a quick econ recap on how this pairs with inflation, check out this article.

To be fair, there are various indicators of a recession, such as job sentiment, unemployment, wage growth, sales, commodity pricing, credit spreads, money supply, yield curve…the list goes on. The fed’s comments include that they feel many of these indicators are strong but are still forced to make a move to curb inflation. Will they be able to do so without creating negative ripple effects in our economy?

The problem is that even if we don’t enter an official recessionary environment, that doesn’t mean the markets won’t behave as such. Markets tend to price in anticipation of events. If the consensus is that we’re headed in the wrong direction, your portfolios may take a beating.

But recessionary environments are a normal part of the economic cycle, and present great opportunities for federal employees as they adjust their plan.

The challenge is that investors tend to view every current crisis as a calamity, while viewing every past crisis as an obvious opportunity.

Your wealth aside, the ultimate risk is your inability to do the things you want when you want. This shows up in many practical ways, like when you want to stop working, move to be closer to your children or grandkids, getting a second home, take care of a health challenge, etc.

Whether we enter a recessionary period or markets simply remain unstable, we’ll address the top items we’re discussing with our clients to successfully navigate the volatile economy in 2022. Years like this one truly separate the disciplined investors from those who “wing it”.

Address Sequence-of-Returns Risk

Defined simply, this is when an investor experiences poor market performance late in their careers or close to their retirement dates. When federal employees come to us for help, this is one of the biggest risks we find families failing to address when managing their wealth. If the markets aren’t favorable nearing your retirement date, you risk running out of money much sooner than you may have anticipated.

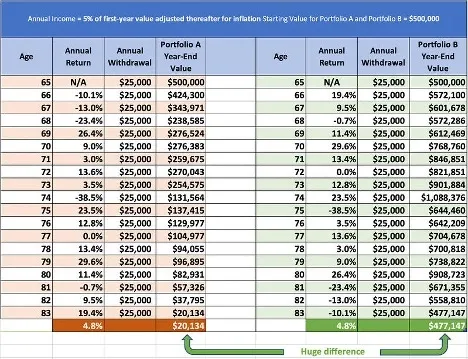

You need to understand what different market returns will do to a portfolio that is supplementing your lifestyle. Let’s use this graph below as an example. We’re assuming a starting $500K investment account, whether that’s your TSP or another vehicle with your assets, and in this model, we project a $25K annual drawdown to help meet living expenses.

The annual returns are exactly the same for both portfolios A and B, except for the years in which the returns occur. In portfolio A, we model the first few years of retirement with unfavorable markets, and in portfolio B the “bad” years occur later. Understand that this starting withdrawal rate is likely too high, but this serves merely as an example to illustrate Sequence-of-returns risk.

The difference in ending account value is significant. A federal employee with portfolio A may consider reducing their withdrawal rates to help curb the draw-down, which is a fine strategy to help against this type of problem. If this was discretionary spending, then it is more easily mitigated by ensuring your portfolio is invested properly. It simply becomes a question of needs versus wants. But what if you have a financial need and are forced to make the withdrawals?

One way that wealthy families address this risk is through SBLOC, or Securities-Backed Lines of Credit. Before we go any further, let me make clear that this is not a recommendation for you to acquire one, rather understand all your options. Simplistically, you may be able to “borrow” against your taxable investments for cashflow needs in times of decreasing markets. Why would an investor do this?

You’ve heard of “buy low and sell high”—if you need cash when the markets (and your investments) have fallen, you may be forced to sell low. SBLOCs may allow you to borrow just enough to cover your need without having to sell the “down” investment. If it’s a good investment, it’s likely to recover, potentially keeping you from “realizing” that permanent loss.

In “up” markets, it allows you to tap into your growth without realizing the capital gains and paying taxes. The interest rate paid is generally significantly lower than the capital gains taxes that you would pay. This is one of the ways that the rich use their money without ever running out of money.

Note that this is not available to any form of retirement assets. You can only have this feature on non-qualified dollars, so it’s only for dollars you’ve saved and invested outside of TSP, IRA, 401k, 403b, etc.

Please understand that SBLOCs can be highly complex, and there are various risks involved. If you’re considering one, I recommend that you read the SEC’s bulletin on SBLOC accounts and discuss this with your advisor.

There are many financial firms that are incentivized to “sell” these products, as they earn revenue on the SBLOC. However, there are other firms that do not earn anything, offering them simply as a value-add available to their clients. It’s critical that you understand this relationship prior to agreeing to an SBLOC. Used intelligently and correctly, they can be a handy tool. But alas a tool is all that it is, for a specific job, for a specific type of investor, like every financial instrument.

It’s also important to not mistake them for “margin”. Adding margin to an investment account is different and should be reserved only for professional managers and institutions. Generally speaking, stay away from margin-type accounts as individual investors.

Not all index funds are created equally

For some federal employees, their TSP and other investments may be only a small part of their necessary income. Between multiple pensions for dual-fed families, Social Security, or anyone with CSRS, you have greater flexibility in being able to pivot properly when the markets don’t go your way.

But just because you can avoid “catching the falling knife” doesn’t mean that you’re not still at risk of jeopardizing your lifestyle or legacy. Part of having a successful portfolio isn’t simply holding the same S&P500 funds for eternity and only touching it when markets are doing well. What good are those savings for if you can’t continuously draw from them later in life?

It is commonly known that one must diversify their assets, but what does that really mean? It’s critical for federal employees to understand what an index fund does and doesn’t offer. Understanding how the C-Fund is going to perform in any given market is incredibly important if you’re going to use the C-Fund as one of your investments to support your financial plan.

Spreading your investments across numerous asset classes and sectors reduces your portfolio’s reliance and correlation to economic events, like a recession. This is done successfully in a multi-layered way:

- Investing in multiple types of the same asset class, like stocks from different sectors

- Investing in multiple different asset classes, like stocks, bonds, real estate, commodities, etc.

- Investing in assets with different risk types and levels

You’ve seen us write about how markets are cyclical in nature. What works in one decade may not work in the next.

If you have 25+ years left of working, market cycles impact you less because you have plenty of time to allow your accounts to recover from a poor investment strategy. But if you’re nearing retirement, the integrity of your financial independence depends on this.

You need to understand the risk of holding only a few large index funds and “waiting it out”. Sequence-of-returns risk is a serious component of your financial safety and crushing markets at the wrong time for you can deliver a blow to your wealth from which you may not recover.

The S&P500 (C-Fund) has many stocks in it that have lost 40% or more in the market this year so far. If you’re already retired or will be soon, this can be devastating. Making the wrong move at the wrong time can become a torpedo to your financial independence. You can’t control the markets, but you can control how you participate.

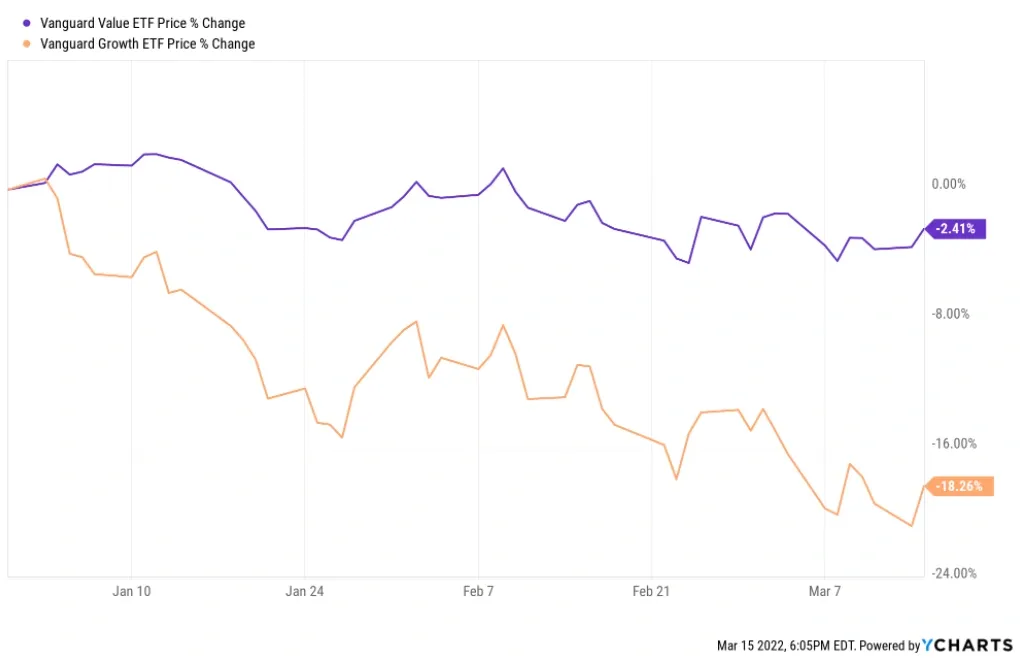

To illustrate this point, take this year’s chart of the Vanguard Growth fund compared to the Vanguard Value fund. A Growth fund and a Value fund are similar in that they are both investments of stocks, but with completely different types of stocks. Take a look at how each has behaved this year so far:

If you’re nearing retirement, having your investments in the Growth fund would have taken out nearly 20% of those dollars since the beginning of the year. How does that impact your plan?

Should you reposition to a different investment instead to help meet your goals? The importance of an investment policy statement cannot be overlooked, and neither can the need for having the right asset allocation.

You may need to de-risk your assets to keep them from tanking with the markets, but you also can’t afford to take risk off the table in a highly inflationary environment, like the one we are in right now. Both of these factors are critical when deploying your 2022 investment strategy.

Finding the silver lining

If you’ve been diligent about saving cash outside of your retirement accounts, then you might have the ability to pay the taxes on a Roth conversion without tapping into the capital. In certain cases, this is better than deploying that cash that you’ve been saving into the markets. You’ll pay capital gains on the growth. Why not use them to pay the taxes on a Roth conversion?

A Roth conversion allows you to take Traditional money, known as pre-tax, and move it into tax-free status by paying the taxes. It’s important to understand that if you’re still an active federal employee under 59.5 years old, your options for this may be limited. The TSP does not allow its participants to affect a Roth conversion within. You are, in some cases, allowed to transfer a portion of your TSP into a Traditional IRA and convert those Traditional dollars into Roth, if you’ve separated from service or are of age.

There are various reasons that Roth conversions are incredible planning tools, but it’s a long-game play that benefits the longer it’s allowed to remain in your Roth account. These include, but aren’t limited to:

- No required minimum distributions (RMDs) on Roth dollars. This means less of your money is forced into higher tax brackets when you turn 72.

- If you take Medicare Part B, retirement account distributions can increase your Medicare premiums. This is known as IRMAA. The Roth gives you access to your money completely tax-free, potentially saving you not only thousands in taxes, but thousands in Medicare premiums.

- Inheritance and estate planning tool—wealthy families that leave money to their kids are concerned with how to best pass on their legacy. Leaving taxable dollars to children who may be in high tax brackets when they inherit can make it so that a significant portion of their inheritance vaporizes to taxes—in some cases, nearly half.

During bear markets, the markets are discounted from their recent high values. If you can get dollars into Roth (tax-free) status and invest them properly, you have the opportunity to ride the markets back up and reap the benefits of that money being completely tax-free.

Just be careful that you’re not making your IRMAA skyrocket if you’re currently taking Part B—Roth conversions count toward filling your income brackets.

Remember that Roth conversions can be tricky to plan, and they’re not right for everyone. Make sure that you, your planner, and your accountant are all of mind.

Apply logic to emotion

When is the last time you got into your car and started driving before you knew where you were going? Managing your family’s wealth is similar. You need to have a plan about where you’re going so that you can take the right path to get there.

Our firm sees the results every day. We see how the people who do these things stand the greatest chance to achieve their wants, needs, and desires. They have removed the burden of financial uncertainty from their lives, allowing them to truly live the retirement they want.

Retirement planning is simple but not easy. The Nasdaq has been down 20% or more 3 times in last few years. Despite that, it has compounded at 21% return for the last 5 years. Read that again.

This is why we invest, and this is why investors can single handedly blow up their portfolio—and their financial independence—by making the wrong move at the wrong time.

If you don’t have a plan for these types of markets, you’re subjecting yourself to making irrational decisions. “Holding the line” isn’t always the right answer.

As you continue navigating through this difficult economy, ask yourself these questions:

- If the bear market continues all year, does it risk my retirement timelines and future financial goals?

- Am I taking the appropriate amount of risk in my portfolio to meet my goals?

- Am I taking the right kinds of risk? How can I tell?

- If the bear market ends tomorrow, am I properly positioned to benefit?

- Are there issues I’m not considering?

- Has anyone else looked at what I’m doing? Am I talking to the right people about my plan?

If you don’t feel 100% comfortable with your answers, then consider getting help. Investors can often become their own worst enemies, so having a team to save you from yourself may be one of the most important factors to your success. After all, it’s not just your money, it’s your future.