4 Pillars to TSP Success – Federal Retirement Investing Strategy

The TSP is a unique retirement account that requires understanding its features well to use it effectively. We’ve helped federal employees over the years with their investment strategy inside the TSP, and we’ve found that there are four necessary pillars to being successful with investing the TSP.

This column will discuss the four areas in which you have the greatest control over how your TSP can help you achieve your financial goals.

TSP Asset Allocation

The first thing I want to point out is that your asset allocation is different than being diversified. When you’re building a portfolio, there are a few factors you need to consider regarding your strategy.

The first is that you need to determine your plan for use of your investments. This involves answering questions like,

- When will I retire?

- How much money will I need?

- How much will I be taking out and when?

- How much growth do I need to continually meet my objectives?

- How much volatility am I okay with?

This gives you a baseline for understanding the high-level structure of your investments. Then, and only then, can you determine whether you want to hold a 70/30 portfolio, or a 60/40, 50/50, etc. (stocks/bonds).

For instance, if determining that for the next six years you will need a 70/30 portfolio to meet your goals, that’s when you start looking at which investments will make up your 70% of stocks and 30% bonds.

You might decide that half of the 70% stocks should be in the S&P500-kind of stocks, so you could set half of your stock position to be in the C fund, or 35% C Fund (half of 70%), and perhaps you decide you’ll split the other 35% between the S and I funds.

It goes without saying that this is merely an example and that you shouldn’t use these numbers for yourself, but I wanted to show you how you should be thinking about your asset allocation.

As time goes on, variables in your life, the economy, the markets, and the world create drift in your wealth, so you should maintain your allocation relative to your current situation and goals.

TSP Diversification

First, let me point out that the TSP funds are essential index funds. This means the C, S, I, and F funds all represent different swaths of the markets. Index funds by nature are diversified within their index, because it’s a big pool of many different investments.

As a TSP participant, you’ve got that going for you already, which is great. But here’s a challenge to which many federal employees have never given thought.

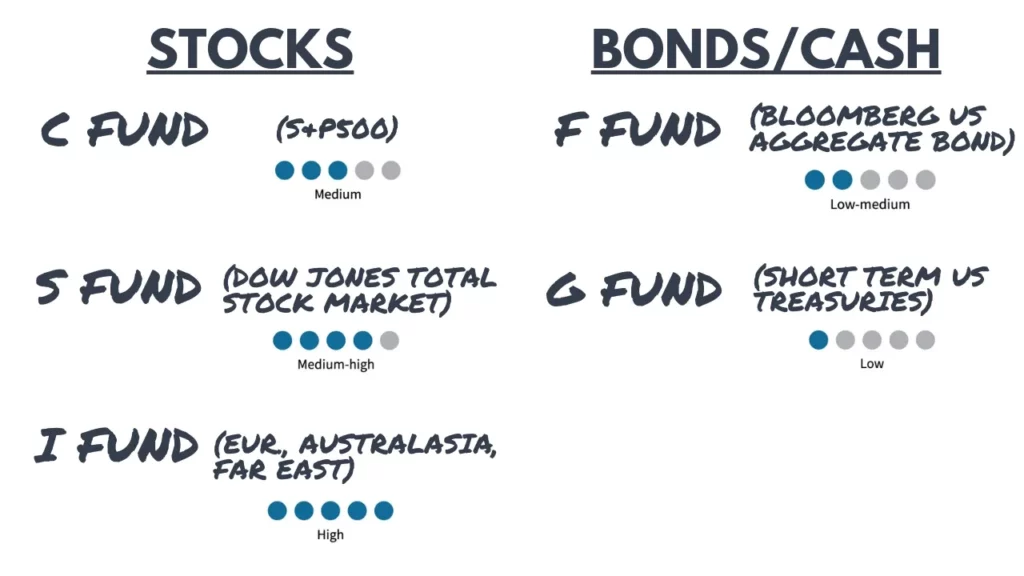

When you think about what your choices for your stock allocation are, you have three core funds: C, S, and I. And for your bonds you have the F fund.

The good thing here is that you don’t have many choices, so you don’t get what I call analysis paralysis, but the bad thing is that you don’t have many choices.

You see, when you’re selecting stocks in your TSP, your LEAST aggressive option is the S&P500.

The S&P500 is a volatile stock investment, which means your least aggressive stock option is actually pretty aggressive by nature.

The S and I funds are even more volatile. The TSP says the S&P500 is a “medium risk” investment. I’m not sure I agree with that entirely, but I see how it’s medium relative to the other options. There are less aggressive choices available that allows investors to still be invested in stocks—allowing them the inflation-fighting power of stocks—but with much less volatility.

How Bonds Help Retirement

As it relates to bonds, we won’t get into how bonds work in this article, but you should understand that bonds are very particular.

They are generally not like stocks in an a rather important want. The concept of stock ownership is that, over time, when you hold equity investments for 10 or 20 years, their values are likely to be higher based on both corporate success and economic growth.

Bonds inside a retirement portfolio are designed to generate cashflow, which is important for people who are retired. The kinds of investments that make federal employees successful up until their retirement date are totally different than from what will allow them to keep being successful in retirement.

In retirement, it’s no longer about the maximum growth and being heavy in the C fund, it’s much more about stability and consistency, and getting the monthly income you need in retirement to supplement your FERS pension and Social security

I intentionally skipped the G fund, as it is in its own category, essentially as a cash position. An honorable mention is that the Lifecycle funds are merely a combination of the five core funds, that gradually get more conservative the closer to the “target date”.

Folks, I want to take just a moment to clarify something: this is not a matter of whether the TSP funds are good or bad. If you have 10, 15, 20 years until retirement, you can hang out in the three stock funds and thank yourself later.

But if you’re planning retirement soon, you have to understand how these investments work, and how to best use them in order to help you achieve your ideal future. Your use of strategy will determine how it affects your wealth.

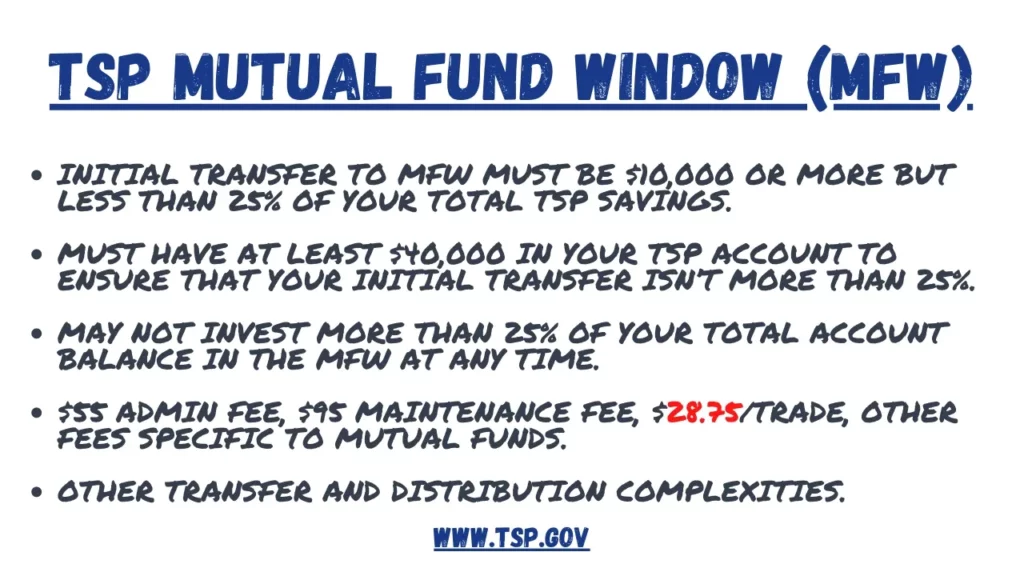

Now, the TSP tried to give federal employees more diversification by adding the mutual fund window in good faith. However, many argue that they want you to be using the core funds instead given the way that the features are set up.

For one, the administrative costs are high, the investment costs are high for many funds, and there are all kinds of restrictions. See below for a summary from the TSP website.

Regardless, if you’re in the TSP, it’s important that you really understand your investment options so that you make sure you’re properly diversified.

Long-term vs Short-term Liquidity

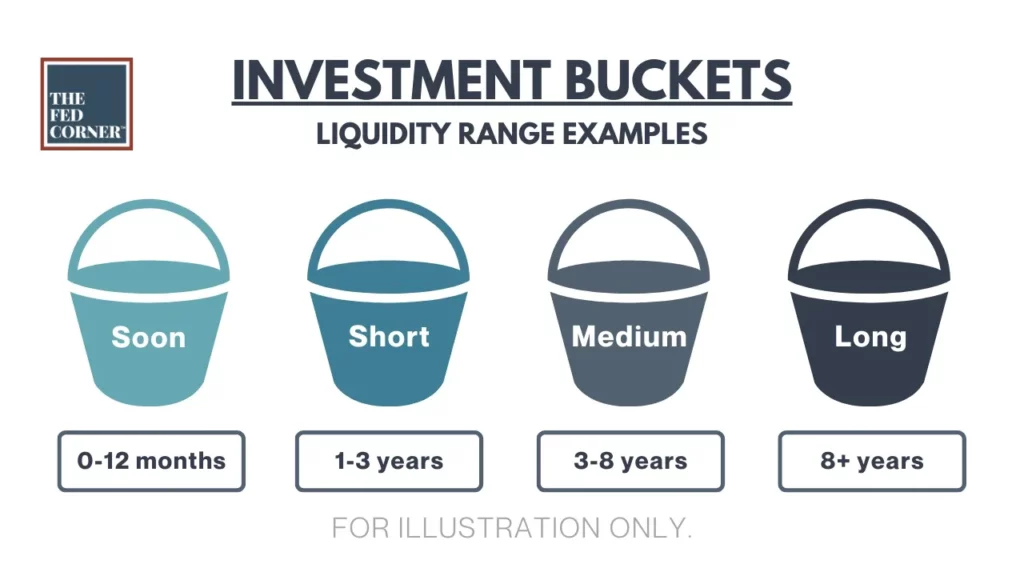

At some point you’re going to need to take money from your TSP. A successful portfolio is one that sets up liquidity for different parts of your life.

The key to a successful portfolio is having it do many jobs all at once. If you’re retired, you need money right now, so this means that a portion of your wealth should be very conservative for the next 0-12 months. And by the way, this could be 16 months, 24 months, it all depends on your plan.

The idea here is that the further away until you need liquidity (access to your money), the more growth oriented your investments should be.

This is because over time, the long-term buckets backfill the short-term buckets as they grow, and as you deplete the smaller short-term buckets.

So, how do you figure out how much goes in each bucket? This is where I shamelessly plug that you need a formal plan. The only way to do this correctly and with minimizing the risk of being wrong, is to model out your retirement and create the scenarios of the future you’d like to achieve. This is not to say you can’t wing it, but you must accept the risks of doing so. Data should drive decisions, not feelings, or worse, yet another blog post online.

Investment Tax-Efficiency

Next up in using the TSP successfully is with tax-efficiency. There are a couple of factors with this.

The first is regarding your TSP contributions. Most of the families we work with are late-stage career or early retirement. If you’re at the end of your career, then you’re probably making the most money you’ve made up until this point.

This means your taxes are higher, and anything you can get in tax deductions is going to be immensely helpful.

The simplest way to be successful in the TSP with taxes is to understand where you fall in taxes now, and where you might fall in taxes in the future.

This applies if you’re retired already too. At some point you’ll have RMDs which means higher taxes, and there are things you can do about it well ahead of time.

This graphic represents federal income tax rates for married filing jointly for 2023. The Y axis are tax rates, and the X axis is taxable income.

If you’re still working and there are two of you, you may very well be in the yellow or red zones, meaning your federal tax bracket may be 24%, 32%, or even higher.

If this is you, you’re reaching the red zone and you should probably be maximizing your traditional TSP, or Pre-tax TSP. Every dollar you put into the pre-tax TSP is now X% less taxes that you owe on that money this year.

The idea here is that at some point you’re going to stop working. Your taxable income is likely going down, so it stands to reason to pay the taxes during the years in which you fall in lower tax brackets. There are strategies for doing so.

And if you’re already retired, you should be projecting where your tax rates will be when you take RMDs, because you might be in a lower bracket right now in retirement compared to facing a tax problem with RMDs later.

It’s becoming abundantly clear that retirement is the moment in which your economics completely change. I’d argue that moment arrives a few years before. So take the time to get a plan in place so that you give yourself the best chance of success. After all it’s not just your money, it’s your future.