5 tips to help you get your first million dollars

Growing Portfolio

Getting to have $1 million might seem like it’s an impossible task. There are currently over 11 million people in the US that are officially “millionaires”. A lot of them followed the same investing and behavioral techniques to get to where they are. Accumulating $1 million over the course of your lifetime is much more attainable than you might think, especially for dual-income households or for those living in metropolitan areas. Money doesn’t have to be complicated. Here are five simple but under-utilized techniques that can help you get to your first $1,000,000.

Embrace The Markets

While there are many opportunities to invest directly into a particular local business or perhaps building out your own business, the stock market offers you the ability to invest in companies that are already established and growing1. You might already be doing this within your 401K. A portion of your paycheck may come out of your total paycheck every pay period and goes into a 401K account, where it gets invested into mutual funds or other indexes. There are many other types of investment accounts like your 401K that you can utilize to invest and grow your wealth. You can purchase small pieces of big companies called “shares”, and your equity position will grow as the company grows as well. You’re able to invest in many different companies, thus diversifying your investment portfolio in order to reduce the risk of being too concentrated in one single investment, risking your total value drastically dropping if that one investment happens to drop in value.

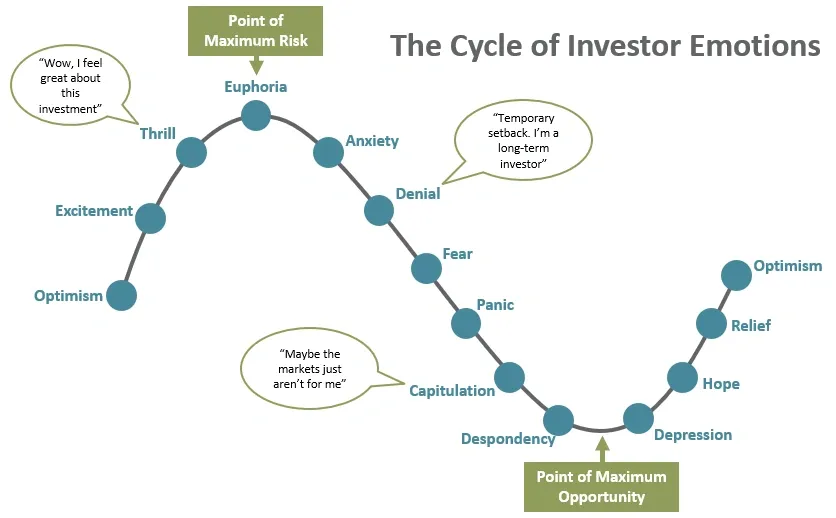

Picking the right investments is different for everyone, so be sure to work with someone that understands your goals and your situation. Remember, risk and volatility are two different things. Volatility is the price we pay for long-term growth. If the money you are investing is for your long-term future, does the volatility it’s experiencing right now really matter? Maybe it does if you can’t sleep at night because of how much the account moves. Maybe it does if you can’t seem to stay invested throughout those volatile times. Figuring out the right balance of investments for you requires a personal, not off the shelf solution. Take a look at the picture below2. You might have seen me use it in the past but it’s such a great depiction of what happens to our emotions as investors:

Maximize Your 401K

Most companies offer a 401K as a part of their compensation and benefits package. The majority of those offering a 401K also offer a matching contribution. That means that for every percentage point that you contribute to your 401K, your company will “match” that amount into your account up to a particular amount. This effectively doubles your investment – free money. As your income grows, you can put as much as $19,000 a year if you’re under 50 or up to $25,000 per year if you’re over 50 years old3 (2019 limits). This really adds up, and the growth on that money compounds even more over time. Not to mention, any 401K contributions are considered tax-deductibles, which means if you made $100,000 in a year and put $15,000 into your 401K, the IRS will only tax you on $85,000.

If you are a business owner and have really started to have excess cashflow, establishing a 401K for your business as an owner can allow you to shovel away hundreds of thousands of tax-deferred dollars, reducing your taxes greatly and increasing your pot of wealth. I talk more about this towards the bottom of an article that I wrote HERE, so check out that article for a bit more detail if you are a business owner.

Pay Yourself First

One thing that millionaires did to get themselves to the position that they’re in is to pay themselves first. What exactly does that mean? This is where the behavioral portion comes in. One of the major factors in whether a person becomes a millionaire, and stays one, is their spending habits. It means setting aside money from your monthly income to invest and grow. As a matter of fact, millionaires have “investing” as a line item within their monthly budget sheets. That’s right, they essentially make it an “expense”, so that they always put money towards investing every time they receive a paycheck. It’s too easy to push investing off to the next month or next year, so millionaires know that they must force themselves to allocate money each pay period toward investing, just like they do for their monthly bills, so that it happens automatically. Once you get into the habit of this, you’ll find that it becomes easier every time and you’ll enjoying watching your accounts grow over the long term.

Cut The Extra Costs

While we’re talking about bills, let’s talk about that plastic card(s) in your wallet: the credit card. Millionaires all know how to keep a budget. That’s right, I’m talking about putting together a list of reoccurring expenses that you have for you to see where you stand with your cashflow. It’s so easy to miss how quickly you’re spending down your wealth. I’m sure you’ve all heard about the professional athletes that went broke only 10 years after retiring and went straight from the Wall of Fame into the Wall of Shame (lame joke, I know). In today’s subscription-based world, it’s really easy for companies to keep charging your credit card every month for services you might not even use. Considering renegotiating your cell phone and cable bill. You can also call your car insurance company and ask them to re-price your rate, or even call other companies and see if they are more competitively priced. Do you really need access to ALL of the LA Fitness gym locations on the east coast or is access to the one right by your house or office sufficient? Maybe you can start cooking 3 nights a week instead of eating out all 7 nights. Maybe you purchase a coffee maker (Nespresso, for the win) instead of buying a $5 latte every day.

All of these small things can really add up and you can easily save $300+ per month. That’s $3,600 a year. If you invest that every year and get a hypothetical average annualized return of 7%, you’ll have nearly $400,000 after 30 years. That doesn’t even count your 401K or other investments. But it all starts with creating a budget, finding out where you can cut costs, and sticking to it. Remember: you can’t improve what you don’t measure.

Use Intelligent Money Management

So you’re maxing out your 401K, you’re keeping to your budget and investing the rest, now what? The money that you are investing needs to be properly invested. You may consider working with an advisor that knows your personal goals and can help you invest properly to make those goals into a reality. A well-diversified portfolio may help reduce the risk and volatility of your accounts, but is that enough? You should also be stress-testing your portfolios to see how they behave in different market conditions.

Are you considering other aspects of your financial life such as how much house should you purchase, how different types of insurance can help build your wealth, how to reduce your taxes now and in the future to keep more of what you earn. There are many moving parts to your economic well-being and you need to look at all of them together as pieces of one big picture. After all, it’s not just your money, it’s your future.

If you have questions about any of these topics or would like to discuss any of them in particular, feel free to reach out. We’d be delighted to work together to help set your trajectory toward building your first $1 million and beyond.

- There are risks involved with investing, including possible loss of principal. Investments will fluctuate and may be worth more or less than when original purchased.

- https://www.google.com/searchq=investor+emotions+cycle&source=lnms&tbm=isch&sa=X&ved=0ahUKEwjP2dukobrjAhWKmlkKHZZQBW0Q_AUIECgB&biw=1459&bih=897#imgrc=OYsM0jmHxqfLeM:

- www.irs.gov