Why A Recession in 2022 Will Be Unlike Any Other

When thinking about a recession, the first thing that comes to mind for many is the thought of Americans losing their jobs. During a recession, GDP (measure of economic output) goes down and unemployment increases.

The model for a recession has been similar ever since the second world war. Typically, when production begins to slow down because of any reason among various, companies may start to reduce their workforce to compensate.

As businesses reduce their workforce, Americans begin to spend less, either for lack of income or in fear of losing their jobs. While the loss of employment is rarely a risk for federal employees, the overall economic health impacts everyone.

When people spend less, businesses make less money, and when they make less money, they begin to lay off more workers. The cycle repeats itself.

A recession can be caused by various factors, including being manufactured by the Federal Reserve through tightening of monetary policy in order to cool off the economy. Economies that run “too hot” for long periods of time bring uncontrolled inflation. As difficult as a recession can be on the populous, long-term and unchecked inflation is much worse.

Historically, recessions have given an overheating economy the time it needed to regulate back to healthy levels again. Now let’s look at 2022.

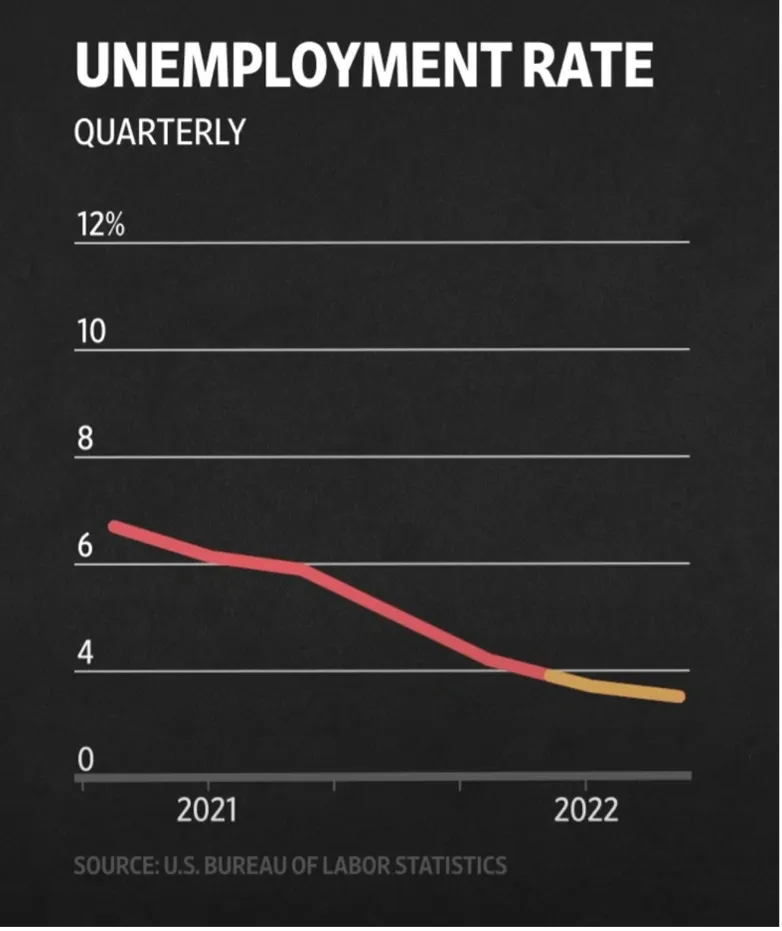

Domestic production has retracted, and economists have been on recession watch for quite some time. Jerome Powell, the Fed chairman, has also commented about the potential need for a recession. But the unemployment rate is actually falling. More people are getting jobs, not losing them, according to the US Bureau of Labor Statistics. Here’s a WSJ chart:

Domestic production and unemployment have always been correlated because of the cyclical nature of how a free market economy works—it runs on supply and demand. But with more people being employed, what impact does this have on the potential for a recession?

Recessions can start with any of the three parts of the cycle in that graph. The consumer sentiment index measures how people are feeling about the economy, which tells us how people feel about spending money. Prior to recessions, we’ve historically had lower sentiment, which accelerated the progression of a recession.

In 2022, people are feeling extremely pessimistic. The cost of goods and services has rocketed, inflation is the highest it has been in 40 years, and the consumer sentiment index is measuring similar to what it did in 2008. If people are feeling negatively about where the economy is headed, then they’re less likely to spend money, which reduces corporate profits, and can worsen the cycle.

But 2022 is unlike any year we’ve seen before. Corporate profits are at the highest levels we’ve seen since the 1950’s. Here’s another graph from the WSJ. The vertical gray bars represent periods of a recession.

Not only are profit margins high, the amount of cash that corporations currently have available to them is the highest it’s ever been, as shown in the graph below. This is a significant hedge against a contracting economy with reduced profits. Many companies are well positioned for a period of slowing business.

This could mean that businesses feel good about their positions and decide not to cut back their workforce so heavily. This could mean that we could have a much milder recession if we do have one.

There is incentive for companies to retain employees. Even the federal government has not been insulated from the masses of people retiring from the labor force. Corporations across America are having trouble filling the positions they need.

With a generational change of the workforce, as well as expectations of wages and work environments, younger workers have become more selective in their job picks and perpetuated the problem. This helps us understand one reason why corporations may be wanting to hold so much cash. They simply need to retain their people. Could we see higher wage growth as a result?

While overall consumer sentiment is weak, demand continues strong, and companies keep scrambling to fill the demand of consumers. This, combined with the high cash and low unemployment has economists scratching their heads in trying to figure out why inflation continues to run so hot.

One simply reason is that the Fed was quite literally 1.5 years late to the party. They were significantly slower to begin reducing economic stimulus than they should have been, and kept money cheap for businesses to keep their lights on during the global pandemic.

The Perfect Storm

All of these factors have created a perfect storm, which leads many economists to believe that a recession in 2022 will be unlike any we’ve seen before. It’s not sustainable for an economy to have reducing production levels while companies are still employing and offering tons of jobs. It’s an imbalance in economic sciences which can only lead to one of two things.

The first is that the corporations could use the cash on hand to hedge against the reducing production while allowing them to hire workers to increase production again. The economy corrects itself, and we’re back to “normal”. The other is that a recession is necessary in order to curb the demand in the market, forcing inflation to drop.

As a financial planning firm, we analyze the activity in the overall markets, and we’ve seen money managers and large financial institutions begin placing their trades to hedge. The economy and the markets are correlated but they don’t always react with proximity of one another. Markets trade ahead of economic news, which is why reacting to news is almost always too late.

Despite whether we’ve reached the bottom of the market or if there’s more to fall, whether we’re in a recession or if it comes later or not at all, the single most important question federal employees should ask themselves is: will whatever happens impact my financial independence?

Money is a tool to help us accomplish our objectives, take care of our families, and enjoy a life of fulfillment. Having a plan to help you accomplish these things will give you the greatest chance of achieving them. The markets won’t always cooperate, neither will the economy, and sometimes your life won’t either. But having a good plan in place allows you to know what you need to do to help maintain your financial safety each time the variables work against your plans.

We view a family’s greatest financial success as their ability to continue living their lives the way they want to live without being ruled by variables outside their control—a life with financial dignity and independence.

That is true financial freedom, and it can be possible with good planning. So don’t wait any longer to prioritize your economic well-being, because it’s not just your money, it’s your future.