How To Create Your Retirement Portfolio

Whether retirement comes for you in 2023 or beyond, maintaining your financial independence for the rest of your life is dependent on the successful management of your wealth.

The universe of managing an investment portfolio is endless. There are countless opinions about the best and worst investments, whether the economy is about to bounce, or if Armageddon is happening next month.

Mostly, those who opine strongly in one direction have their fingers crossed behind their backs. The reality is that markets are unpredictable in the short term, and smart investors know better than to make portfolio decisions based on short term market indicators.

The most successful investors of our time understand the markets at a deeper level than most who participate. With this understanding comes various practices which precipitate their success.

The first of which is understanding the difference between strategy and tactics. Both are imperative to the ongoing success of a retirement.

Strategy v. Tactics

Strategic decisions about your portfolio’s structure should be derived from retirement planning. Only within its context can you have sufficiently accurate data and modeling from which to determine an appropriate asset allocation. Anything else is reckless and a risk to your financial independence. Think of strategic structure as “gross motor” decisions.

Tactical decisions are “boots on the ground” ones. Within your asset allocation, there may be relevant factors in your life, the economy, and/or the world writ large that call for “fine motor” moves within the context of your overall strategy.

For example, let’s assume that your retirement plan requires that you maintain an annualized X-percent return through your retirement, and that a 70% stocks/30% bonds portfolio allocation for the next X-number of years is appropriate to help accomplish this. This is a strategic decision to help create your ideal future.

However, we’re currently in an environment containing the highest inflation in four decades, and an interest rate environment for which we’ve yet to see its future impact on the profitability of corporations—and the subsequent impact on price of their stocks and equities market.

A tactical decision may involve maintaining the same 70/30 allocation, but within those 70% stocks, making changes to the kinds of stocks that are being held. Perhaps half of your 70% stocks are S&P500-type investments. Should you be filtering out high-growth investments to reduce risk and volatility? Are you properly diversified within sectors of the stock portion in your portfolio? Have you addressed and mitigated the various risks that may be relevant to each?

Or, perhaps your tactical analysis influences your strategy, leading to more fixed income (bonds) because yields are finally back in town, and you can now earn money without having equities exposure. But is that yield enough to outpace the systemic inflation? Have you mitigated the risk of the inverse relationship that bond-values have to interest rates?

And then picking your investments involves two forms of analysis: fundamental analysis—addressing a business’ present/future financial health, and technical analysis—addressing present/future economic and market health.

The Bucket Approach

Once understanding how to fundamentally construct a portfolio, how do you begin putting together all the pieces?

The power of compound interest helps our wealth grow and replenish so that we can keep drawing from it over the rest of our lives. It also helps keep up with rising costs over time (inflation).

But a retirement portfolio should look completely different than a portfolio during your working years.

On the one hand, you need some of that money to help pay for your expenses today. On the other, you also need that money to be growing for you, so that there is always a pile of money from which you can withdraw throughout retirement.

So how do we accomplish such opposing goals? We use something called the bucket approach.

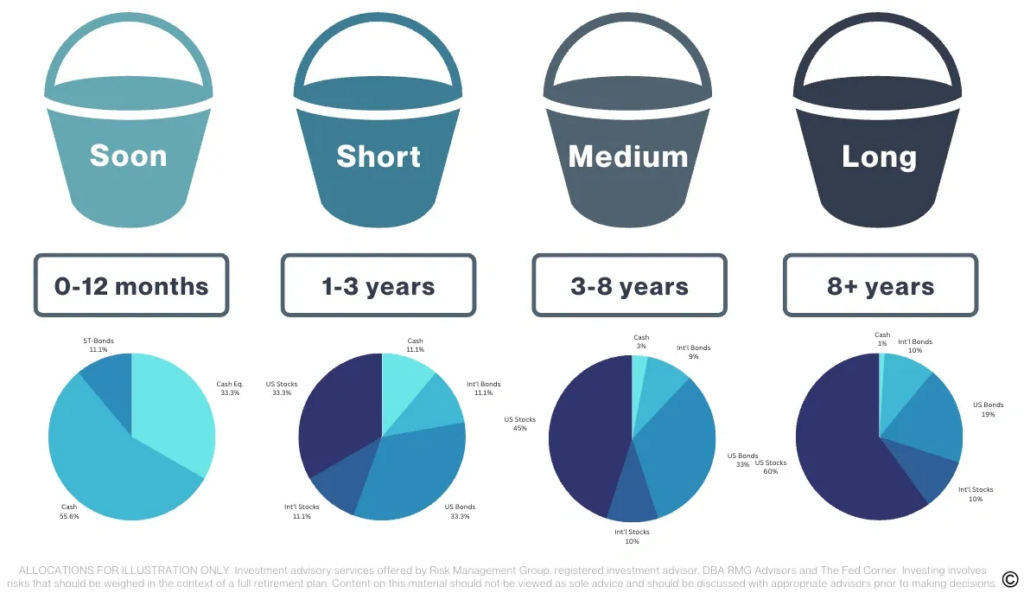

Let’s take this example. This is one way to utilize the bucketed strategy. Each bucket represents a different portion of your portfolio and makes up certain ranges of time into the future.

The idea is that the sooner you need your money, the less amount of risk you’re able to take, so you’d want to be in things like cash, cash equivalents, short term bonds, etc. Your individual circumstance will dictate the number of buckets, durations, and allocations of each, so do not use the above as your own.

As you move roughly 1-3 years into the future, that’s enough time for inflation to start eroding your purchasing power, and possibly just enough time that your money should be doing something beyond sitting in cash.

You still don’t want to be very aggressive, but you must start earning some kind of return on your money. As we push further into the future, say perhaps 3-8 years, we can start looking at investments that are going to give you longer-term growth, and then 8-10 years—or beyond—even more growth.

Why It’s Effective

The reason that this strategy can be effective is because market volatility is risk in the short term but opportunity in the long term. Our mantra.

The less amount of time you have until you might use that money, the more you risk pulling out your money once the markets have dropped in value.

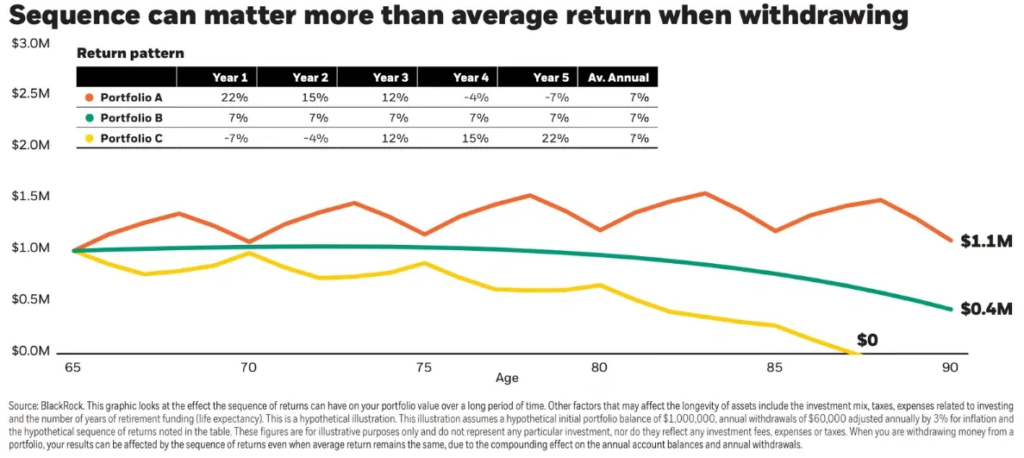

The variability of market volatility is a risk to retirees, formally known as Sequence of Returns risk. The graph below from Blackrock illustrates the impact of a poor income strategy in retirement.

In their illustration, all three portfolios achieved the same annualized returns, but some did not utilize a proper bucket strategy from which to take their retirement income, and the results are striking:

Taking your retirement income from the wrong places at the wrong time can lead to a severely depleted portfolio, and in some cases, cause a retiree to run out of money before running out of time. Having a bucket strategy that is regularly maintained helps mitigate the risk of realizing permanent losses and helps extend your wealth.

In short, you need to constantly have parts of your portfolio that are set up to meet your short, intermediate, and future needs.

Time Heals and Kills Portfolios

Time introduces variables along the way. Markets change, pandemics occur, wars happen, your life changes, economies go through cycles. As illustrated by Blackrock above, taking the correct course of action in each will either support—or be the demise of—a retirement plan.

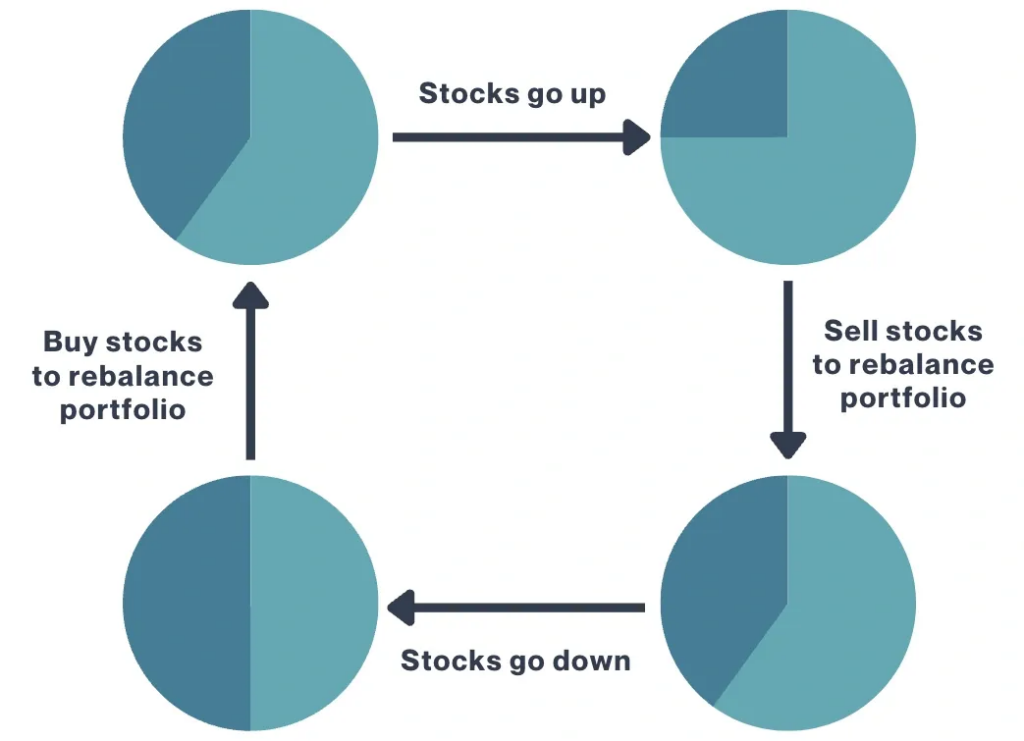

These variables influence your wealth and cause a need for changes within your buckets. As you spend money or as the markets change your wealth, the buckets become out of balance. This is formally called Portfolio Drift. Below is a very simplistic illustration of how this works.

Let’s say the pie chart represents your portfolio. As stocks go up in value, the more aggressive and growth-oriented buckets are going to compose a large portion of your overall wealth.

As a result, now your portfolio is subject to more risk and more volatility. This new balance of investments may no longer be appropriate for your needs. This could mean that a rebalance is needed, perhaps in the form of selling some stocks, to bring you back to your target allocation.

Then maybe stocks go down in value. Those buckets may now make up a smaller portion of your wealth, creating of not growing your wealth fast enough to meet your future needs.

This cycle repeats itself as long as there continues to be an economy.

Putting It All Together

As you approach retirement or evaluate your current retirement progress, we caution investors not to put the cart before the horse. Your values and what’s important to you will create your vision, and from this vision should be where we develop our strategy. Every family’s portfolio looks different because everyone has their own unique circumstances.

Your investment strategy is a big part your retirement plan, but it’s not the retirement plan. There are myriad factors with which a family can greatly influence their futures, and you should take care to address all of them in uniformity.

The process of implementing your plan over time is significantly more valuable than receiving a report with projections. Those are important too, but as we regularly see our doctors, so should you visit with the appropriate professionals to ensure your financial health is in good order. After all it’s not just your money, it’s your future.