Vanguard Just Said Your Retirement Plan Is Wrong. Here’s Why That Matters.

Recently, Vanguard released new guidance suggesting retirees should shift their portfolios to 70% bonds and just 30% stocks.

Using TSP terms, that means loading up 70% in the F Fund, with only 30% spread across the C, S, and I Funds.

That’s a big departure from the classic 60/40 mix retirees have leaned on for decades. So, what’s going on? Why is Vanguard suddenly so cautious?

What Vanguard Is Really Saying

Vanguard has quietly increased bond allocations across some of their own funds. Their reasoning?

- Stock valuations are stretched. After a decade of eye-popping growth, they believe future returns won’t be nearly as generous.

- Bonds look more attractive. With higher rates, fixed income finally provides real income and stability.

- Volatility risk is elevated. With markets at highs, the cost of a downturn feels heavier—especially for retirees.

Their report compares the traditional 60/40 portfolio to their new model. Notice what stands out: far fewer stocks, and less emphasis on S&P 500–style large caps.

The message is clear: diversification matters, and just holding the S&P 500 isn’t enough.

Why Now?

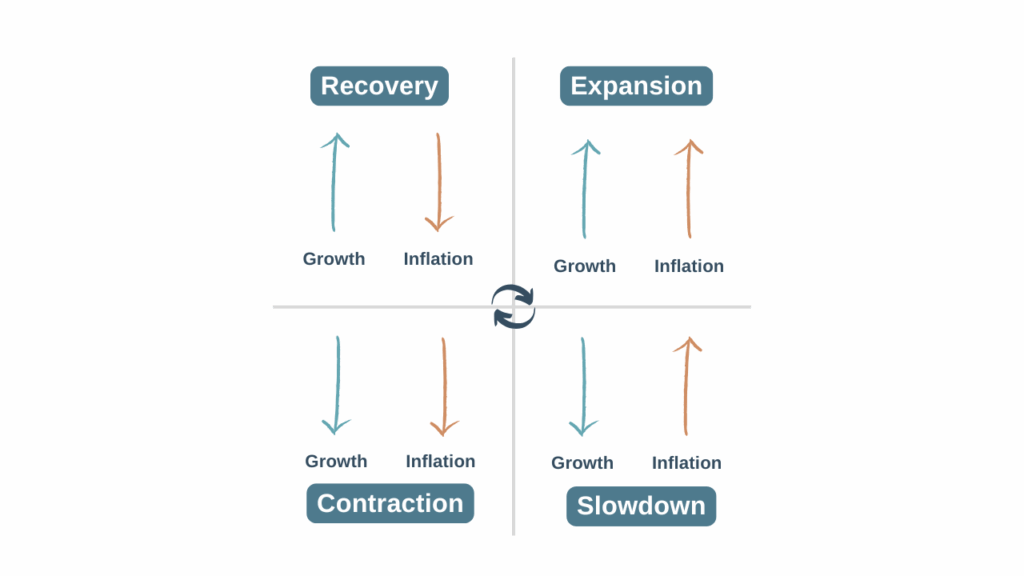

Think of the economy like seasons. Expansion. Slowdown. Contraction. Recovery.

But unlike the weather, economic seasons don’t come on schedule. Some last a few years. Others can stretch a decade.

We’ve just come through a long expansionary season: big growth, high valuations, and high inflation. Vanguard’s move suggests they believe we’re closer to a contractionary period—one where bonds will shine while stocks cool off.

It doesn’t mean stocks won’t grow. It just means the rocket fuel of the past decade may be running out, and the next stretch might look more like regular unleaded.

Should You Copy Vanguard?

It’s tempting to say, “Well, they must know more than I do,” and overhaul your TSP.

But here’s the problem: Vanguard’s analysis is looking at a 10-year window. For a retiree, 10 years is just one slice of your journey—not the whole picture.

If you follow their approach too literally, you risk being overly conservative. That could keep your money safe in the short run, but may leave you short in the long run.

Why Time Horizons Matter

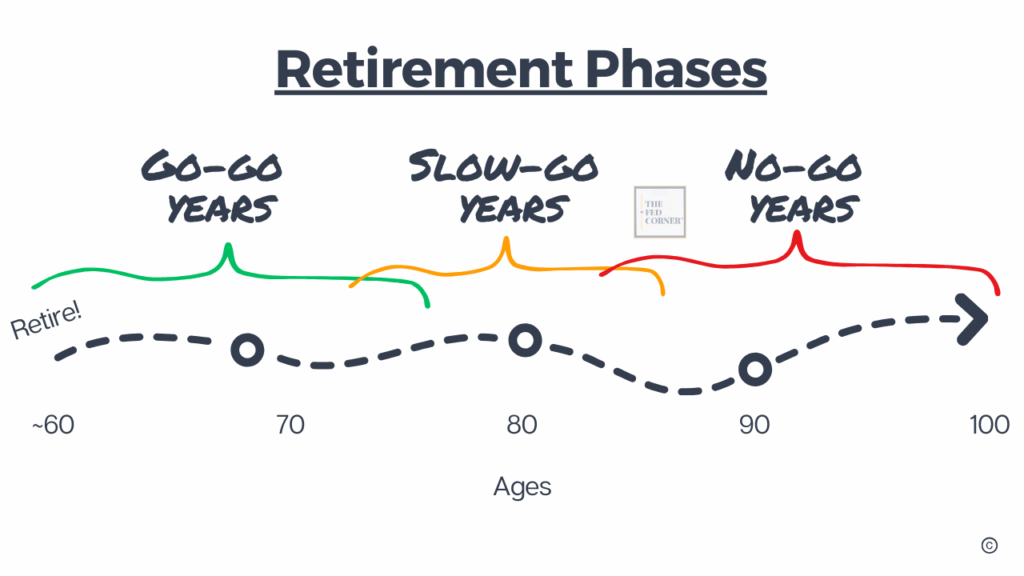

Federal retirees don’t have one time horizon. They have many.

Now, or start of retirement (0–3 years): You may need immediate cash for living expenses. Your FERS pension and Social Security help, but gaps need to be covered by liquid assets.

5 years out: Maybe you’re planning a move—kids are out, retirement home calling your name, or many other “go-go years” items.

10 years out: You’ll still want to travel and enjoy life—but costs will be higher, and inflation will be eating away at your purchasing power. You might have grandkids now, and life starts changing.

15–20+ years out: Healthcare and long-term care needs can dominate your budget, and those costs rise nearly twice as fast as general inflation.

Each stage of retirement has different risks and different investment needs. A one-size-fits-all allocation doesn’t capture that complexity.

The Psychology of Loss

Part of Vanguard’s caution is psychological. Research shows the pain of losing money is about 2.5 times worse than the joy of gaining it.

Imagine this:

- You find two $100 bills in a parking lot. Later that day, you lose one of them.

- Or… you find just one $100 bill and keep it.

Either way, you’re up $100. But losing that bill stings far more than never having had it.

That same feeling hits retirees when portfolios drop. Even if long-term results balance out, the short-term loss feels unbearable—and can lead to bad decisions at the worst possible time.

Here’s the real takeaway:

- Too conservative, and you risk outliving your money.

- Too aggressive, and you risk a devastating early setback from sequence-of-returns risk.

The answer isn’t to blindly follow Vanguard—or anyone else. It’s to build a plan tailored to your cash flow, your goals, and your time horizons.

For federal retirees, that means stress-testing your plan around:

- Your FERS annuity and supplement.

- The timing of your Social Security claim.

- How and when you’ll draw from the TSP.

- The tax impact of those choices over decades.

Retirement planning isn’t about chasing the right allocation at any given moment. It’s about reducing the risks that could derail your future.

Final Thought

Vanguard’s report isn’t a prescription. It’s a reminder.

The economy is shifting. Risks are real. And your retirement plan needs to adapt—not just to the markets, but to your life.

Because at the end of the day, retirement isn’t about matching a model portfolio. It’s about protecting the lifestyle you’ve worked so hard to build—through every season the economy throws your way. After all, it’s not just your money, it’s your future.