Navigating Retirement Planning During an Election Year: Insights for Federal Employees

As a federal employee, managing your retirement and investments can feel particularly challenging during an election year. Election cycles can bring uncertainty about the future of your role as well as the world around you.

It’s no secret that markets react to uncertainty. This is particularly true during election years when changes in policy, tax legislation, and leadership are anticipated. Historically, markets experience increased volatility leading up to and after elections, whether the administration is Democratic or Republican. When markets are volatile, it’s common to feel uneasy about the future of your retirement savings, especially if you’re nearing or already in retirement.

This article will walk you through essential insights on how elections can impact markets and provide practical advice to help you stay on track with your retirement planning.

Lessons From Market Volatility and Election Cycles

There many factors that influence the markets. Sometimes one element can affect the market in one year while having no impact in the following year. This is why investing can be so difficult.

To better understand how markets behave during election cycles, consider this historical perspective. A study from Fidelity shows that stock market performance tends to fluctuate during different political administrations.

Pre-election market volatility has been as positive ~30% or as low as negative ~38% in the S&P. This degree of market volatility can be challenging to deal with. This is due to several factors, including policy change expectations. However, the key takeaway is that markets have remained resilient over the long term, with positive average returns when annualized.

In the same study, we also learn how certain sectors of the market perform differently depending on the political landscape. Contrary to popular belief, there is an even split between underperforming and overperforming years during both Democratic and Republican administrations.

This underlines the importance of diversification in your portfolio, particularly in volatile periods. By spreading your investments across different sectors, you can better manage risk. More on the later.

I know that federal employees have a love relationship with the TSP C Fund, but I encourage all participants to consider the impact of using only one sector in the markets, and how diversification may help protect your goals from volatility.

The Role of Congress: Gridlock is Good for Markets

Another factor to consider is the role of Congress in influencing market stability. In a study from Capital Group, when Congress is split between parties, markets have historically performed better. Why?

This is because a divided Congress typically leads to gridlock, which limits major policy changes. Investors prefer this stability, as fewer changes mean fewer surprises that could unsettle the market.

When one party dominates both Congress and the White House, however, there is more potential for policy shifts, which can introduce uncertainty and increase market volatility.

But again, it’s essential to focus on the bigger picture—markets have continued to grow in the long term despite these shifts.

Common Mistakes and Their Impact on Your Wealth

Despite the long-term positive outlook, we cannot ignore the impact of volatility on our plans. One of the greatest risks to a retirement plan is sequence of returns. A portfolio with too much volatility can derail a retirement plan.

This is a particular challenge for those of you who are retired or will be soon. Volatility is most dangerous to those in the decumulation phase, where they are withdrawing from their retirement savings.

If you’re still working and investing for growth, you have the luxury of time to ride out market fluctuations. But as a retiree, you don’t have the same time horizon to recover from market dips. Retirees don’t live in 4- or 8-year cycles, and you don’t have time to wait 2, 3 or even 4 or more years for the markets to recover again.

This is why it’s essential to carefully plan your short-term strategy to protect your assets. You may love the C fund this year, but this same investment could be the factor that causes you to have to push back your retirement.

Risk is an arbitrary concept until you experience it. Rehearsing getting punched is far different than experiencing it firsthand. Despite how you’ve behaved during market volatility in the past, it will be a new experience for you once you are retired.

I have seen this be the case for our clients in retirement. It will feel different when you’re no longer earning an income. You’re going to start questioning whether you should be doing something differently or how you should be reacting to what’s happening. It’s your actions that determine the outcomes.

Protecting You from Yourself

There is overwhelming research that shows humans are their own worst enemies when trying to make rational and sound decisions around money. There’s no shame in this. We are hardwired to want to protect what is ours, which influences our actions.

In the study from Capital Group, they point out that nearly $200 billion flows into cash during election years, which is five times the amount going into stocks. What about in the year after the election? Almost a complete reversal.

Consider that if you miss only 10 of the best days in the markets during a given year, you’ll have missed out on more than half the growth available. We know that in the long-term, you’re likely to average positively if you can remain invested, so wouldn’t moving to cash be counterintuitive? It is, and yet. Somehow, we just can’t seem to help ourselves.

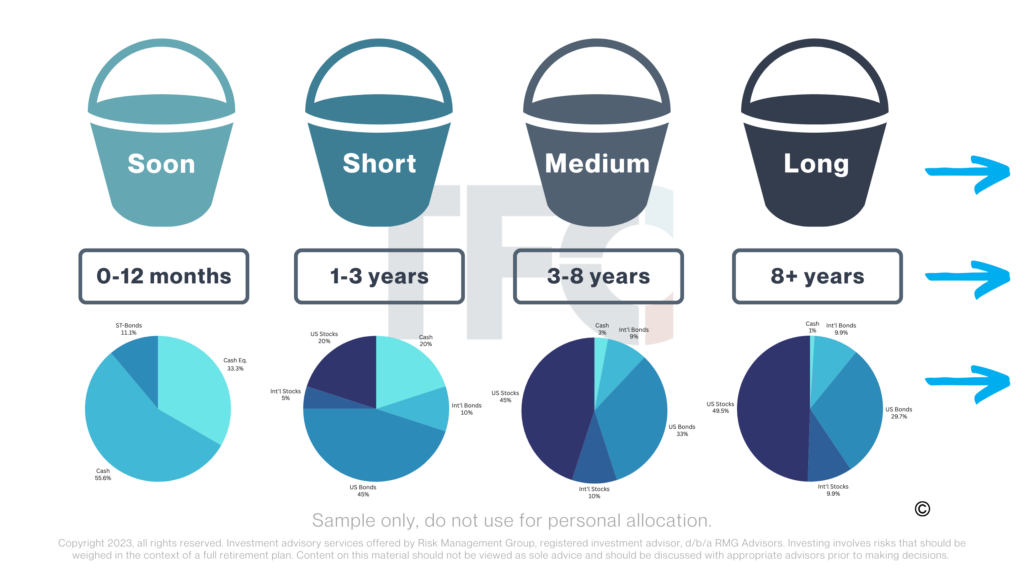

On the other hand, I can’t overemphasize the importance of having a short-term strategy in your plan. I want you to think about your money in terms of “buckets” —that is, segmenting your portfolio into short-, medium-, and long-term needs.

For short-term needs, consider keeping between six months to five years of liquidity needs in safer investments. This will allow you to weather market downturns without having to sell off long-term investments at a loss.

The right length of “short term” will depend on your circumstance. Some families require only 6 to 12 months of cash and cash equivalents, while utilizing money market funds, Treasury, short-term bonds, or various other conservative investments for the next one or two “buckets”. Others may require a heavier allocation to conservative investments.

Your retirement plan should determine what it costs to live your lifestyle both today and into the future, while adjusting for inflation and replacing your spending. Once you have that, you can calculate your retired rate of return, and then develop a portfolio strategy surrounding those parameters. This is the appropriate way to make your investment allocation decisions.

Retirement is never a straight line from point A to point B. Your plan will inherently deviate from its origin as we encounter obstacles, failures, and variabilities of the world around us. Now is the time to build in “what-if” scenarios so you can adjust correctly that allows you to stay successful.

By maintaining a well-thought-out strategy that accounts for short-term volatility and long-term growth, you can navigate the uncertainty with confidence, because it’s not just your money, it’s your future.