Aging is Getting More Expensive – Trouble with LTC

As we age, we start to spend more money on taking care of our health. It’s not unusual for your most expensive years in life to be a result of health challenges in late life.

Depending on the level of care needed, the costs could create challenges for your financial independence. Moreover, health insurance does not cover true long-term care (LTC) beyond a limited amount.

This means that the responsibility of paying for these potentially massive healthcare bills falls entirely to you as a federal retiree. What’s the best way to handle this risk?

There are two primary methods of addressing this need: self-insuring or passing some or most the risk to an insurance carrier. Both come with pros and cons.

In this column, I address both methods of dealing with LTC, the crisis that the LTC business is in, and include a real example of how to compare your options so you can use it as a model for your own planning.

Self-Insuring

The option of self-insuring against long term care events requires diligent saving throughout the course of your career. Your ability to remain financially independent is based on being able to potentially cover large healthcare costs even after having been retired for decades.

Health and Human Services informs us that approximately 70% of people over age 65 will need some type of long-term care, but they stop short of defining the need. A LTC event could cost you a little or a lot. Some of our clients have needed full assisted living facilities in late life, and it cost them over $100,000 per year. The truth is that it’s almost impossible to know what your future need might be.

As a general rule, we suggest retirees incorporate a “What-if” scenario in their planning, for roughly $75K-100K/yr at your age 80 for 3-5 years. Note that this figure should be in today’s dollars, adjusted for medical inflation. This is a “worst case scenario” that should allow you sufficient flexibility in your retirement plan. Most people don’t have a need this great, but it’s better to plan for it and not need it than to need it and not have planned for it.

Many people make the mistake of thinking that federal support systems like Medicaid will save the day. While they are helpful, they are not designed to provide the type of care that you would want for yourself or your family in LTC.

Building in a large cost like this into your retirement plan at a future date could mean that your retirement plan runs out of assets prematurely, or it causes you to have to make substantial lifestyle changes between now and then or risk not being prepared.

This is where insurance policies can be helpful.

Insuring Against LTC Risk

To protect their liquid assets from being cannibalized for LTC expenses, may families opt to pass on some or most of this risk to an insurance carrier. Federal employees have historically had the option of enrolling in FLTCIP offered by John Hancock, but this program is still currently closed to new applicants.

This brings up an interesting question: why would John Hancock stop selling LTC policies to federal employees? And why doesn’t John Hancock sell LTC policies to the rest of the country?

While we can’t know the intricate details of OPM’s negotiations with John Hancock, we can only speculate that the costs of maintaining those policies is growing at an alarming rate. This is precisely what’s occurring in the LTC industry writ large.

One of the biggest challenges with Traditional LTC insurance is its unpredictability of costs in the future. It’s true that the FLTCIP has been competitively priced and has remained among the more cost-efficient plans available to feds.

However, for the first time in years, the FLTCIP has implemented a series of price increases. This should come as no surprise if you’re on the plan as you would have received your premium increase letters. The price increases are occurring over the next three years.

This is very similar to how private LTC insurance policies tend to operate. We have many clients with private plans, and most seem to implement 20-25% premium increases every 4-5 years or so.

At that rate, many retired feds may be forced into having to choose between maintaining their LTC coverage or other lifestyle choices, particularly later in life and when they are most likely to need the policy in the first place.

Medical advancements have allowed retirees to live longer, and the LTC insurance providers grossly underestimated their expense estimates. As a result, they did not price traditional LTC policies correctly. With healthcare costs rising twice as fast as regular inflation, we can only come to expect that carriers will continue to increase prices to keep up with their own costs.

Having a variable cost like this in retirement, where you have fixed income sources and a finite pile of money from which to generate your retirement paychecks, creates an unsettling feeling and introduces risks to a retirement plan.

Other Options

To help solve this issue, insurance carriers have begun offering hybrid LTC policies. By creating a plan wrapped around a very small life insurance policy, they’re able to create stable premiums that can eventually become “paid-up”. This means that there is a finite amount of premiums that have to be paid, and then there are no more premiums owed to maintain the LTC coverage. Not only that, but the death of the policy holder may also come with a small death benefit to help recover the costs of the premiums paid during their life.

For the record, I’m not an insurance agent but the type of retirement planning we do for our clients focuses on everything that includes a dollar sign. Our team has extensive knowledge and experience in the methods of protecting and extending wealth during retirement. That said, we’re not insurance experts and as such, I spoke to one about these types of policies and how they work. You can find the conversation here.

The benefits are obvious. Knowing exactly how much you’ll owe and for how long makes it substantially easier to address this cost inside a retirement plan. If you decide to pay it over 10 years (common method), now you have a time horizon and can decide which investment vehicles can you help tackle this cost.

The cons? They’re expensive. For the insurance carrier to offer these kinds of guarantees, they need to collect higher premiums from you in the earlier years. These higher premiums allow them to do what they do to hedge against their own risk of default.

Without diving into how financial institutions like insurance companies remain solvent, just know that their business is based on actuarial probabilities. If they have higher premiums early on in a contract, they can invest accordingly to help protect themselves against losses. This is not unlike investment strategies for retirees, only on a much larger and more nuanced scale.

You’ll find that over those 10-years, the premiums paid each year is much higher than traditional LTC programs like the FLTCIP, but they’re finite and eventually go away. If you have extra cash on hand, you can also opt to pay it all up front in a lump sum check, and you’ll likely save yourself an additional 15-20% as a result, making your total lifetime insurance cost significantly less.

And that’s the name of the game: which type of plan gives you the best value for what you pay in premiums? At which point do the higher but finite premiums of hybrid plans intersect with the lower but permanently recurring (and increasing) premiums from traditional LTC policies?

If you’re confident in Excel, you can chart this out by outlying cumulative premiums paid in each kind of plan. You’ll want to get quotes/prices, so you know what to expect from the hybrid policy costs, then make an assumption with which you feel is reasonable for premium increases for traditional LTC policies.

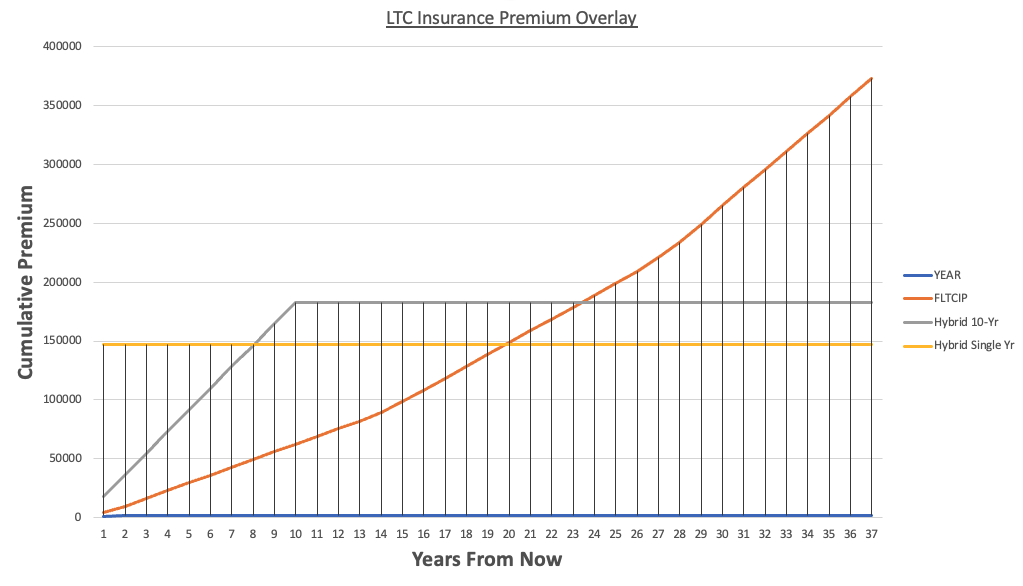

My suggestion? Use history as a guide…or just look at the chart we already made below:

This chart is a real example created for one of our clients. They’re both healthy retirees that each pay around $190 (him) and $182 (her) per month on FLTCIP. Together they pay $4,478 per year for FLTCIP this year. They’re experiencing a 46% premium increase over the next three years with FLTCIP, which is modeled. We also modeled this premium increase again every decade. That’s the orange line.

The gray line is their hybrid LTC policy quotes that came back for $720/mo and $805/mo, totaling to around $18,300 per year. That’s significantly higher than FLTCIP. However, this premium is only for 10 years, then it stops.

What if they pay it all up front? That’s the yellow line: $147,198 for both of them, one-time and they’re done. These costs were for similar coverages they currently have in FLTCIP.

In their specific case, the 10-year and lump sum costs intersect after 8 years, the lump sum intersects with the FLTCIP after 20 years, and the 10-year intersects with the FLTCIP after 23 years. Note that you should perform your own analysis, as everyone’s premium outlay is likely to be different.

But this is a good example of how you should be thinking about your own LTC risk. Is it worth the break-even point 20+ years? Maybe. That’s for them to decide. Is it worth dropping all insurance and self-insuring instead? The myriad other financial goals they have in retirement will be influential to the decision.

The takeaway is to get you thinking about your own LTC needs. The earlier you start planning for this, the better chance, and more flexibility you’ll have in being successful. Wait too long and neither time nor premium costs are in your favor. Take the time this year to get your planning done, because it’s not just your money, it’s your future.