4 Ways to Optimize Your Savings and Investments in 2024

If you’re serious about retiring within the next couple years, or about being better with your saving and investing, in this column is a must read.

One of the most influential components of a successful retirement plan is maintaining awareness of what’s happening during the year and adjusting accordingly. We’ll cover maximizing your TSP, minimizing your taxes, understanding cash flow, and other factors that influence your success.

Save and Invest, No Matter the Environment

The beginning of the year is the perfect time for you to sit down and think through what your objectives are for your TSP this year. If you received a raise or COLA, then you should consider increasing your TSP contribution amount if you’re not already maxed out. Remember that if you’re 50+ this year, you can also contribute the catch-up amount, increasing the maximum allowable contribution to your TSP.

As quickly as you can manage to do so, consider maximizing your TSP contributions. This, combined with the right investment strategy, can harness the power of compounding in your portfolio and create a satisfying and financially healthy retirement for you. The right strategy will allow you to remain invested even during bad times of the markets. As illustrated by Visual Capitalist, if you miss out on just the 10 best days in the markets during the year, you may have missed out on the majority of the growth available that year. Having the right allocation is imperative. Remember, it’s time—not timing—that matters most.

If you can afford to do so, consider saving even outside the TSP. If you and your spouse earn a combined income, are you spending through anything that doesn’t go into your retirement accounts? Are your checking and savings accounts growing, staying the same, or declining over time?

If you’re not sure, that’s okay. Life gets busy and we seldom take the time to manage cash flow, especially when there’s enough of it coming through the threshold to pay for everything you want. But consider that in retirement, owning assets that are all taxed differently helps create better choices for you. Having non-retirement assets saved can create a lot of flexibility for retirees.

Start Preparing for Higher Taxes

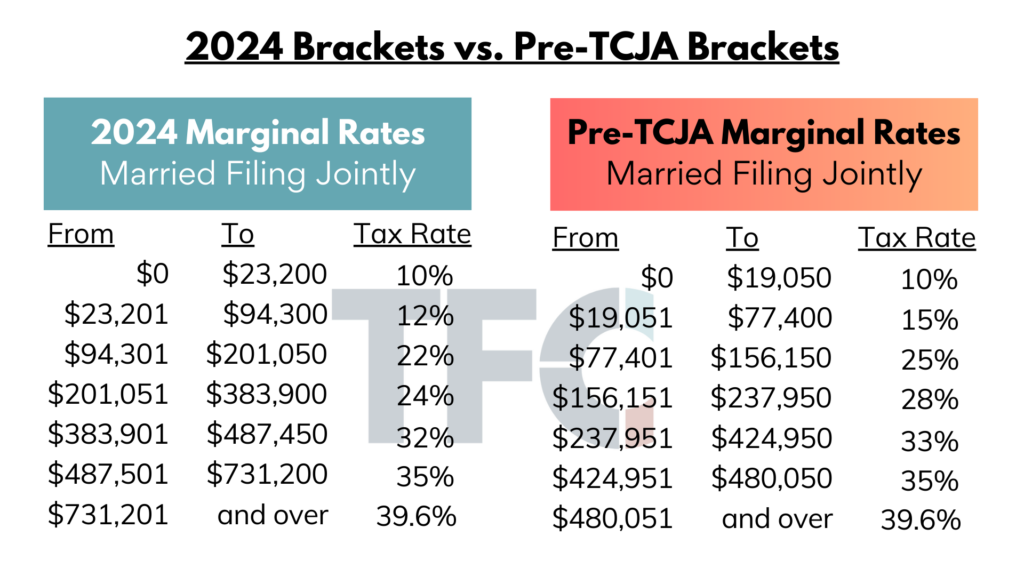

Our current tax brackets are a result of the Tax Cuts and Jobs Act that was passed in 2017. One important piece of that law is that it’s designed to sunset at the end of next year.

This means we only have this year and next until tax rates are going to substantially increase if no law change occurs.

Here’s what you can expect:

Notwithstanding inflationary adjustment and law change, someone that’s in the 22% bracket today could easily be in the 28% bracket after the sunset.

Someone in the 24% bracket today could see a big portion of their income taxed at 33%, which is a whopping 9% more in federal income tax.

Folks, I’ve been shouting this from the mountain tops—you need to start doing tax planning in the overall management of your wealth. The success of your investments is only as good as its supporting strategies like your tax planning.

It’s likely that your income—whether salary from your job or from your portfolio—is going to be taxed at a higher rate soon.

This is where strategies like Roth conversions and myriad others might be helpful. Here are a few scenarios in which you might consider Roth:

- If most or all your money is inside a Traditional TSP/IRA

- If you’re planning on continuing to earn an income through your retirement years

- If you’re expecting to inherit a retirement account

- If you have RMDs in the next few years

Get a Handle on Your Cash Flow—Dollars In vs Dollars Out

Even the strongest retirement plan can be derailed by spending that is not in accordance with the plan. Whether you’re spending more because of higher taxes, higher inflation, or just higher lifestyles, there’s virtually no retirement plan that’s bulletproof.

We can create incredibly strong and long-lasting retirement plans, but rogue cash flows are easily one of the quickest ways to destroy financial independence.

We often tell our clients to become aware of something called lifestyle creep, particularly if you’re retired or close to it. While working, people tend to manage their spending based on paychecks every couple of weeks.

But in retirement, now you have this big pile of money from whence to create your retirement paychecks. It can become easy to justify “one-time purchases” because you know there’s a large pile of money that you can tap. It can be helpful to know your spending guardrails, especially for when things don’t go as planned.

Consider Risks Beyond the Markets

When people think about how much risk they’re taking, they usually think about their stock-to-bond allocation. But financial planning involves much more than just your investment portfolio.

There are things that we can’t control at all, like inflation or what happens in the economy, and some that we have less control like our health and how we manage our cash flows.

One way that wealthy families preserve their assets is by reviewing their insurance portfolio. You should assess whether you are either over/under insured in the three main areas:

- Life and longevity

- Health and morbidity

- Property and casualty

If you don’t live as long as planned, can your family support themselves with less income? No matter whether you’re working or retired, your death will mean less income coming to the family. At the death of a fed, their FERS pension is, at best, reduced by 50%. One Social Security benefit will also go away. Maybe insurance on your life is necessary for your family to remain financially secure.

Similarly, if you live long but not as healthily as you might like? How much support will you need? What will this cost? Could you afford to have in-home help in the future? For how long?

For your property, have you considered if your insurance limits are appropriate? What if you cause an accident that goes beyond your limits? What if someone is injured on your property? How can you protect your wealth from being subject to civil suits, especially non-retirement assets?

These are all questions that you can ask yourself this year. Take the time to do the planning to help protect the wealth you’ve built for your family. After all, it’s not just your money, it’s your future.